Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 08, 2016

Chinese stock market panic jolts global credit

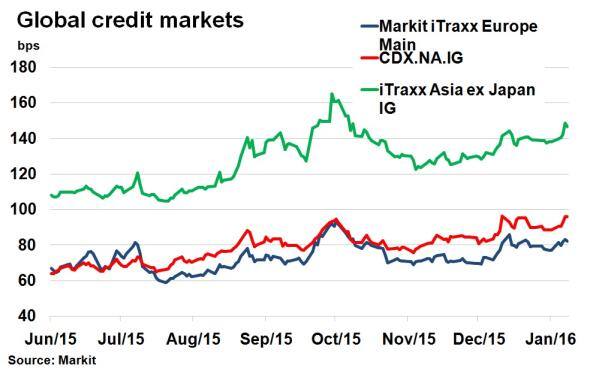

Weak manufacturing data and further steps to devalue the Chinese yuan saw global credit indices jump to their widest levels since last October, while the US treasury curve continues to flatten.

- The Markit iTraxx Asia ex Japan IG index saw its spread widen to three month high

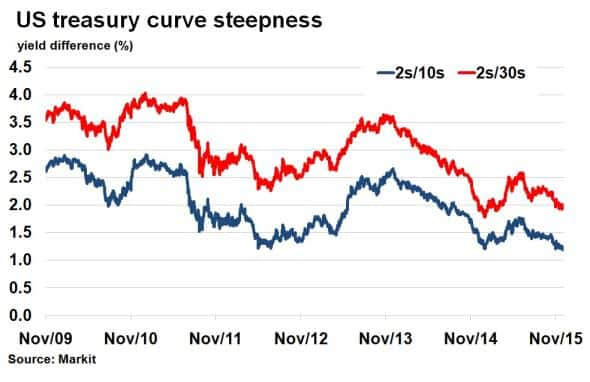

- The short end of the US treasury curve is at its flattest since the financial crisis

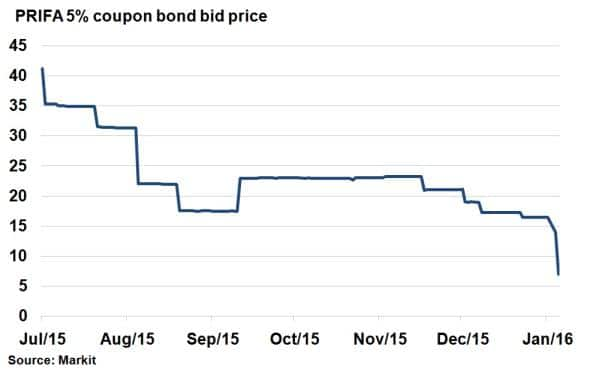

- Puerto Rico's infrastructure finance authority saw its 5% coupon bond price halve as it missed a bond payment

Chinese deja vu

Fears of a slowing Chinese economy reignited volatility in global financial markets this week. Weak Markit PMI manufacturing data on Monday and further depreciation of the yuan on Thursday saw Chinese equity markets fall more than 7% on both days.

The volatility was reminiscent of the turmoil seen in the summer of 2015, when the Chinese authorities decided to systematically devalue its currency. This moves caused wider cross asset volatility, and credit markets were not spared.

The Markit iTraxx Asia ex Japan IG index, made up of investment grade corporations, saw its 5-yr CDS spread widen 10bps this week to hit 148bps. The index level, used to gauge corporate credit risk in the region, was the widest seen in three months but still remains 17bps tighter than the seen last summer.

The effects were also felt across global credit markets, with the Markit CDX IG index, compromising of US investment grade credits, widening to the highest level since October 2012. The region also faces a crisis among high yield debt and the repercussions of an end to zero interest rate policy. European credit markets fared better, with the Markit iTraxx Europe index seeing minimal impact, moving 1bps wider this week.

The move away from risky assets towards perceived safe haven fixed income products is typical in times of heightened volatility. 10-yr US treasuries and 10-yr German bund yields (which move inversely to price) tightened 12bps and 11bps respectively this week.

While calmer equity markets in China today have put a halt to any credit risk escalation for now, in part due to scrapping circuit breakers, all eyes will be on how China manages its currency management in the future.

A direct consequence of heightened volatility in credit markets has seen 10-yr and 30-yr treasury yields sink lower over the past month. Conversely, as the Fed started its interest rate tightening cycle last December, short term interest sensitive 2-yr treasury yields moved in the opposite direction.

With inflation subdued, the effect has been a treasury curve that has been flattening since July of last year. The yield difference between 2-yr treasuries and 10-yr treasuries has dropped to 1.19%, the lowest level since the financial crisis, according to Markit's bond pricing service. A flatter treasury curve typically indicates higher recession risk.

Puerto Rico latest

Puerto Rico's infrastructure finance authority (PRIFA) missed a key January 1st debt payment, essentially putting the authority in default.

Prices on PRIFA bonds fell to as low as $7 (cash basis to par) as a result of the default, according to Markit's municipal bond pricing service.

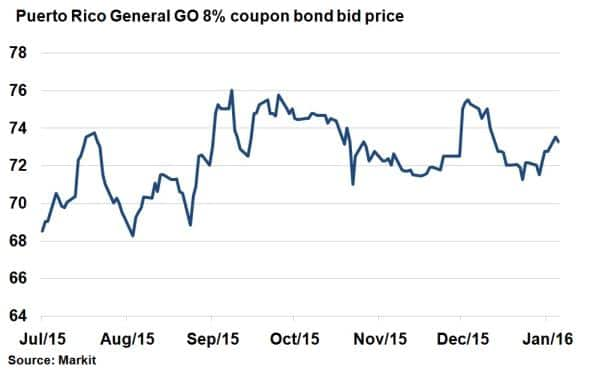

Puerto Rico Commonwealth however honoured its most senior general obligation (GO) debt by making payments in full. This resulted in a rally with the 8% 2035 maturity trading as high as $73.25 on January 5th.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Credit-Chinese-stock-market-panic-jolts-global-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Credit-Chinese-stock-market-panic-jolts-global-credit.html&text=Chinese+stock+market+panic+jolts+global+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Credit-Chinese-stock-market-panic-jolts-global-credit.html","enabled":true},{"name":"email","url":"?subject=Chinese stock market panic jolts global credit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Credit-Chinese-stock-market-panic-jolts-global-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+stock+market+panic+jolts+global+credit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Credit-Chinese-stock-market-panic-jolts-global-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}