Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 11, 2016

Indonesia leads Asean domestic bond outperformance

China's latest economic interventions and the Fed's retreat from interest rate hikes have encouraged investors to return to emerging market debt, particularly in the Asean region.

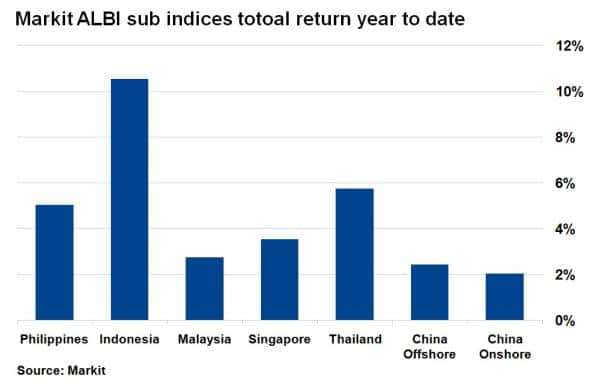

- Asean-5 local currency bonds have returned 5.5%, outperforming Chinese counterparts

- Led by the Markit iBoxx ALBI Indonesia index, which has returned 10.5% so far this year

- Asian local currency bonds still yield 156bps above US treasuries

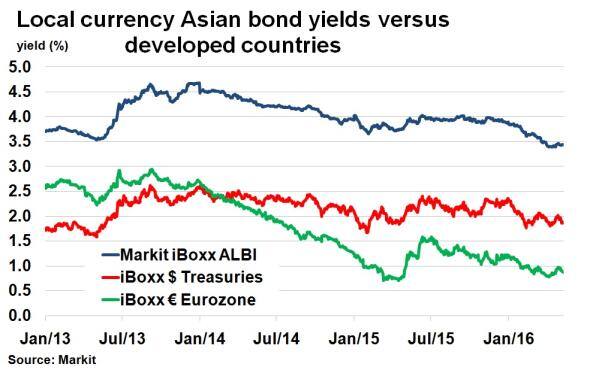

The Markit ALBI index, which represents 11 Asian local bond markets accessible to international investors, has seen its average yield fall to the lowest level since the index's inception in 2013.

The recent rally in local currencies coupled with diminishing fears of an imminent Chinese 'hard landing' has meant sovereign bond returns in the Asian region have flourished so far this year. This has been primarily led by the Asean-5 group of countries (Philippines, Singapore, Indonesia, Malaysia and Thailand).

Asean leads emerging market rebound

Investors in Asian local currency bonds this year have been richly rewarded. According to Markit's iBoxx indices, local currency Asian bonds have returned just over 3% on a total return basis. While this figure falls short of the returns seen in some of the more developed markets (US treasuries have returned 3.7%), there are significant discrepancies between the Asian nations' individual return profiles.

The rally has been primarily led by the Asean-5 nations, which have outperformed (for example) the larger markets of onshore and offshore Chinese local currency bonds so far this year. The average total return for the Asean-5 has been 5.5%, around 2.2% more than average Chinese local currency bonds.

The Asian region has certainly reaped the rewards of the recently improved sentiment towards emerging markets. China reacted to fears of an economic slowdown by boosting credit creation and tightening capital outflows, boosting commodity prices in the process. Singapore exports much to China, and its local currency bonds have returned 3.5% so far this year. Two of the region's larger public debtors, Malaysia and Thailand, are likewise big Chinese trade partners, but have also benefited by the slowdown in the US dollar.

The Fed's retreat from hiking interest rates has seen currencies in the region rise versus the US dollar, including the Indonesian rupiah. Indonesia is the riskiest of the five nations; its CDS spread the widest and its credit rating sitting just above junk status. But investor appetite for risky assets has seen the Markit iBoxx ALBI Indonesia index return 10.5% so far this year. With yields above 8%, a smaller credit overhang and relatively smaller trade deficit, investors have been keen to snap up Indonesian local currency bonds.

Hunt for yield

Investors in the hunt for yield are likely to consider the Asian local currency market as it may represent an attractive proposition compared to developed nation alternatives.

Yields in Europe remain suppressed with "3tn of notional outstanding in the Markit " Overall index exhibiting a negative yield. The Markit iBoxx " Eurozone index currently yields 0.87%, while US treasuries, as represented by the Markit iBoxx $ Treasuries index, currently yields 1.87%. In comparison, Markit iBoxx ALBI index yields 156bps more, while certain areas such as Indonesia and Malaysia offer even more attractive returns.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Credit-Indonesia-leads-Asean-domestic-bond-outperformance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Credit-Indonesia-leads-Asean-domestic-bond-outperformance.html&text=Indonesia+leads+Asean+domestic+bond+outperformance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Credit-Indonesia-leads-Asean-domestic-bond-outperformance.html","enabled":true},{"name":"email","url":"?subject=Indonesia leads Asean domestic bond outperformance&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Credit-Indonesia-leads-Asean-domestic-bond-outperformance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indonesia+leads+Asean+domestic+bond+outperformance http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Credit-Indonesia-leads-Asean-domestic-bond-outperformance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}