Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 11, 2017

Securities lending inventories pass key milestone

We analyze the trends that drove the value of securities sitting in lending programs past the $17trillion mark for the first time ever.

- Equities drove nearly all of the surge in market inventory

- High inventory levels coincided with large inflows into passive products

- Flat demand takes the long short ratio to historic highs

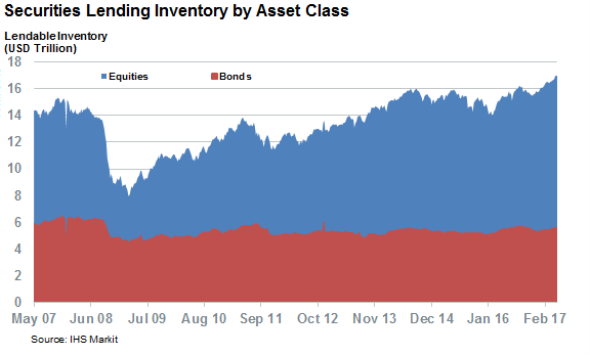

The inventory glut that has plagued the securities lending profitability for much of the last few years has been exasperated by ongoing global bull market which has pushed the value of lendable assets tacked by the Markit Securities Finance database to new all-time highs. This recent surge has tipped the value of all lendable assets past the $17 trillion mark for the first time ever in the opening days of May. This significant milestone crowns a 15 month rally in inventory which saw the industry record a $3 trillion rise in lendable assets from the recent lows set in February of last year.

A deeper dive into this data shows that the nearly all of the recent rise in lendable inventory ($2.5 trillion) has come from equities which have been the driving force behind the recent cash market rally. Astonishingly, the value of equities in lending programs is now over three times higher than the levels registered immediately after financial crisis when a less than $3.5 trillion of equities sat in lending programs.

While equities across Europe, Asian and North America have registered a double digit percent rise in lendable inventory over the last 12 months, the latter of the three regions, by virtue of its size, has been responsible for nearly two thirds of the r equity inventory surge.

Bonds, which have driven the industry's revenues over the last few quarters, have registered a much more muted rise in inventory as the aggregate value of bonds available to borrow has only jumped by 8% over the last 15 months to $5.6 trillion. Despite the recent rise in inventory, the value of bonds available to borrow still 15% off the levels registered before the financial crisis when $6.5 trillion of bonds were available to borrow.

Move to passive

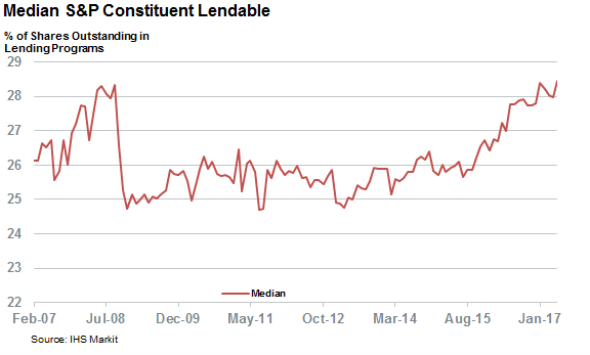

While there is no denying that a large part of the recent surge in inventory is directly attributable to rising equity values; the rise of passive investing, be it through ETFs or other products, has also been a contributing factor. Fueling short sellers, which is a key historical objection to securities lending, doesn't matter to passive fund managers whose main mandate is to track the performance of an index's constituents as closely as possible. In fact, passive funds tend to actively seek out securities lending income to entice value seeking investors to their products. Conventional fund managers, which are seeing their margins squeezed by their increasingly popular competitors, are also finding it increasingly hard to pass up on the revenues that can be earned from securities lending which further adds to the cycle.

The S&P 500 index, which is by far and away the most popular index with passive funds, highlights this trend perfectly as the median lending program availability across its constituents has jumped from 26% of shares outstanding a decade ago to 28.5% currently. The proportion of the index's constituents which have more than quarter of shares outstanding in lending programs has also increased materially over the last 10 years, jumping from 60% to 70%.

Demand fails to keep up

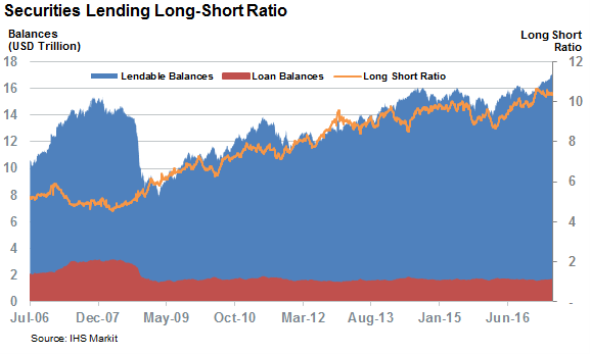

Surging inventories wouldn't create an outright glut had demand to borrow asset remained buoyant. This so far failed to materialized however as the value of all loans outstanding has only risen by 3% since the inventory build started last February. This lackluster demand growth has ensured that a large part of the newly minted inventory has failed to find willing borrowers. Our long short ratio, which looks at the ratio of inventory to loans across the securities lending industry, has never been higher as there are now over 10 dollars in assets in lending programs for every outstanding loan. This trend is much more pronounced in the equities world where every loan is backed by over 13.3 dollars of inventory, up from 11.7 a year ago.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Equities-Securities-lending-inventories-pass-key-milestone.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Equities-Securities-lending-inventories-pass-key-milestone.html&text=Securities+lending+inventories+pass+key+milestone","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Equities-Securities-lending-inventories-pass-key-milestone.html","enabled":true},{"name":"email","url":"?subject=Securities lending inventories pass key milestone&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Equities-Securities-lending-inventories-pass-key-milestone.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+lending+inventories+pass+key+milestone http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Equities-Securities-lending-inventories-pass-key-milestone.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}