Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 11, 2015

European financials spreads widest in a year

A new law on banks which aims to put an end to government bailouts has heightened credit risk in the European financial sector.

- The Markit iTRAXX-Financials Senior index is at its highest level since May 2014

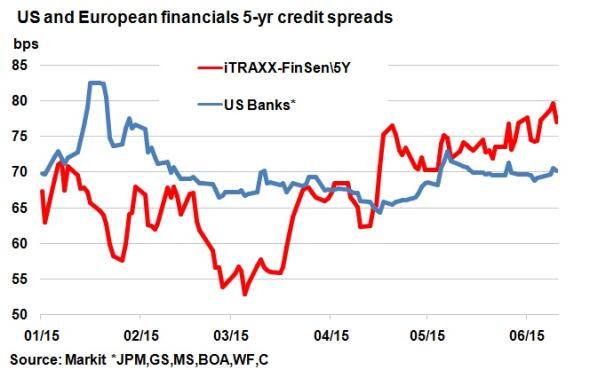

- CDS spreads show US banks are now perceived safer than European peers

- Banks' credit gains attributed to safer post QE environment have since been erased

This year, European banks have been hit hard by rating agencies' downgrades and negative outlooks.

Almost of this stems from European lawmakers taking steps to reduce the need for government intervention and bailout in times of crisis, lessening the burden on taxpayers. As a result, creditors, namely bondholders, have to bear more of the burden of the costs of a failed bank.

European financials credit has mixed performance year to date, as Europe's central bankers use QE to stimulate lending in the sector.

European financials deteriorate

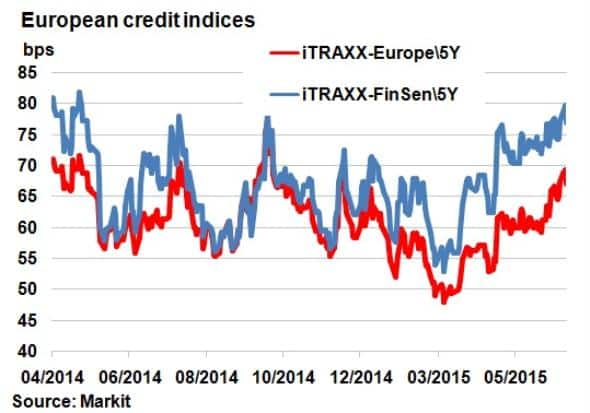

The spread of the Markit iTRAXX-Financials Senior index, compromising 25 financial single name CDS, has widened 15bps over the past two months and is at its widest since May 2014.

The relationship between European financials and the broader European corporate bond sector has also deviated ytd 2015. For much of 2014, the basis between the Markit iTRAXX-Financials Senior index and the Markit iTRAXX-Europe index was negligible, but opened up from 4bps at the start of the year to 10bps. While both indexes have seen spreads widen 2015 ytd, the widening of the basis demonstrates how perceived credit risk among financials has deteriorated at a greater pace than the broader corporate sector.

The past few months have also marked a lower perception of US banks' risk. , which The average CDS spread among the six biggest US banks currently stands at 70bps, which is 7bps below that of the Markit iTRAXX-Financials Senior index. Rigid stress testing and regulation, coupled with an economy further along in the recovery cycle has boded well for the US banking sector.

QE euphoria wiped out

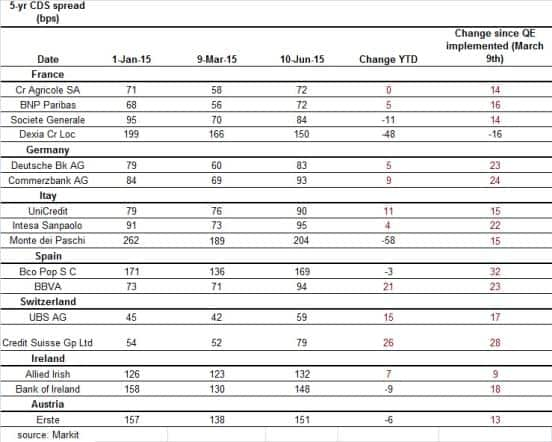

Looking at 5-yr CDS spreads of European banks, spreads have widened across the board. German banks were downgraded this week by S&P, which cited the possible lack of government aid in a time of crisis. They have been among the names that have seen spreads widen the most ytd. So far this year, Deutsche Bank and Commerzbank have seen spreads widen 5bps and 9bps, respectively.

The year started with eurozone spreads tightening, coinciding with expectations of eurozone QE, when corporate credit risk dropped across all sectors. But since the implementation of QE on March 9th this year, bankspreads have widened significantly. Deutsche Bank's 5-yr CDS spread has jumped 38% and Credit Suisse's by 51%.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Credit-European-financials-spreads-widest-in-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Credit-European-financials-spreads-widest-in-a-year.html&text=European+financials+spreads+widest+in+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Credit-European-financials-spreads-widest-in-a-year.html","enabled":true},{"name":"email","url":"?subject=European financials spreads widest in a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Credit-European-financials-spreads-widest-in-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+financials+spreads+widest+in+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Credit-European-financials-spreads-widest-in-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}