Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 09, 2016

European financials deflate in 2016

The potential for a prolonged sub-to-near-zero interest rate environment has turned the market tide against European banking shares, but investor sentiment is not unanimously bearish.

- Strong sell off in European financials as sector plummets 20% year to date

- Investors pull over $1bn in funds from European ETFs exposed to financials

- Despite the recent underperformance, few short sellers have jumped on the sector

Whatever it takes

2016 has seen continued stimulus efforts and ambitions of central bankers fighting deflation square off against European financials. With Japan surprising markets with the implementation of negative interest rates last week, sentiment has turned aggressively sour towards major European banks.

In the past few weeks, the decline of financials has accelerated at nearly twice the pace that is seen in across the broader European market, as gauged by the iShares Stoxx 600 Europe Banks which is down by a staggering 20% year to date, twice that of its broader full index peer.

ETF investors ahead of sell off

ETF investors seem to have no appetite to call the bottom of this trend as the 73 financial ETFs listed in Europe have seen significant outflows since the start of the year, with net withdraws approaching the $1bn mark year to date. This already outpaces the previous largest quarterly outflow of $1.1bn, seen in Q3 2011 when fears of financial contagion gripped European markets.

The recent outflow combined with poor price performance means that the AUM from these funds has shrunk by over $2bn, over 15% of last year's year end total.

Short sellers may have missed the sell off

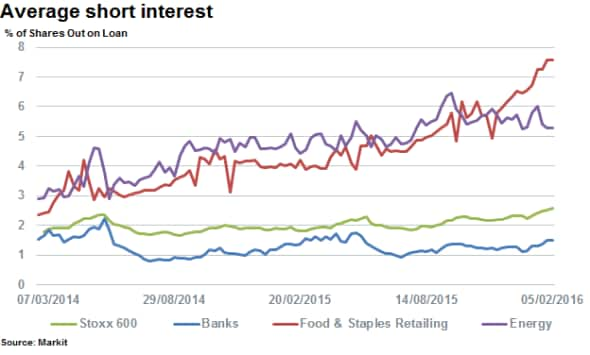

But investor sentiment is not uniformly pessimistic sector wide, as short selling across European banking firms has continued to stay below that seen in the wider market. Banking shares now see 1.5% of their shares out on loan on average, one-third less of that of the average for Stoxx 600 constituents which stands at 2.6%.

This gap has also shown no signs of closing in the recent weeks as demand to borrow stocks of banking firms in Europe has only increased by 9% in the last 12 months, while the rest of the market has seen a 33% increase in short interest.

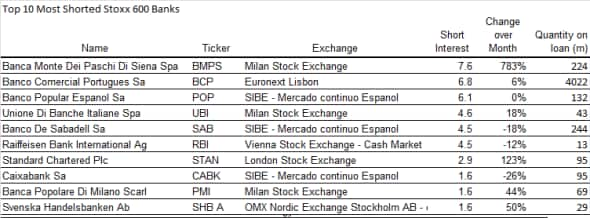

The relatively low demand to sell banking firms short has revolved around periphery banks featuring Italian, Portuguese and Spanish banks. Even this trend has failed to see the kind of concentrated short selling seen in energy names, as only three European banks currently have short interest north of 5% of shares outstanding.

Perhaps in the wake of the recent sell off in major European banks, combined with increasing CDS spreads, short sellers may be more tempted to go short financials if the uncertainty in the sector increases.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-equities-european-financials-deflate-in-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-equities-european-financials-deflate-in-2016.html&text=European+financials+deflate+in+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-equities-european-financials-deflate-in-2016.html","enabled":true},{"name":"email","url":"?subject=European financials deflate in 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-equities-european-financials-deflate-in-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+financials+deflate+in+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-equities-european-financials-deflate-in-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}