Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 09, 2015

Credit investors spurn oil sovereigns

As the oil tide recedes, oil-exporting sovereign entities have been treated with increasingly bearish sentiment by credit investors.

- Dollar denominated 5 year Venezuelan bonds trade with a 30% yield

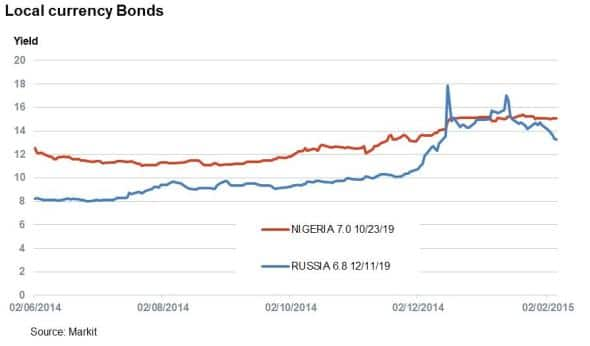

- Russian bonds briefly traded wider than Nigerian sovereign credit, but trend recently reversed

- Large sovereign wealth funds look to have buoyed Norway and Saudi Arabia as their CDS spread sits largely unmoved

Oil has seen its price halve since the end of July last year, from around $100 per barrel to around $50 today (WTI), compelling net exporters to rethink their budgets.

The biggest net exporter of oil, Saudi Arabia, has so far contained its troubles, with its latest 5 Year CDS spread, 75bps, is comparable to that of Israel and below China. Its large cash reserves have curtailed running budget deficits plus its elasticity to supply shocks means the Gulf nation has been able to sustain market share. Other major net oil exporters in the region such as Kuwait and the UAE have battled by decreasing prices and increasing supply respectively.

Norway is Europe's biggest supplier and one of the world's richest petro-economies. The country will see a sizeable chunk of its GDP shaved off, but like Saudi Arabia is not at risk of credit deterioration due to its mammoth sovereign wealth fund and diversified economy.

Bond markets

But slumping oil prices have reaped havoc among a certain select group of countries, as evident by the spiralling cost required to service their debt. The big spenders, heavily reliant on petro dollars as their main source of revenue have suffered the most.

Venezuela, a notorious junk grade issuer with an average coupon of 9.5%, has seen its benchmark bond due 2020 spike to yields above 30%; the highest across all sovereign bonds. Although the country holds the world's largest oil reserves, inflation is now soaring at over 60%.

Unlike Venezuela, Russia and Nigeria have also been dealing with geopolitical instability, placing significant pressure on their currencies. While yields on their dollar denominated 5 year debt having crept above 6%, Nigeria and Russia have seen their local government debt fall under selling pressure from investors, which makes up a larger chunk of debt outstanding.

Russia's ruble denominated bond due 2019 saw yields at 17% after a large interest rate hike by the central bank in mid-December, but these have since declined to just over 13% as the price of oil settled.

Nigeria's 5 year borrowing costs have seen around a 4% increase since last summer. Budget cuts are already underway, and the country expects slower economic growth.

Default probability

Current swap rates indicate Venezuela has a 94% chance of default in the next five years. As the South American country relies heavily on capital markets and has overseas assets creditors could seize on, the next few years are looking bleak.

Russia and Nigeria currently have an implied default probability of 31% and 34% respectively, and much depends on price stability and ongoing geopolitical risks. These firms have also seen the most bearish reactions from CDS traders as their spread has widened significantly in the last six months

The recent mini surge in oil last week might provide some hope to investors, or it could be shrugged off as volatility, something that will become apparent in the coming weeks.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Credit-Credit-investors-spurn-oil-sovereigns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Credit-Credit-investors-spurn-oil-sovereigns.html&text=Credit+investors+spurn+oil+sovereigns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Credit-Credit-investors-spurn-oil-sovereigns.html","enabled":true},{"name":"email","url":"?subject=Credit investors spurn oil sovereigns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Credit-Credit-investors-spurn-oil-sovereigns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+investors+spurn+oil+sovereigns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Credit-Credit-investors-spurn-oil-sovereigns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}