Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 10, 2015

Greek shares volatile on talk breakthrough

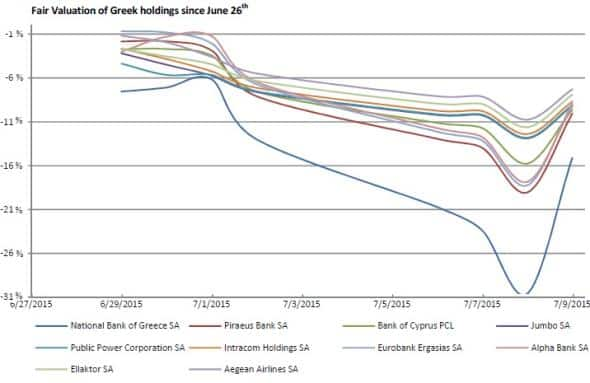

The Greek stock market has been shut for the last ten days, but Markit's Fair Value pricing has quantified the impact of the recent developments on the country's shares.

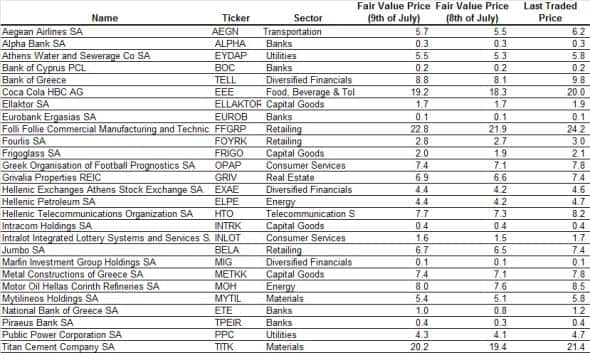

- Markit Fair Value of domestically traded Greek equities' market cap rebounds from post shutdown low, but prices still down by 7.5% from the last traded price

- Banks have been most volatile with National Bank of Greece seeing a 15% fall in fair value

- Hellenic Bottling has seen the smallest decline, with a 4% drop

Greek stocks have not traded since talks between the country's lawmakers and international creditors broke down on June 26th, which prompted lawmakers to temporarily close the country's banks and stock market. Despite the recent rapprochement between the two sides, the stock exchange is expected to remain shut until July 14th after the regulator extended the trading halt for the third time.

This ongoing situation poses a challenge for investors looking to put a realistic value on their Greek holdings which haven't been subject to open market price setting for the past ten trading days. This is also not helped by the fact that the situation has been extremely fluid, with the market reacting violently to any change in the tone between Greece and its creditors.

The price discovery task is helped somewhat by the fact that several overseas listed Greek equity products, such as American Depository Listings and ETFs, have continued to trade. This has ensured that Markit Fair Value has continued to provide a fair value price for Greek equities that trade on the Athens stock exchange.

Greek stocks set to fall

Not surprisingly, the recent developments have had a detrimental effect on Greek equities, as the average fair value prices for the 27 Greek equities covered by Markit Fair Value now see their fair value share price lower than at the close on June 26th. The total monetary impact to investors from the falling equity values means that the market cap of Greek stocks covered by Markit Fair Value has fallen by roughly $3.4bn as of Wednesday's close. This represents a 7.5% fall in aggregate value from the last traded price.

The situation was much worse on Wednesday the 8th of July, when the fair value market cap for the same group of shares stood 14.1% off the levels seen on June 26th.

Banks lead the fall

The recent situation has not impacted all equities equally, with banks unsurprisingly taking the largest hit in fair value over the last ten days. The eight financials covered by Markit Fair Value, many of whom are reliant on continuing support from the ECB's now frozen Emergency Liquidity Assistance program to meet redemptions, have led the market downturn with an 11% loss in fair value market cap since they last traded. Things looked much worse at Wednesday's lows, as fair value indicated a 21% fall in the sector's market cap.

This market trailing performance is led by the National Bank of Greece whose fair value share price has fallen by 15%.

The company's ADR has been a key driver of the fair value price set for Greek equities, and its 17.5% fall (in dollar terms) has helped price the rest of the sector; many of whom don't have an actively traded international listing. The firm's ADR jumped by a significant 22% on Wednesday, which shows how volatile the situation has been for the country's financials.

Hellenic Bottling bucks the trend

While every Greek share covered by Markit Fair Value pricing has seen its price fall in the wake of the recent developments, Coca Cola Hellenic Bottling has been able to avoid most of the recent volatility. The company, whose stock also trades on the London exchange, has seen its fair value fall by a market beating 6%, no doubt due to fact that the company's Greek exposure is minimal relative to the other Greek traded shares.

Greece only represents 5% of Hellenic's total sales volumes, according to the company's latest annual report. This relative isolation from the Greek situation means that Hellenic Bottling's fair value market cap is now twice that of the second largest traded share on the Greek exchange.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Equities-Greek-shares-volatile-on-talk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Equities-Greek-shares-volatile-on-talk.html&text=Greek+shares+volatile+on+talk+breakthrough","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Equities-Greek-shares-volatile-on-talk.html","enabled":true},{"name":"email","url":"?subject=Greek shares volatile on talk breakthrough&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Equities-Greek-shares-volatile-on-talk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+shares+volatile+on+talk+breakthrough http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Equities-Greek-shares-volatile-on-talk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}