Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 08, 2015

Shorts double down on UK supermarkets

The latest round of the UK supermarket price wars has seen short sellers redouble their attention in listed UK retailers, with current average short interest at an all-time high of 11.02%.

- Average short interest in the four listed grocery retailers has surpassed 11% for the first time

- Sainsbury's and Morrisons now the two most shorted constituents of the FTSE 100

- Online grocers also under pressure: Ocado has seen short interest climb above the 10% mark

UK supermarkets were a major high conviction short play of last year as a mixture of new competition, changing consumer behaviour and accounting irregularity sent share prices in the sector down sharply. This negative climate saw the average short interest in the three listed "big four" retailers (Tesco, Sainsbury's, Morrison's and Asda) more than double over the year to hit just shy of 11% in November 2014.

While things had stabilised in the opening months of the year recent earnings updates have dampened the rally and Morrisons recent pledge to lower prices on over 200 items has seen short sellers redouble their position in anticipation of a possible margin eroding price war.

Short interest at new highs

Demand to borrow shares of UK grocery firms has surged to new highs over the last few weeks. Average demand to borrow shares in the sector now stands at 11.02%. This surge in short interest means that current demand to borrow is up by around a quarter from where it stood eight weeks ago and has surpassed the highs seen in November of last year when short sellers borrowed 10.9% of shares.

The two standout names in the sector are perennial short targets Sainsbury's and Morrisons, which have both seen short interest surge past the 15% mark. This has enshrined the two firms at the top of the most shorted ranking in the FTSE 100 index. The third most shorted constituent Petrofac only has 11% of its shares out on loan.

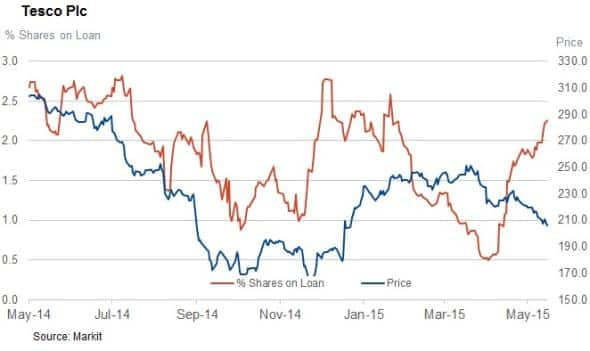

Industry leader Tesco has also felt its fair share of bearish sentiment as its demand to borrow has risen to 2.3% of shares outstanding.

This recent growth in short interest in the sector has been paying off for short sellers so far as all three of the listed "big four" retailers have seen their shares slide in the last eight weeks.

Ocado also shorted

Weakness is also permeating the high end of the sector with high end grocery delivery Ocado seeing its short interest surge to the highest level in over two years in the last few weeks. Short interest in the firm, which also has a distribution agreement with Morrisons, now stands at 10.5% despite the fact that its shares have continued to climb in the eight weeks.

Consumers not complaining

While investors in UK supermarkets may be bemoaning the recent situation, consumers have been reaping the rewards of the increased market competition as food and non-alcoholic prices have fallen across the board, according to the most recent inflation data released by the UK office for National Statistic.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Equities-Shorts-double-down-on-UK-supermarkets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Equities-Shorts-double-down-on-UK-supermarkets.html&text=Shorts+double+down+on+UK+supermarkets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Equities-Shorts-double-down-on-UK-supermarkets.html","enabled":true},{"name":"email","url":"?subject=Shorts double down on UK supermarkets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Equities-Shorts-double-down-on-UK-supermarkets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+double+down+on+UK+supermarkets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Equities-Shorts-double-down-on-UK-supermarkets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}