Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 09, 2015

Remember Greek sovereign CDS?

'Grexit' is back on the agenda

- Greece's spreads have widened considerably amid uncertainty over its status in the eurozone

- CDS still relatively illiquid, though there are signs of volumes picking up

- Positive CDS-bond basis has opened up and the curve has inverted

It seems like an aeon ago that a relatively small country in south-eastern Europe held the fortunes of the global economy in its hands. But less than two years has passed since Greece's debt was restructured, and it is all too apparent that the sovereign still has the capacity to create a noise that belies its modest size.

The latest bout of volatility was triggered by the imminent general election; one which current opinion polls indicate will be won by Syriza, a radical leftist party. Syriza's leader Alexis Tsipras has campaigned on a platform of debt relief and threatened to abandon the austerity policies enforced by the troika (the IMF, EU and ECB). This has raised the prospect of Greece leaving the eurozone (Grexit), a scenario that most though had been banished with the last bailout.

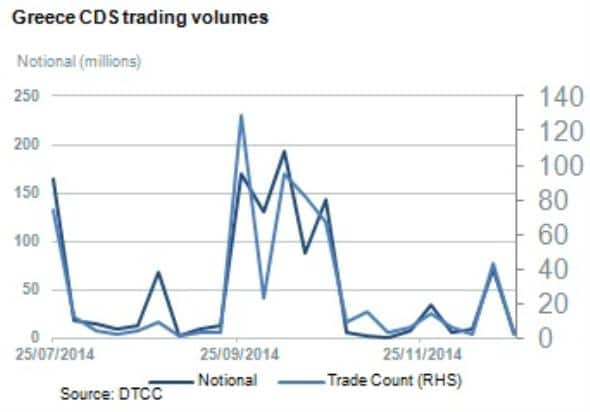

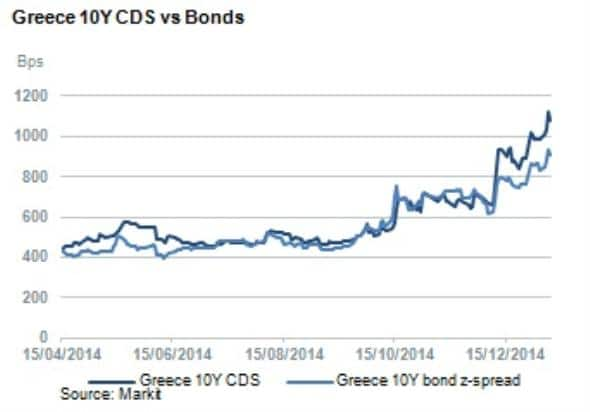

Greece's CDS is nowhere near as liquid as it was during the height of the debt crisis (it has a Markit Liquidity Score of '3', an average to poor score). The EU ban on naked shorting via sovereign CDS is now in place, which deters some speculative activity. But volumes are picking up (albeit still low - see chart), and it remains a useful signal on the sovereign's creditworthiness. And the signal is quite clear - spreads have widened from 500bps to more than 1,100bps (2003 definitions) in little over three months. This suggests that the prospect of a Syriza government, and a possible default, is taken seriously by the markets.

Even if one has doubts about the relatively illiquid CDS, Greece's government bonds have also widened significantly. The chart shows that the 2025 2% coupon bond (which was issued as part of the 2012 restructuring) has seen its z-spread spiral upwards. A positive basis has opened up in recent weeks, perhaps a consequence of the relative CDS illiquidity. Greece's curve has also inverted over this period.

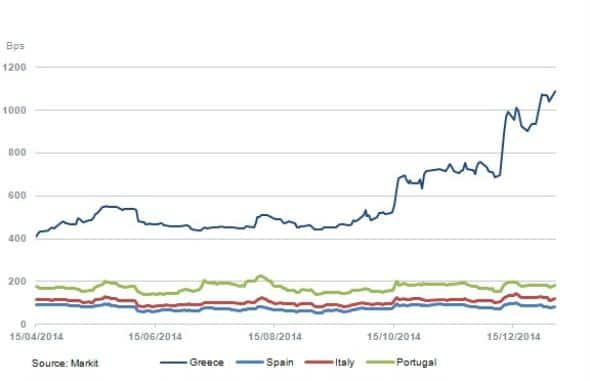

However, the contagion that was so evident in 2010-2012 hasn't re-emerged - so far. Spain, which also has a left-leaning anti-austerity party leading the polls, has seen only mild widening in its spreads. The same applies to Italy, Europe's largest debtor. The German government thinks that Grexit would be more manageable this time around due to the more robust bailout mechanisms now in place (ESM, OMT), according to unconfirmed reports, and recent spread performance suggests that the market agrees.

If Syriza is victorious, it is not at all clear that it will seek to exit the euro if its demands are not met. A compromise with Germany and other creditors is a more likely outcome. In any case, some form of debt relief is probably inevitable given Greece's mountainous debt burden (probably in the form of maturity extensions and/or interest reductions). But history tells that investors shouldn't be complacent, and we can expect spread further volatility ahead of the January 25th election.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Credit-Remember-Greek-sovereign-CDS.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Credit-Remember-Greek-sovereign-CDS.html&text=Remember+Greek+sovereign+CDS%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Credit-Remember-Greek-sovereign-CDS.html","enabled":true},{"name":"email","url":"?subject=Remember Greek sovereign CDS?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Credit-Remember-Greek-sovereign-CDS.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Remember+Greek+sovereign+CDS%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Credit-Remember-Greek-sovereign-CDS.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}