Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 09, 2016

European financials bonds lag in QE rally

European financials bonds are rallying, but a closer look at the asset class shows that the extra spread required by investors to hold the asset class has remained stubbornly high.

- Markit iTraxx Europe Senior Financials trading at its lowest level in four months

- Spread difference in European financials bonds near yearly high despite rally

- GBP financials spread difference surged after BOE corporate bond purchase decision

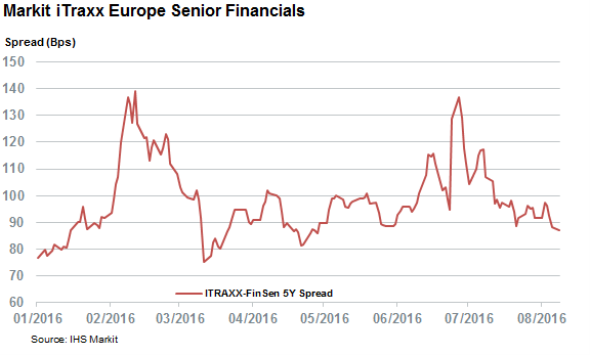

Financials on both sides of the English Channel have borne the brunt of the recent market volatility but last week's release of the European Banking Authority stress test results and the Bank of England's (BOE) decision to add corporate bonds to its revamped quantitative easing programme has brought some calm to the sector. The Markit iTraxx Senior European Financials, which tracks credit risk across the sector, rallied strongly following these developments and now trades at 87bps.

The index is now trading at its tightest level in over four months and indicates that credit risk across the sector has tightened by a stunning 30% from its post brexit high.

Sterling and euro denominated financials bonds have mirrored the improving credit outlook of the credit world as the spreads of the financials part of both the iBoxx Euro and GBP indices are now trading at new yearly lows.

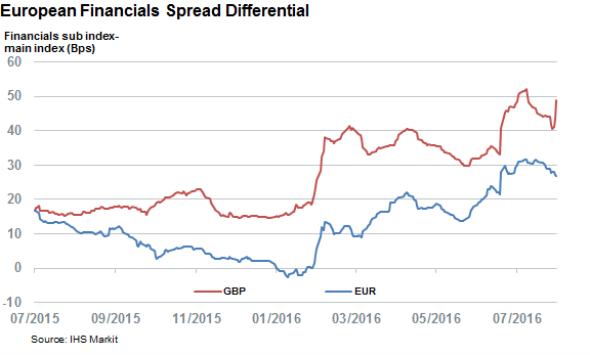

Spread difference near yearly highs

While these moves may look promising at first glance, it's worth noting that much of the spread tightening has been driven by improving investor sentiment towards the region's corporate bonds rather than a renewed affinity towards financials bonds. When accounting for spread movements in the wider euro and sterling denominated corporate bonds, the recent rally looks anything but given that the extra spread demanded by investors to hold financials bonds has gradually widened over the last few months.

The spread difference between the financials part of the Markit iBoxx Euro and GBP corporate indices and their respective corporate peers is now materially wider in both currencies from the levels seen a year ago. The most recent spread differential has also shown no signs of materially tightening given that the spread differential in euro and GBP denominated bond is only 3 and 5bps off the yearly highs seen last month.

The stubbornly high spread difference between financials bonds and the wider universe indicates that much of the recent rally has reflected glory from external forces, such as quantitative easing, rather than a full blown reversal in the sector.

This trend is likely stoked by the fact that many financials bonds are ineligible for these asset purchase programmes. This was made even more evident last week when pound denominated financials bonds saw their spread differential widen materially in the wake of the BOE stated that its will not include bonds issued by banks, insurers and building societies in its Asset Purchase Facility Corporate Bond Purchase Scheme.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082016-Credit-European-financials-bonds-lag-in-QE-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082016-Credit-European-financials-bonds-lag-in-QE-rally.html&text=European+financials+bonds+lag+in+QE+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082016-Credit-European-financials-bonds-lag-in-QE-rally.html","enabled":true},{"name":"email","url":"?subject=European financials bonds lag in QE rally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082016-Credit-European-financials-bonds-lag-in-QE-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+financials+bonds+lag+in+QE+rally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09082016-Credit-European-financials-bonds-lag-in-QE-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}