Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 08, 2017

Asia Sector PMI signals rising capex but weaker consumer spending

The majority of Asian sectors expanded midway through the third quarter, according to latest PMI data, with strong performances seen in sectors which hint at rising capital expenditure. By contrast, sectors targeting consumers seemed to have lost some momentum.

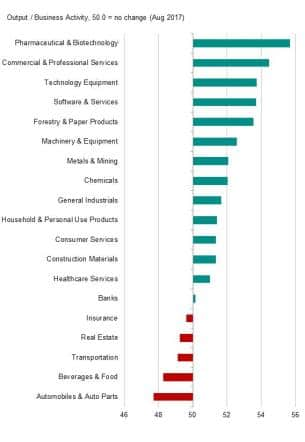

Growth was recorded in 14 of the 19 detailed sectors covered by the Nikkei Asia Sector PMI™ data in August, slightly down from 15 in July. The fastest expansion of output was registered among manufacturers of pharmaceutical and biotechnology products. July’s top performer, chemicals, meanwhile slipped to eighth place in the rankings. Nonetheless, a quicker expansion in resources, notably metals & mining, offset slower growth in chemicals, leading to another robust expansion in the broader basic materials category.

Rising capex but weaker consumer spend

Recovering from a two-year low in July, producers of machinery & equipment posted a solid rise in output in the middle of the third quarter, joining technology equipment among the top six in the rankings. Both sectors are bellwethers of capital investment spending by companies, and as such augur well for the sustainability of the broad-based upturn.

Economic growth remains steady in Asia, with the Asia Composite PMI Output Index signalling a further moderate increase in output, with particularly positive news coming from the China PMI surveys which saw growth hit a six-month high.

There are however signs of weakening consumer spending in the region. The slowest rates of growth of the major sectors covered by the PMI data were seen among providers of consumer goods and services. This could be connected to a sluggish labour market and rising inflation, which in turn eats into households’ spending power. Across the region, employment levels continued to increase only slightly in August, while firms’ selling prices rose at a faster pace.

Higher prices for metals & mining

All broad categories, except financials, reported higher average output prices in August, with the strongest rate of inflation seen in basic materials. This was primarily driven by a sharp rise in prices charges for metals & mining. In fact, the rate at which selling prices rose in the sub-sector was the steepest for nine years.

Higher prices for raw materials such as metals have been widely cited in the national PMI surveys across Asia in recent months, and are seen as a key driver of cost inflation.

Asia Sector Output Index: detailed sectors (August 2017)

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092017-Economics-Asia-Sector-PMI-signals-rising-capex-but-weaker-consumer-spending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092017-Economics-Asia-Sector-PMI-signals-rising-capex-but-weaker-consumer-spending.html&text=Asia+Sector+PMI+signals+rising+capex+but+weaker+consumer+spending","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092017-Economics-Asia-Sector-PMI-signals-rising-capex-but-weaker-consumer-spending.html","enabled":true},{"name":"email","url":"?subject=Asia Sector PMI signals rising capex but weaker consumer spending&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092017-Economics-Asia-Sector-PMI-signals-rising-capex-but-weaker-consumer-spending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+Sector+PMI+signals+rising+capex+but+weaker+consumer+spending http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092017-Economics-Asia-Sector-PMI-signals-rising-capex-but-weaker-consumer-spending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}