Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 09, 2015

UK bonds prove to be market's guilty pleasure

UK gilts have provided a safe haven for investors seeking stability since the Greek crisis deteriorated over the last ten days, leading pound denominated bonds to outperform their euro counterparts.

- 10 year gilts have tightened by 30bps since Greek talks broke down on June 26th

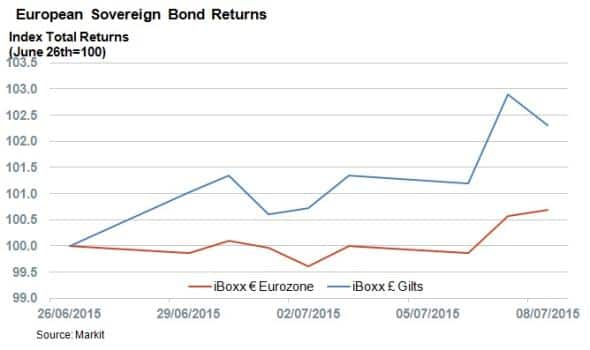

- iBoxx " Gilts index has outperformed the iBoxx € Eurozone by 1.6% in the last ten days

- UK bond ETFs have seen over $100m of inflows since the Greek crisis worsened

One of the interesting side effects of the ongoing Greek situation has been the fact that European bonds have proven fairly resilient as investors seek safety in fixed income. One particular area of safety in the region has been British pound denominated bonds, which are more isolated from the ongoing euro saga than their cross channel peers.

This flight to safety in UK bonds has seen 10 year UK gilts tighten by 30bps, putting this key UK benchmark rate down below the 2% mark for the first time since May. This may be driven by the fact that uncertainty stemming from the Greek crisis could make an early rate rise less likely.

German bunds have also proven resilient in the last couple of weeks, but the 25bps tightening has failed to match that seen in UK gilts.

UK bonds outperform

The rebound seen in gilt yields has ensured that UK sovereign bonds have outpaced their European peers since the start of the latest Greek chapter. The iBoxx " Gilts index has returned 2.3% since June 26th, driven primarily by the tightening yields.

Continental euro denominated sovereign bonds have not proved as resilient as periphery bonds in the wake of the Greek situation. The iBoxx € Eurozone has not held up as well as German bunds in the last ten days, as the index has only delivered 0.7% of total returns since talks broke down over Greece. This underperformance is driven by the fact that the index spread over benchmark bunds has widened by13bps as investors became more sceptical of periphery sovereign bonds.

The same phenomenon has been seen in corporate bond market, with the Markit iBoxx " Corporates returning 1.2% since June 26th; 1% above the returns delivered by the iBoxx € Corporates.

UK bond ETFs see inflows

ETF investors have taken note of this outperformance, as bond ETFs which track the UK market have seen over $100m of inflows in the last week and a half. Eurozone bond ETFs on the other hand have suffered outflows, with investors pulling over $120m of assets from the 250 plus funds which invest in the region.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Credit-UK-bonds-prove-to-be-market-s-guilty-pleasure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Credit-UK-bonds-prove-to-be-market-s-guilty-pleasure.html&text=UK+bonds+prove+to+be+market%27s+guilty+pleasure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Credit-UK-bonds-prove-to-be-market-s-guilty-pleasure.html","enabled":true},{"name":"email","url":"?subject=UK bonds prove to be market's guilty pleasure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Credit-UK-bonds-prove-to-be-market-s-guilty-pleasure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+bonds+prove+to+be+market%27s+guilty+pleasure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Credit-UK-bonds-prove-to-be-market-s-guilty-pleasure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}