Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 08, 2015

Shorts make smart bets on chipmakers

Smartphone market saturation and price deflation has continued to drive increased consolidation in the semiconductor and component supply industry, propelling a rise in average short interest in recent months.

- Semiconductor sector and ETF sees a spike in short interest in recent weeks

- Investors withdraw $250m from SOXX semiconductor ETF, AUM halves year to date

- Ambarella, video chip maker for GoPro, successfully targeted by activist short sellers

Component consumption

Global smartphone saturation saw unit sales forecasts and average selling prices cut back significantly in 2015. Lower prices and volume growth means more intense competition and price pressure for handset makers and component manufacturers alike.

Despite battling lower cost competitors out of China and higher end competition from Apple, South Korea's Samsung Electronics beat expectations for third quarter earnings this week, signalling a recovery for the stock after two years of strife.

While improved display panel margins and stronger smartphone shipments did contribute, a booming semiconductor division continues to be the main driver of the company's recovery as chip sales outperformed. This good fortune, however, is on the back of increased internal supply of components and means lower sales for other chip makers in a low growth and saturated environment.

ETF components

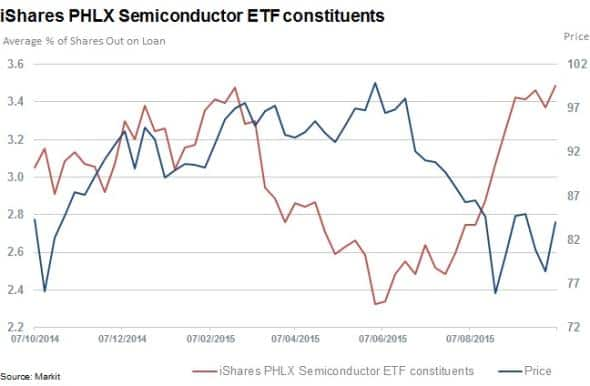

Investor sentiment towards the semiconductor industry can be gauged by the iShares PHLX Semiconductor ETF (SOXX), which tracks US companies in the sector. The ETF has seen a surge in average short interest across constituents since June 2015, rising to 3.5%, close to the 12 month highs of 3.7%. The ETF is down 8% year to date and 15% off highs reached in early June.

Investors don't look to be eagerly buying the dip as they have withdrawn almost $250m from the SOXX ETF year to date with total AUM almost halving to $357m. The rest of the semiconductor ETF field has also experienced large outflows with just under $400m of funds leaving the 12 semiconductor ETFs over the third quarter, the most on record.

Two of the largest constituents of the STOXX ETF, Intel and Qualcomm, are down 11% and 24%, respectively year to date. Qualcomm's 23% sales exposure to South Korea (Samsung) explains some of the recent weakness seen in the share price. Intel's exposure to the rapidly declining PC chip market has seen investors' uncertainty grow as sales and earnings at the largest chipmaker in the world have stagnated since 2012.

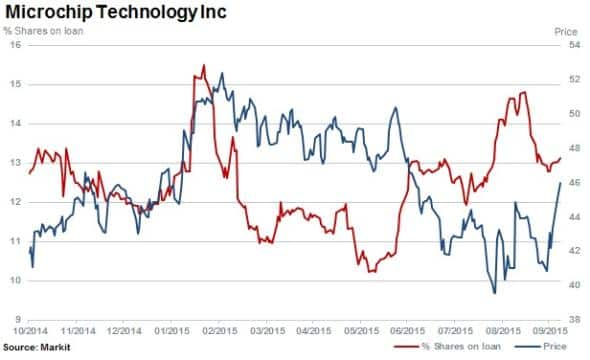

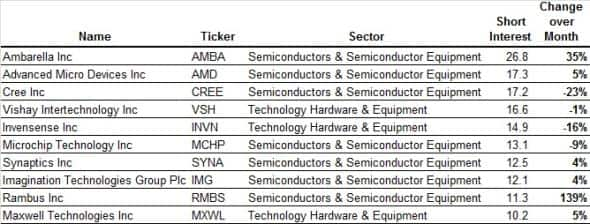

Despite stronger earnings expected for the full year based on consensus forecasts, the most shorted constituent of the SOXX ETF is Arizona based Microchip Technology with 13.1% of shares out on loan. Microchip supplies components in the "internet of things" arena with products that control and interact with devices. This segment of the market is set to face increased commoditisation.

Shorts prosper further down the line

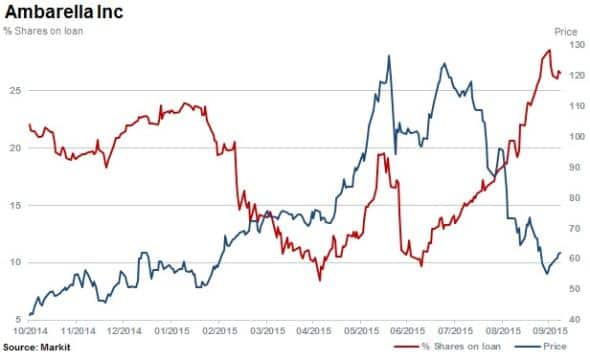

Non SOXx constituents have also seen their fair share of shorting activity. Ambarella is the most shorted chipmaker across a universe of 500 semiconductor and device companies worldwide. The stock has seen short sellers increase positions by a third since activist short seller Citron Research released a scathing report on the GoPro video chip supplier.

Ambarella's stock has fallen 45%, briefly holding below Citron's 12 month target of $60. Demand to borrow stock remains high with a fee above 10%.

Component suppliers beware

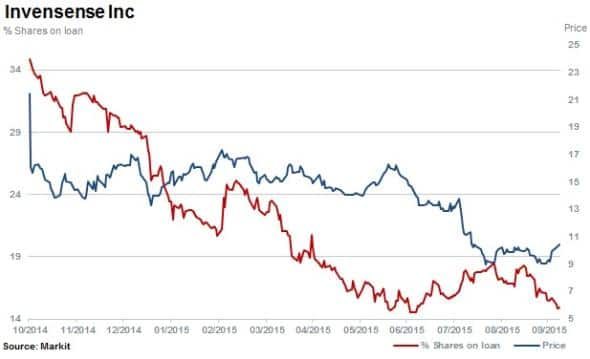

Shorts have covered positions by 58% (and profited) in Invensense, component supplier to Apple, Samsung and now Xiaomi. The firm supplies micro-electro-mechanical system gyroscopes and missed out on the Apple Watch.

Shares came under pressure when earnings fell in the 2015 financial year due to decreased margins as the firm discounted to secure sales volumes.

Shares have continued to cover over 2015 and are down 50% over the last 12 months while shares outstanding on loan have declined to 14.9%.

The stock remains relatively short sold despite consensus forecasts indicating a strong recovery in sales and earnings for the 2016 financial year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Equities-Shorts-make-smart-bets-on-chipmakers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Equities-Shorts-make-smart-bets-on-chipmakers.html&text=Shorts+make+smart+bets+on+chipmakers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Equities-Shorts-make-smart-bets-on-chipmakers.html","enabled":true},{"name":"email","url":"?subject=Shorts make smart bets on chipmakers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Equities-Shorts-make-smart-bets-on-chipmakers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+make+smart+bets+on+chipmakers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Equities-Shorts-make-smart-bets-on-chipmakers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}