Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 08, 2017

Short sellers SNAP to attention

Initial borrow fees indicate that short sellers are willing to pay up to go short Snap shares, however the fee is still relatively low compared to several of its social media peers.

- Short sellers being charged in the region of 15-25% to borrow Snap

- 4.4% of freely floated Snap shares now in lending programs

- Snap fee ranks in the top half of recent social media IPOs

Early indications from the stock borrow market indicate that short sellers are willing to pay what would be considered extortionate fees in order get a hold of Snap Inc shares to short. Few things inspire short sellers more than a social media IPO owing to their tempting combination of sky high valuations and early trading "pops" from investors rushing to grab a piece of these highly publicized deals. Both these events have been seen in recent Snap's IPO which has resulted in short sellers being charged anywhere between 15-25% in order to borrow shares.

This is based on the initial $155m of trades that settled yesterday, the first day Snap shares became available in the securities lending market. This initial trading activity means that short sellers have borrowed roughly 1.5% of the freely traded Snap shares according to free float number calculated by Reuters. It still early days, however, as Snap shares are just starting to filter through to lending programs.

Despite the early nature of trading, inventory levels are starting to fill up as $430m of Snap shares have made their way to lending programs in less than a week. This represents 4.4% of Snap's float. Furthermore this supply is pretty evenly distributed as 14 lenders now have Snap shares available to lend of which eight have made loans in the opening day of trading.

How does it compare

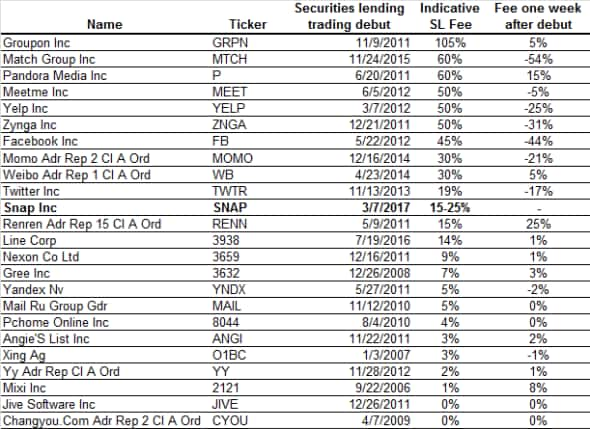

While Snap is extremely expensive when compared to the current average cost to borrow US equities, shares has been on par to that seen among social media shares on their debut in the securities lending market. The initial fee to borrow Snap places it 11th out of the 24 constituents of the Global X Social Media ETF which have IPO'd in the 11 years since Markit Securities Finance started tracking daily securities lending data.

Snap's two closest competitors, Facebook and Twitter, commanded fees of 45% and 19% respectively on their securities lending trading debuts.

All three are still way off of the 105% that short sellers were willing to pay to short Groupon shares immediately after its trading debut which saw the firm's shares surge by over 80% on their debut.

It's impossible to foresee where Snap shares will trade in the securities lending market going forward. The borrow fee commanded by IPO shares tends to fall in the days immediately following their securities lending trading debut as more shares make their way to lending programs. In fact over half of recent social media IPOs see their fees fall in the subsequent week.

This seems to be happening with Snap as intraday trades on the second day trading day have fallen to the lower end of the 15-25% range.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Short-sellers-SNAP-to-attention.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Short-sellers-SNAP-to-attention.html&text=Short+sellers+SNAP+to+attention","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Short-sellers-SNAP-to-attention.html","enabled":true},{"name":"email","url":"?subject=Short sellers SNAP to attention&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Short-sellers-SNAP-to-attention.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+SNAP+to+attention http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Equities-Short-sellers-SNAP-to-attention.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}