Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 08, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Shorts cover positions in Alcoa as stock rallies ahead of earnings

- Despite a 28% rally in shares short sellers increase positions in Tesco

- Japanese real estate targeted as short interest in Properst rises along with shares

North America

With 28% of its shares outstanding on loan Sm Energy is the most shorted stock in North America ahead of earnings. Short interest has surged by almost a fifth in the last month, despite a jump in share price and is back to highs last seen in January 2015. The oil & gas explorer and developer is focused on preserving balance sheet strength and improving its liquidity - its shares have fallen by two thirds over the past 12 months.

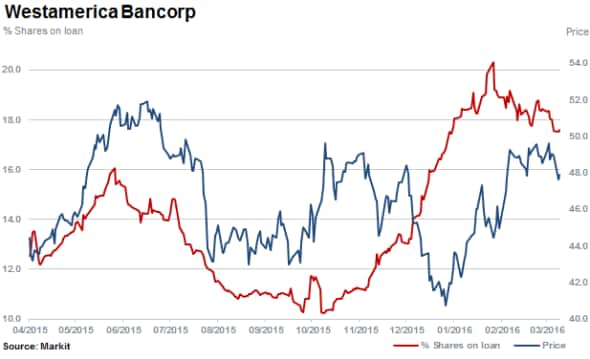

Westamerica Bancorp and Fastenal feature for a consecutive quarter among the most shorted firms ahead of earnings in North America.

Shares outstanding on loan in Westamerica breached 20% in February 2015 with its stock surging but some covering has been seen lately, with short interest now at 17.6%.

Fastenal citied tough trading conditions in the last quarter as the health of clients deteriorated in the second half of 2015. Despite this, shares have rallied almost 30% since January lows.

Shorts have covered 23% of positions in Fastenal since peaking in February with 15% of shares currently outstanding on loan.

Kicking off earnings season with the second largest aggregate short position in North America (behind Fastenal's $1.6bn value on loan) is metal producer Alcoa with over $750m in value on loan. After posting a fourth quarter loss but beating analyst earnings expectations, shares in Alcoa have bounced and shorts have covered. The company currently has just fewer than 10% of shares outstanding on loan with the stock still down some 30% over the past 12 months.

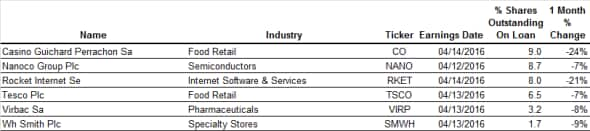

Western Europe

Most shorted in Europe is French food retailer Casino Guichard with 9% of shares outstanding on loan.

Casino joins Tesco with 6.5% of its shares sold short. European retailers continue to attract strong short interest as the industry battles against price deflation and aggressive competition from German discounters Aldi & Lidl. Tesco has staged an impressive rally year to date rising 28%. However, despite the rise short sellers have increased positions by 41% with only some marginal covering in recent weeks.

Second most shorted ahead of earnings in Europe is Manchester based Nanoco PLC with 8.7% of shares outstanding on loan.

Nanoco researches and develops quantum dot based products for use in display, lighting, solar and biomedical applications. Shares have slid 60% in the last 12 months.

Lastly the third most shorted stock ahead of earnings in Europe is incubator/venture firm Rocket Internet with 8% of shares outstanding on loan. Shares in Rocket have almost halved over the last 12 months, continuing to fall after the company's IPO in 2014.

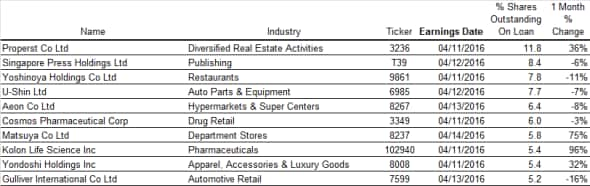

Asia Pacific

Most shorted in Apac and seeing a significant rise in short interest year to date is Japanese real estate firm Properst with 11.8% of shares outstanding on loan. Shares in the company have risen dramatically year to date, up by 70%.

Among the most shorted in Apac last quarter is the largest newspaper publisher in Singapore, Singapore Press which has seen shorts cover their positions, shares outstanding declining to 8.5% as shares jumped higher in 2016.

Japanese food chain Yoshinoya is the third most shorted with 8.5% of shares outstanding on loan. Shares have come under pressure in 2016, declining 15% with short interest increasing by almost two fold.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}