Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 09, 2017

Indonesia GDP points to steady second quarter growth but headwinds remain

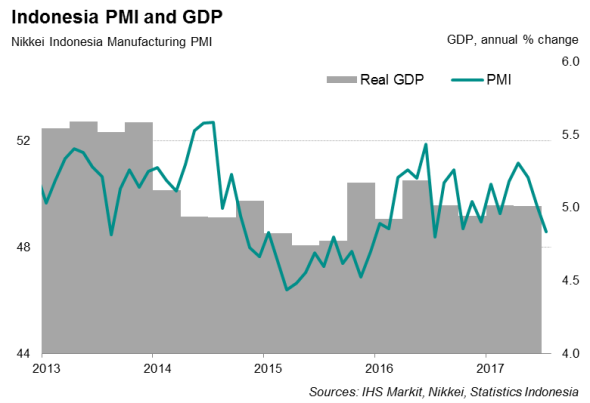

Indonesia's economy maintained strong growth momentum in the second quarter, but PMI data suggest that the pace of expansion has likely waned at the start of the third quarter.

Data from Statistics Indonesia indicated that Indonesian gross domestic product rose 5.0% in the second quarter, slightly undershooting analysts' forecasts of 5.1%, but broadly in line with that signalled well in advance by the PMI surveys. The latest expansion of GDP was identical to that seen in the previous quarter, and in line with IHS Markit's forecast of 5.0% annual GDP growth this year.

On a quarterly basis, the economy grew 4.0% in the three months to June, recovering from the 0.3% decline in the opening quarter. However, first quarter GDP figures tend to be relatively weak as the data are not seasonally adjusted.

Weaker outlook

While consumption and capital investment remained key drivers of the economy, growth was hampered by a decline in government spending and a marked slowdown in net export growth. Overall, economic growth over the first half of 2017 was below expectations, and there are indications that hitting the 5.2% target set by the government will be challenging.

After its recent peak in April, the Nikkei Indonesia Manufacturing PMI fell to a one-year low in July, signalling a deceleration in growth momentum. Moreover, it was the second consecutive month that the headline index indicated a deterioration in manufacturing conditions.

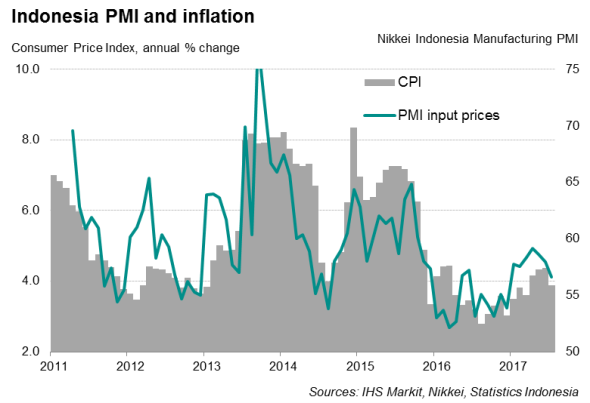

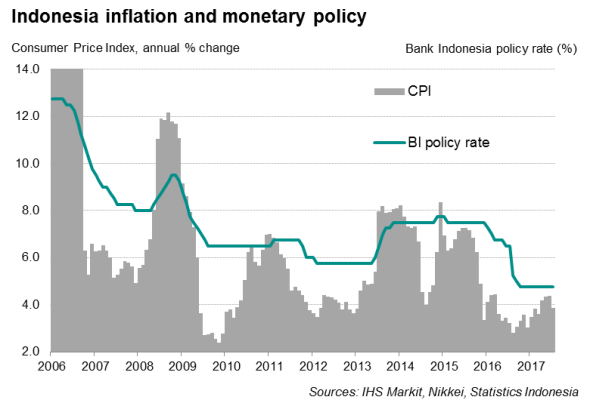

A weakening manufacturing sector added to the government's struggle to boost economic growth ?and raised the chances of Bank Indonesia (BI) restarting a rate cut cycle in the coming months, especially as growth prospects have increasingly tilted to the downside while inflationary pressures have softened. BI governor Agus Martowardojo commented recently that policymakers are open to the possibility of easing.

These headwinds ? softening commodity prices and weaker external demand ? weighed on hiring. Employment in Indonesia's manufacturing sector continued to shrink at the start of the third quarter, which could in turn dampen household expenditure in the near future.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082017-economics-indonesia-gdp-points-to-steady-second-quarter-growth-but-headwinds-remain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082017-economics-indonesia-gdp-points-to-steady-second-quarter-growth-but-headwinds-remain.html&text=Indonesia+GDP+points+to+steady+second+quarter+growth+but+headwinds+remain","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082017-economics-indonesia-gdp-points-to-steady-second-quarter-growth-but-headwinds-remain.html","enabled":true},{"name":"email","url":"?subject=Indonesia GDP points to steady second quarter growth but headwinds remain&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082017-economics-indonesia-gdp-points-to-steady-second-quarter-growth-but-headwinds-remain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indonesia+GDP+points+to+steady+second+quarter+growth+but+headwinds+remain http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082017-economics-indonesia-gdp-points-to-steady-second-quarter-growth-but-headwinds-remain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}