Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 09, 2014

German export fall adds to recession worries, but trend not really so bad

German exports plunged 5.8% in August, adding to fears that the eurozone's largest member state is sliding back into recession. The news follows data showing similar slumps in factory orders and manufacturing output.

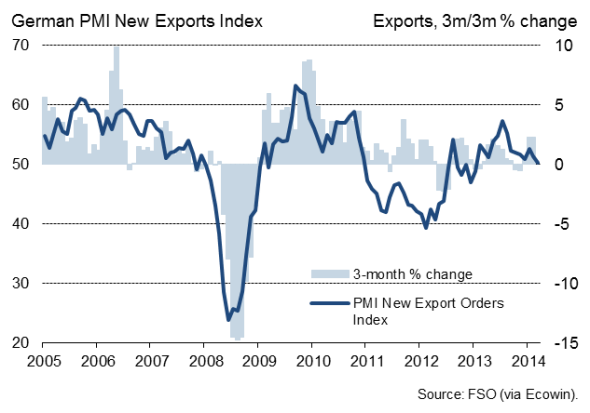

However, difficulties in estimating for changing holidays urge caution in relying too heavily on the official data, suggesting the August drop overstates the deteriorating trade position and chance of recession. But PMI survey data confirm that a weakening trend is clearly evident, especially in industry and that, if not contracting, the economy is certainly cooling.

Export plunge caused by holidays

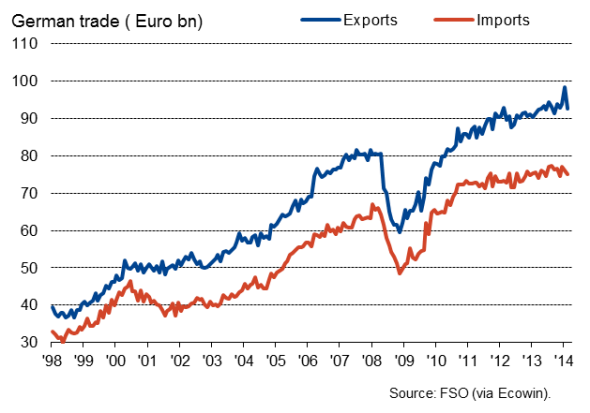

Data from the Federal Statistical Office showed the 5.8% drop in exports in August was the largest since January 2010, but the decline was in part due to the timing of school holidays. In many L"nder, the holidays were later than usual. Such shifting holiday trends are difficult for standard seasonal adjustment techniques to make full allowance for.

A better indication of the underlying trend can often be gained by looking at the pattern over several months. Some reassurance can be gained from the fact that exports in July and August combined are running 2.0% higher so far in the third quarter compared to the second quarter. However, even this rebound does not provide a true picture of the trend, because the second quarter had also been affected by holidays. Exports rose a mere 0.5% in the second quarter, a period when GDP fell 0.2% and manufacturing output dropped 0.6%, in part due to an unusually high number of public holidays (read our article here for more details).

The true export picture is therefore most likely something in between the steep decline signalled by the August data and the 2.0% growth seen in the third quarter so far. Fears of a recession may therefore be exaggerated.

German goods exports

Imports and exports

Recession fears overplayed?

PMI survey data add further clues as to the business trend in Germany, offering the advantage of tending to be less affected than official data by special factors such as changing holiday patterns. The PMI data suggest that the economy rebounded modestly in the third quarter, but that the recovery is all-too dependent on the domestically-focused services sector. Manufacturing growth slowed to stagnation in September, and goods exports barely rose, according to PMI respondents, staging the worst performance for 14 months. The deteriorating picture from the PMI surveys is one of German industry suffering from headwinds such as sanctions with Russia and ongoing economic malaise in its euro area partners, notably France and Italy.

Even if a technical recession is avoided, policymakers will no doubt be concerned by the loss of momentum in the euro area's largest member state.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-German-export-fall-adds-to-recession-worries-but-trend-not-really-so-bad.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-German-export-fall-adds-to-recession-worries-but-trend-not-really-so-bad.html&text=German+export+fall+adds+to+recession+worries%2c+but+trend+not+really+so+bad","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-German-export-fall-adds-to-recession-worries-but-trend-not-really-so-bad.html","enabled":true},{"name":"email","url":"?subject=German export fall adds to recession worries, but trend not really so bad&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-German-export-fall-adds-to-recession-worries-but-trend-not-really-so-bad.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+export+fall+adds+to+recession+worries%2c+but+trend+not+really+so+bad http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-German-export-fall-adds-to-recession-worries-but-trend-not-really-so-bad.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}