Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 10, 2015

Japanese tech sees resurgent short interest

Consolidation and risk separation are trending among Japanese electronics manufacturers as firms with concentrated consumer exposure are facing strong pressure from component commoditisation and smartphones.

- Investors see risk as Sharp shares dive on weak demand and as firm snubs Japanese Display

- Nikon reports lower earnings driven by shrinking digital camera demand and lens sales

- Short sellers bet against diversified Casio despite firm delivering returns

Japanese exports

The most shorted stocks of the Nikkei 225 are previous giants of the 1990s consumer technology revolution. Sharp, Casio and Nikon are facing a wave of threats and currently make up the top three most shorted despite renewed government efforts to actively help the country's exporters by actively devaluing the yen.

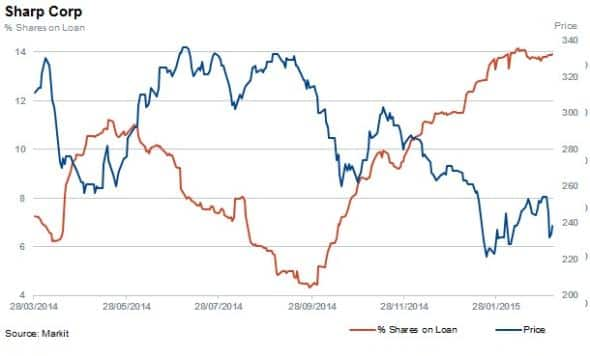

Sharp Corporation has borne the brunt of the recent negative sentiment. Since the end of September 2014, the proportion of shares outstanding on loan for the Osaka based firm has tripled to 13.9% while its stock has retreated by a quarter.

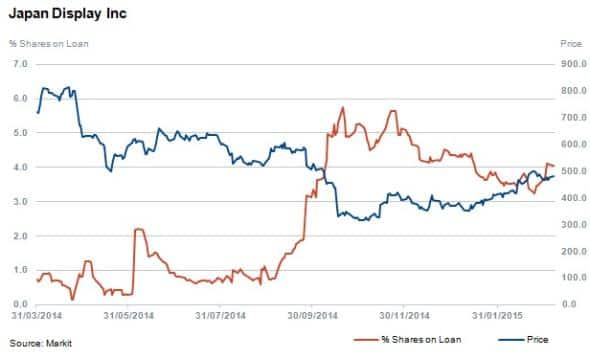

Since its formation in March 2014 by Sony, Toshiba and Hitachi, Japan Display has effectively rolled up underperforming display businesses across the industry; a move which mirrors steps taken by the banking industry in the wake of the financial crisis.

These industry movements have effectively left Sharp exposed to the weakening market for displays, developments which short sellers have capitalised on. This trend is set to continue in the near term as the company has quashed rumours of a potential tie-up with Japan Display.

Japan Display has struggled operationally recently, which has been reflected in its share price and rise in short interest. News flow coming from the firm has turned around as of late with the announcement that the firm was building a new plant under Apple's auspices to supply screens for iPhones from 2016. Short sellers have since retreated from their highs and the firm's shares have rebounded strongly.

Japanese technology short sale targets

In comparison to Sharp, Casio Computer has delivered strong sales and earnings growth since 2013 with continued growth forecast up to 2016. But short sellers have not been convinced by Casio's recent performance translating into future success. Shares out on loan have increased from 2% in March of last year to 16% in August and have hovered around that mark since, despite a recent share price surge.

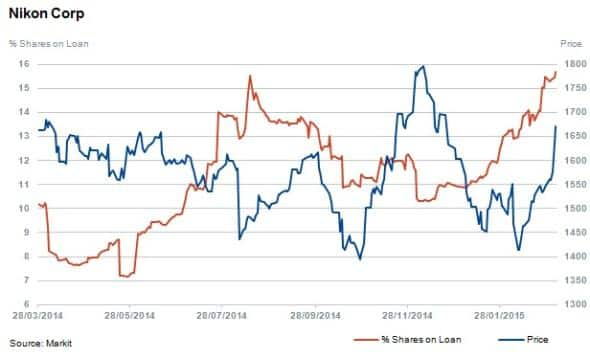

The most short sold of the three firms is Nikon which has just under 16% of shares out on loan after the company announced guidance for the current financial year which missed analyst expectations.

Short sellers are no doubt spurred on by the firm's over reliance on cameras which makes up the majority of its instruments division, responsible for 70% of its revenue. Nikon has recently announced that operating income in the instruments division was under pressure, and competitor Cannon has recently reported weakness in its camera division caused by the ever increasing appeal of smartphones. Short sellers continue to bet on the negative impact of smart phones on electronic component suppliers in Japan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-equities-japanese-tech-sees-resurgent-short-interest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-equities-japanese-tech-sees-resurgent-short-interest.html&text=Japanese+tech+sees+resurgent+short+interest","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-equities-japanese-tech-sees-resurgent-short-interest.html","enabled":true},{"name":"email","url":"?subject=Japanese tech sees resurgent short interest&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-equities-japanese-tech-sees-resurgent-short-interest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+tech+sees+resurgent+short+interest http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-equities-japanese-tech-sees-resurgent-short-interest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}