Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 10, 2014

Casinos miss out in tourism's winning streak

Tourism & recreation firms have posted a strong increase in reported business activity in Markit's Sector PMI. We reveal the stocks not enjoying the recent improvements in the overall sector.

- Strong new bookings saw tourism & recreation firms beat out every sector save technology equipment firms

- Analyst revisions in casino firms have trailed the rest of the hotel and entertainment services

- Market Vectors Gaming ETF has continued to see outflows since the start of the year and now sees its AUM at a five-year low

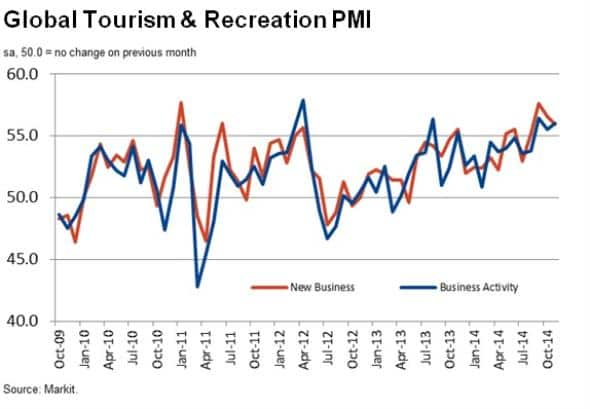

The latest Markit's sector PMI releases saw the tourism and recreation sector continue its strong recent run with the output index coming in at 56. This marks the fourth month in a row that the sector has registered above 55; its longest streak above that mark since the survey began in 2009. New orders were particularly buoyant in the last month with the sector registering the largest jump in new order of the entire sector PMI landscape.

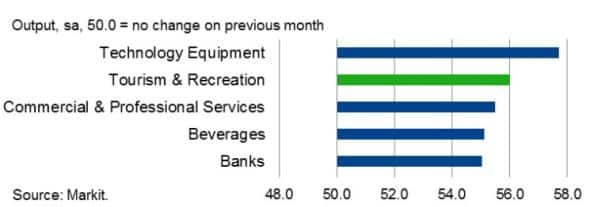

The latest strong PMI reading makes tourism & recreation sector the second fastest growing sector globally with only technology firms responding with a stronger indication of growth over the last month.

But a closer look at the recent improving fortunes across the sector reveals that the recent rise has not been unanimous, as the gaming subsector has largely been left behind by the recent spike, according to analyst revisions.

Casinos losing out

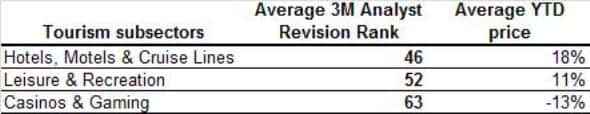

Casino and gaming firms rank much worse than the rest of their broader hotels and entertainment services peers in the Markit Research signal 3M Revision in FY1 factor when comparing to a global index of shares. The factor ranks firms according to recent analyst revisions for the coming fiscal year, with those seeing the best revision rank earning a low score. Global gaming firms in the Markit Developed World universe rank worse than average with an average rank of 63 in the factor.

This average rank is much worse than the hotels, motels and cruise lines segment of the sector which have an average rank of 45, mirroring the recent buoyant PMI readings.

China looks to be a playing a key role in the recent trend as operators with heavy exposure to Macau's recent woes see some of the worse ranks among the sector. This trend is led by SJM Holdings which has a rank of 96, the fourth worst possible analyst revision rank.

The other Macau exposed firms in that space include Melco Crown and Macau Legend, which score 91 and 89 respectively. This increasing bearishness among analyst comes in the wake of an across the board price fall in the sector, something which we commented on recently.

The recent pinch felt by Macau firms driven by China's recent bout of austerity also looks to be felt across US operators, with Vegas operators Wynn and MGM holding both scoring with the worse ranked 20% of shares globally.

Investors cash in their chips

This recent bearish analyst sentiment seen by gaming shares globally has seen ETF investors head to the proverbial cage. As the pure play gaming ETF, the Market Vectors Gaming ETF has seen its AUM fall to five year lows of $41.5m. This has been driven by a combination of strong outflows of $26.4m and a 22% year to date fall in its value.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Equities-Casinos-miss-out-in-tourism-s-winning-streak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Equities-Casinos-miss-out-in-tourism-s-winning-streak.html&text=Casinos+miss+out+in+tourism%27s+winning+streak","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Equities-Casinos-miss-out-in-tourism-s-winning-streak.html","enabled":true},{"name":"email","url":"?subject=Casinos miss out in tourism's winning streak&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Equities-Casinos-miss-out-in-tourism-s-winning-streak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Casinos+miss+out+in+tourism%27s+winning+streak http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Equities-Casinos-miss-out-in-tourism-s-winning-streak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}