Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 08, 2015

Interest rate hedging falls out of favour

Investors have been fleeing interest rate hedged ETFs in recent weeks, despite the fact that the bond market is increasingly gearing up for a December rate rise.

- Markit iBoxx $ Treasuries index yield back above 2.3%, levels last seen since June

- US interest rate hedged corporate bond ETFs shed 25% of their AUM from summer highs

- High yield funds have driven outflows as credit risk surges in the asset class

Last week's better than expected US jobs report saw the market clear what had been tipped to be the final hurdle for a December interest rate hike. As a result, yields on US treasuries surged to levels not seen since last summer, before the China/emerging market volatility saw US policy makers to delay the long awaited rate hike. These rising yields are reflected in the Markit iBoxx $ Treasuries index whose yield now sits north of 2.3%, for just the fifth time since the start of the year.

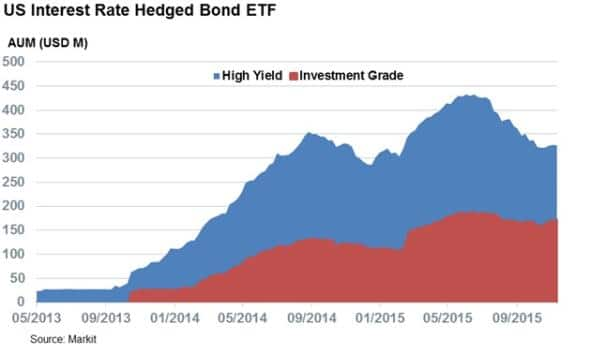

Interestingly, the recent strong market consensus towards a US rate rise has not proven to be the boon that ETF issuers had been hoping for as interest rate hedged funds have fallen out of favour with investors in recent months. Issuers have been actively listing interest rate hedged products in anticipation of a flood of investor demand, but the demand for the products has fluctuated in recent weeks. To this end, the four US corporate bond interest rate hedged ETFs have seen their AUM fall by a quarter from their recent highs.

The previous highs were seen just before this summer's treasury volatility when these four funds managed $430m in combined AUM.

High yield left behind

The exodus out of interest rate hedged products was led by the two high yield products, the iShares Interest Rate Hedged High Yield Bond ETF and the ProShares High Yield-Interest Rate Hedged ETF, which have seen their combined AUM fall by over a third from the summer's highs. This trend is driven by the deteriorating credit situation among the asset class as its spread over treasuries has surged to recent highs in the wake of the commodities collapse.

Investment grade bond hedged ETFs have had a much better time of it as these funds manage over 90% of their peak AUM as the asset class proves much less exposed to the recent commodities driven volatility. This trend underscores the continuing popularity of interest rate hedged products as the market consensus towards a December rate rise grows. The falling AUM is therefore most likely more reflective of the headwinds faced by high yield bonds in recent months rather than a falling desire to hedge away credit risk.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com<<p>

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-credit-interest-rate-hedging-falls-out-of-favour.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-credit-interest-rate-hedging-falls-out-of-favour.html&text=Interest+rate+hedging+falls+out+of+favour","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-credit-interest-rate-hedging-falls-out-of-favour.html","enabled":true},{"name":"email","url":"?subject=Interest rate hedging falls out of favour&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-credit-interest-rate-hedging-falls-out-of-favour.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Interest+rate+hedging+falls+out+of+favour http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-credit-interest-rate-hedging-falls-out-of-favour.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}