Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 11, 2016

Draghi bazooka sends European credit risk tumbling

New measures taken by the ECB has seen risk in the region fall; while high yield bonds continue to steam ahead.

- The Markit iTraxx Europe Main index saw its spread tighten to 74bps, a four month low

- High yield bond returns have squared earlier losses this year

- The Markit iBoxx " Hypothekenpfandbriefe covered bond index yields just 0.24%

ECB goes all in

Further monetary stimulus measures unveiled by ECB president Mario Draghi has sent European investment grade (IG) corporate credit risk tumbling to the lowest levels so far this year.

With market expectations running high, the ECB lowered key interest rates further and expanded its current QE programme to "80bn from "60bn per month - including an expansion into non-bank IG corporate bonds.

The announcement saw perceived credit risk in Europe fall dramatically. The Markit iTraxx Europe Main index, made up of 120 European IG single name CDS spreads, saw its spread tighten to 74bps; a four month low according to Markit's CDS pricing service. European bank credit also saw risk fall, with the Markit iTraxx Europe Senior Financials tightening 17bps, now 42% lower than during the height of recent fears in the sector in February.

Despite the aggressive action from the ECB, German government bond yields rose to the contrary, as Draghi suggested interest rates had little chance of going further lower.

High yield pars losses

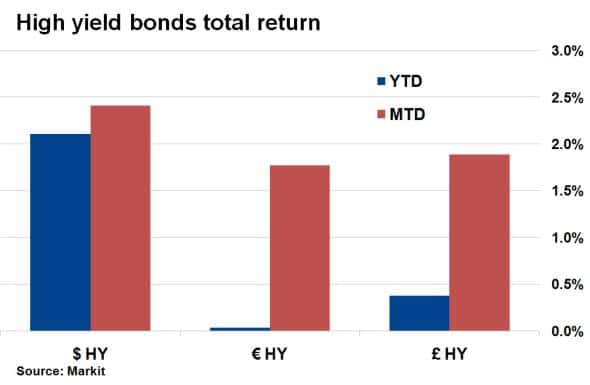

March's risk on market sentiment has seen high yield (HY) bond returns in developed currencies claw back losses made at the start of the year.

HY bonds prove to be rewarding asset class so far this month buoyed a number of factors.

The bounce in oil prices, led by rumours of a pact among oil exporting countries to freeze production levels, easing macroeconomic tensions in Europe and China's commitment to sustain growth levels have also boosted returns.

According to Markit's iBoxx indices, dollar denominated HY bonds have returned 2.41% so far this month, erasing January and February's combined losses. Euro denominated HY bonds have also squared losses for 2016, returning 1.8% so far in March. Sterling HY has fared slightly better, with 1.9%, meaning HY bonds in all three currencies have exhibited positive total returns as we approach the end of the first quarter.

Covered bond landmark

Amid Europe's low yield environment, the primary bond market saw its first ever zero coupon covered bond this week, issued by German bank Berlin Hypo.

The "500m bond was priced to issue no coupon, imitating traditional zero coupon bonds. Issuers had avoided issuing with no coupon so far by extending maturities. Covered bonds in Europe have already seen yields fall drastically over the past years, distorted by inclusion in the ECB's QE programmes.

Covered bonds issued by German Hypo banks (mortgage providers), as represented by the Markit iBoxx " Hypothekenpfandbriefe index, have seen yields fall to 12bps as investors have looked for alternative, higher yielding safe haven assets.

A covered bond has never defaulted in its hundred plus year history. Yields did however spike to 24bps as of yesterday's close, in response to the ECB's rhetoric. Covered bonds issued by German Hypo banks currently yield 37bps over equivalent German government bonds.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032016-Credit-Draghi-bazooka-sends-European-credit-risk-tumbling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032016-Credit-Draghi-bazooka-sends-European-credit-risk-tumbling.html&text=Draghi+bazooka+sends+European+credit+risk+tumbling","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032016-Credit-Draghi-bazooka-sends-European-credit-risk-tumbling.html","enabled":true},{"name":"email","url":"?subject=Draghi bazooka sends European credit risk tumbling&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032016-Credit-Draghi-bazooka-sends-European-credit-risk-tumbling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Draghi+bazooka+sends+European+credit+risk+tumbling http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032016-Credit-Draghi-bazooka-sends-European-credit-risk-tumbling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}