Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 11, 2017

Bank of England policy on hold after data confirm economy's weak start to 2017

Official data showed UK manufacturing and construction sector output dropping for a third successive month in March, adding to signs of the economy's weak start to the year. The trade deficit also widened. More recent survey data suggest activity picked up at the start of the second quarter, but worries persist about the sustainability of the upturn as rising prices continue to squeeze consumer spending.

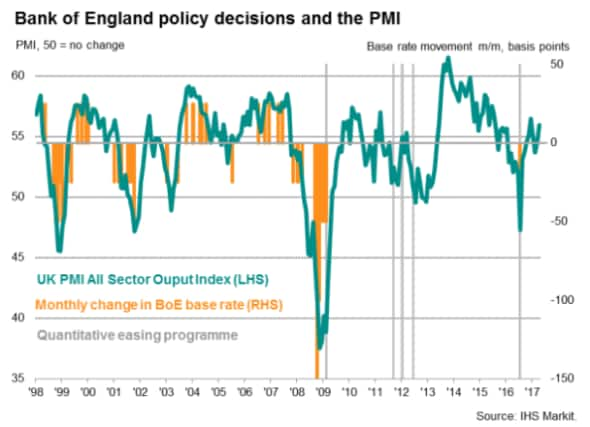

The Bank of England meanwhile left policy unchanged, with interest rates at record lows, and revised down its forecasts for 2017 growth slightly, citing the weaker than expected start to the year.

Manufacturing woes

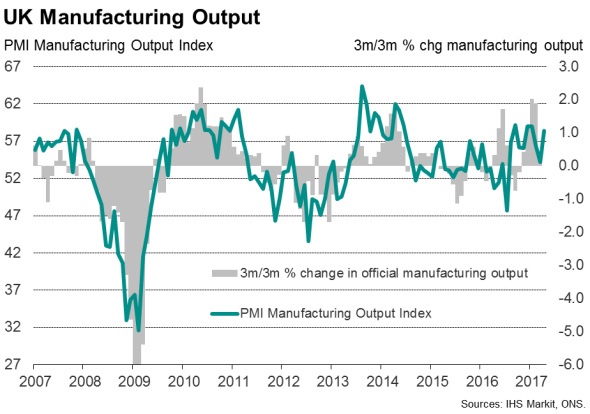

Data from the Office for National Statistics showed manufacturing output dropping for a third successive month in March, down 0.6% and leaving output only 0.3% higher in the first quarter of 2017 compared to the final quarter of 2016. The wider measure of industrial production was up only 0.1% in the first quarter, hit by a 0.5% decline in March.

The deteriorating trend in factory output followed the weakest manufacturing PMI survey data seen for eight months in March. The PMI has since turned up in April to suggest that the production trend improved at the start of the second quarter, although the sustainability of the upturn remains very much in question.

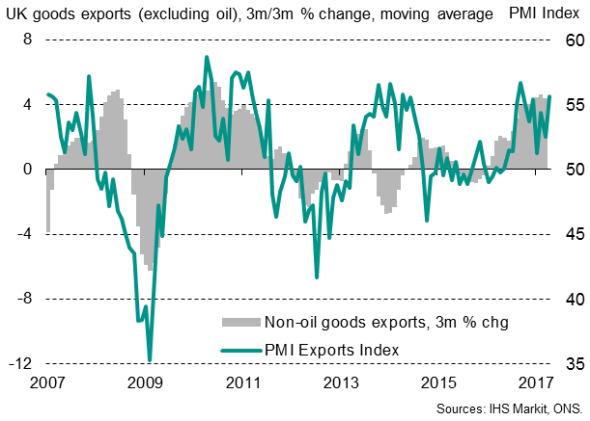

The ONS also reported that the UK's goods trade deficit widened in March to "13.441bn, its highest since last September. Over the first quarter, goods exports rose a mere 0.2% in volume terms while imports surged 3.3%. Our preferred gauge of non-oil goods exports was also flat in the three months to March, but the trade official data are volatile. The trend in the non-oil export performance remains positive, and a further strengthening is in fact signalled by April's PMI data.

UK goods exports

Construction malaise

Compounding the disappointment was news of a 0.7% drop in construction output in March; a third successive monthly decline which means the sector grew a mere 0.2% in the first quarter compared to the final three months of last year. That slowdown was comparable with the weakening seen in the PMI data in the first quarter, but - like manufacturing - the construction PMI revived in April. However, the April lift in the PMI was only very modest and means the survey continued to signal a disappointing building sector performance at the start of the second quarter.

Mixed signals for second quarter

The updated data leaves the initial estimate of first quarter GDP growth unchanged at 0.3%, according to the ONS, which is slightly weaker than the 0.4% indicated by the PMI. However, the message from both the official and survey data is clearly one that the economy slowed at the start of 2017.

The signs of faster growth at the start of the second quarter indicated by the survey data are meanwhile by no means indicative of a renewed upward trend in growth. Importantly, the surveys also highlight an on-going struggle among consumer-facing firms as household spending is squeezed by higher prices.

Cautiously optimistic policymakers

The official data were released on the same day that the Bank of England nudged its forecast for 2017 economic growth down to 1.9% from a prior expectation of 2.0%. The reduced forecast reflected the weaker than anticipated start to the year and the expectation that slow growth will extend into the second quarter. However, higher exports and business investment are expected to follow later in the year, alongside a reduced squeeze on consumer spending, contingent on a smooth Brexit process.

Inflation is expected to rise more than expected in 2017 but to then fall back towards the 2% target next year. This would largely be a consequence of the increase in import prices resulting from the weaker exchange rate falling out of the year-on-year comparisons.

The Monetary Policy Committee left interest rates unchanged, with only one of the eight policymakers voting for a rate hike. The minutes of the meeting noted that it would not need much further better news on the economy to warrant considering a reduction in stimulus. In this respect, the May PMI surveys could prove important: the rise in the April PMI has already pushed the surveys into territory consistent with a hawkish monetary bias.

Looking further ahead, the latest Inflation Report, published alongside the rate decision, lays out a scenario of interest rates rising towards more normal levels over the next three years. However, this is dependent on smooth Brexit negotiations, stronger wage growth and improving productivity; all of which may be seen as rather optimistic assumptions for a base case scenario.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Economics-Bank-of-England-policy-on-hold-after-data-confirm-economy-s-weak-start-to-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Economics-Bank-of-England-policy-on-hold-after-data-confirm-economy-s-weak-start-to-2017.html&text=Bank+of+England+policy+on+hold+after+data+confirm+economy%27s+weak+start+to+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Economics-Bank-of-England-policy-on-hold-after-data-confirm-economy-s-weak-start-to-2017.html","enabled":true},{"name":"email","url":"?subject=Bank of England policy on hold after data confirm economy's weak start to 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Economics-Bank-of-England-policy-on-hold-after-data-confirm-economy-s-weak-start-to-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+policy+on+hold+after+data+confirm+economy%27s+weak+start+to+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-Economics-Bank-of-England-policy-on-hold-after-data-confirm-economy-s-weak-start-to-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}