Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2015

Week Ahead Economic Overview

A fleet of economic data releases in the US are likely to add to the policy debate, while inflation numbers are released across a number of regions, including China, the eurozone and the US. Industrial output data are meanwhile out in China and Asia.

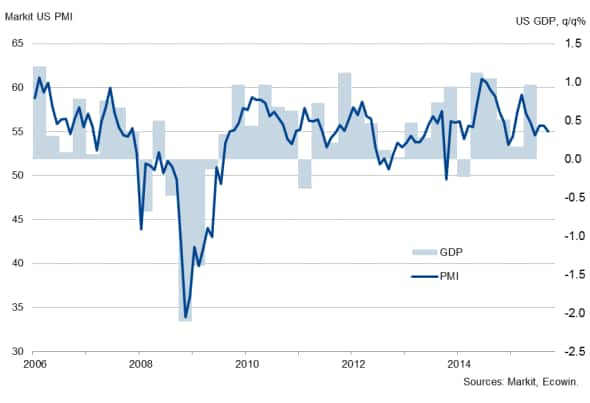

With the Federal Reserve leaving monetary policy unchanged at its September meeting, the 'data dependent' Fed will observe the data flow in coming months carefully for signs that the US economy is ready for a first rate hike. While PMI data suggest that the economy expanded by around 2.2% (annualised) in the third quarter, the data also signal that average prices charged for goods and services are falling at the fastest pace since the survey started in 2009 and that the manufacturing sector struggles against the strong dollar.

US GDP and the PMI

The release of inflation, industrial production and retail sales data will therefore be eagerly watched by policy makers. Consumer prices rose a mere 0.2% in the 12 months through to August, and the Fed has lowered its inflation forecast for the year further. The most recent estimate of 0.4% inflation is well below the Fed's target of 2% and is clearly an argument against a rate hike. Moreover, industrial production fell 0.4% in August and latest PMI data signalled a further loss of growth momentum, adding to signs that economic growth may slow as we head into the final quarter of the year.

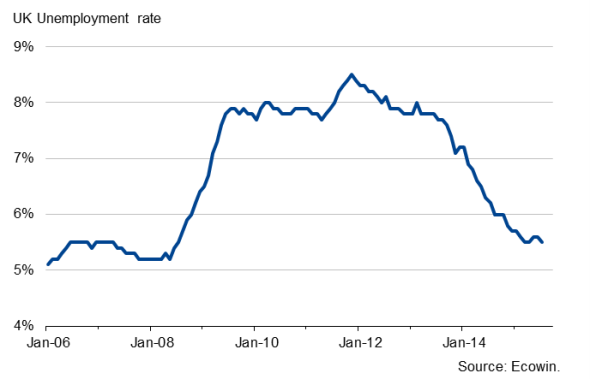

Although PMI data for the UK signalled that the pace of economic growth slowed in September, firms continued to take on staff at an impressive rate, as a fractional decline in workforce numbers at manufacturers was more than offset by robust hiring at constructors and service providers. However, the weakest rise in new business for two-and-a-half years suggests that there's a likelihood of a further slowdown in both economic activity and hiring, with the Bank of England stating that "the most recent official estimates and survey data are consistent with a gentle deceleration in UK output growth since its peak at the beginning of 2014."

July's jobs report showed that the unemployment rate was at its joint-lowest since the financial crisis, with wages rising 2.9% in the latest three-month period (steepest increase since February 2009). Moreover, with inflation at zero, households are clearly benefitting from an upswing in real pay, which should help boost the economy in coming months. While higher pay and a tight labour market suggest that a first rate hike by the end of the year may still be a possibility, low inflation and a slowdown in economic growth are arguments against any imminent rate rise. In its October meeting, the Bank of England voted 8-1 to keep rates steady.

UK unemployment

The eurozone also sees the release of consumer price and industrial production data. While industrial output increased by 0.6% in July (strongest rise since February), it is expected that August's numbers will be much weaker. Production fell 1.2% in Germany and data in Spain also disappointed. Moreover, PMI results suggest that manufacturing is likely to provide only a minor boost to the overall economy in the third quarter, as the sector is failing to achieve significant growth momentum despite central bank stimulus and currency depreciation.

Eurozone industrial production and the PMI

Consumer prices in the currency union are estimated to have fallen 0.1% in September, according to a flash release from Eurostat, pushed down by a substantial fall in energy prices. If confirmed by the final data, the region would have fallen into deflationary territory for the first time since March, and more pressure would be put on the European Central Bank to boost its stimulus programme in order to achieve its inflation target.

Eurozone inflation

PMI data for China signalled a further weakening of the economy at the end of the third quarter, with the survey data pointing to GDP growth waning further from the 7.0% seen in the second quarter. The data also highlighted a continuation of deflationary pressures, with prices charged for goods and services falling at the steepest rate in one-and-a-half years. The release of industrial production and consumer price data will add to the policy debate in Asia's largest economy and provide data watchers with more information on the health of the economy.

Japan, meanwhile, see updates to industrial production and consumer confidence numbers, with the Bank of Japan hoping to see the goods producing sector benefitting from the weakened yen.

Monday 12 October

The latest UK Commercial Development Activity Report is out.

India sees the release of trade, consumer price and industrial output data.

Regional PMI data are released across the UK.

The latest Ulster Bank Ireland Construction PMI is out.

Current account information is published in France.

Tuesday 13 October

Business confidence data are released in Australia, while Japan sees the publication of consumer confidence numbers.

Trade data are out in China.

ZEW economic sentiment and inflation data are meanwhile issued in Germany.

Inflation data and BRC retail sales figures are released in the UK.

In the US, the latest NFIP Business Optimism Index is issued.

Wednesday 14 October

The National Australia Bank publishes latest consumer sentiment data.

In India, wholesale price data and M3 money supply information are released, while China sees the publication of consumer price figures.

Eurostat publishes industrial production data for the currency union.

In France, Italy and Spain, consumer price figures are issued.

Labour market data are updated by the Office for National Statistics in the UK.

Brazil sees the publication of retail sales numbers.

Retail sales numbers and business inventory data are released in the US.

Thursday 15 October

In Australia, unemployment numbers are issued.

Industrial output figures are meanwhile released in Japan and Russia.

The IPA UK Bellwether Report is published.

In the US, consumer price information, initial jobless claims numbers and the Philly Fed Business Index are released.

Friday 16 October

Consumer price numbers are out in the eurozone and Russia, with the former also seeing the release of trade data.

Manufacturing sales figures are meanwhile issued in Canada.

The US sees the release of industrial production numbers and the Reuters/Michigan Consumer Sentiment Index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}