Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 09, 2015

Distressed bonds multiply in turbulent market

The ratio of distressed US $HY bond's has doubled over the past year, just as the Fed looks to raise interest rates and commodity prices hit fresh multi year lows.

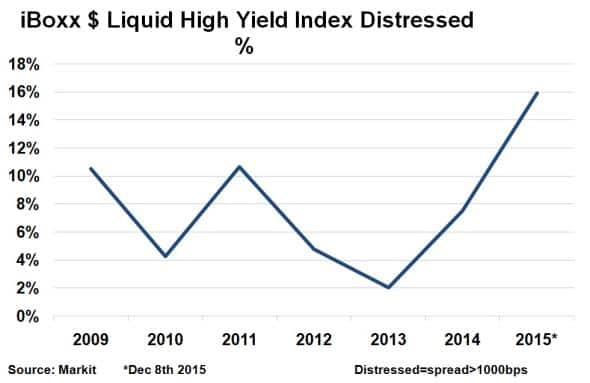

- 16% of constituents in Markit iBoxx $ Liquid High Yield Index are currently 'distressed'

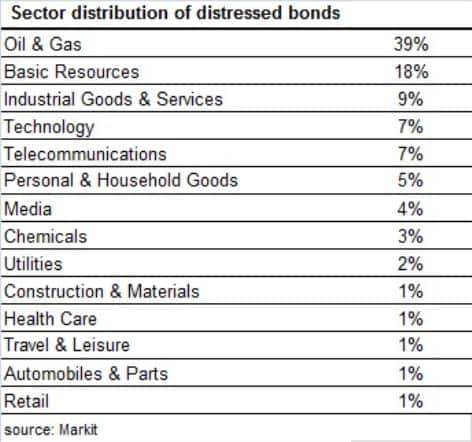

- Oil & Gas and Basic Resources sectors make up 58% of the distressed bonds

- Euro denominated high yield bonds have proven much more resilient in current market

With a downturn in commodity prices and the end of zero interest rate policy approaching, investors are anticipating further strain on commodity-exposed corporate balance sheets and higher future borrowing costs. It is no surprise, then, that investors are shunning the riskiest part of the US corporate bond market; high yield (HY).

While recent default rates have been running below the recent average in the US corporate bond market over the last few years, levels at which current high yield issuances are trading indicate that the tide may be turning. The yield on the iBoxx $ Liquid High Yield Index is currently 7.85%; close to four year highs.

This surging yield has been driven by an increasing proportion of bonds trading at distressed levels, an early indication of potential defaults. A distressed bond can be loosely defined as trading with an annual benchmark spread (a measure of credit risk) of over 1000bps. The latest data shows that 157 of the 985 current constituents of the iBoxx $ Liquid High Yield Index currently trade with a spread above 1000bps. This represents a distress ratio of 16%.

The current distress ratio represents a doubling from the levels seen last year when 8% of the index was in distressed territory. In fact, the current distressed ratio is the highest seen during a year end over the past six years, with 2011 and 2009 marking the only other two years with a figure above 10%.

Among the distressed names, the main protagonists are bonds in the Oil & Gas and Basic Materials sector, which make up 58% of distressed bonds.

With crude oil prices hitting fresh six year lows this week and commodity prices crumbling, excess leverage during the good years has dented credit profiles. This is represented by the sharp change in the distressed ratio over the past two years.

Euro HY

Compared to their European counterparts, the current distressed ratio among $HY highlights that the trend is largely isolated within the US market. 32 bonds in the 448 constituent iBoxx EUR Liquid High Yield Index are currently trading distressed, giving a 7% distressed ratio. This is less than half the percentage seen in the US high yield market. Stripping out reverse yankees and eurobonds (for example Petrobras issuing in euros), and the distressed ratio falls to 3%.

While it is worth noting that the European market is much less exposed to factors such as commodities and higher interest rates, the trend could also signal a different stage in the credit cycle.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122015-credit-distressed-bonds-multiply-in-turbulent-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122015-credit-distressed-bonds-multiply-in-turbulent-market.html&text=Distressed+bonds+multiply+in+turbulent+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122015-credit-distressed-bonds-multiply-in-turbulent-market.html","enabled":true},{"name":"email","url":"?subject=Distressed bonds multiply in turbulent market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122015-credit-distressed-bonds-multiply-in-turbulent-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Distressed+bonds+multiply+in+turbulent+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122015-credit-distressed-bonds-multiply-in-turbulent-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}