Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 07, 2016

Yen and deflation defeating Japan

Japan has been battling deflation since the early '90s, with the country amassing debt to stimulate the economy. But an aging population and a resilient yen has made it hard to kick-start growth and even more difficult to find investment signals.

- Exporters lead downturn in manufacturing as yen surge impacts competitiveness

- Long-short inflation strategy posts positive returns of over 25% in past 12 months

- Shorts correctly identified low ranking names which posted largest monthly declines in June

Fighting for inflation

The Japanese yen continues to strengthen and despite recent a ratings downgrade, government bond yields continue to hover at record lows. Prime Minister Shinzo Abe's 'Abenomic' arrows seem to be losing the battle against deflation and economic stagnation.

The appreciating yen has seen Japan's manufacturing sector suffer its steepest downturn since 2012, driven by the fastest slump in exports seen since 2013, according to Markit's PMI survey data. As yen strength decimates competitiveness in global markets, input costs have fallen at the steepest rate since the financial crisis, adding even more pressure on to plummeting prices.

While inflation in Japan may take longer to take hold, US inflation and its relationship to Japanese equities reveals some interesting insights. Ranking Japanese stocks across a universe of over 1000 securities, according to Markit Research SignalsInflation Sensitivity (IS) factor, reveals some interesting returns data.

The factor ranks stocks based on sensitivity to inflation, measured by US Consumer Price Indexes CPI, with the top ten percent (D1) most positively related to moves in inflation and the bottom (D10) the least. Interestingly, average monthly returns over the past 12 months have been increasingly negative on average, moving lower down the deciles.

A strategy of going long the highest ranked stocks (D1) and short the lowest (D10), has delivered positive returns in ten out of the past 12 months with a material cumulative return of 26% as at the end of June 2016.

The returns above were delivered from both the short and long side during June with bottom ranked names falling 5.4% and top ranked names rising by 4.6%.

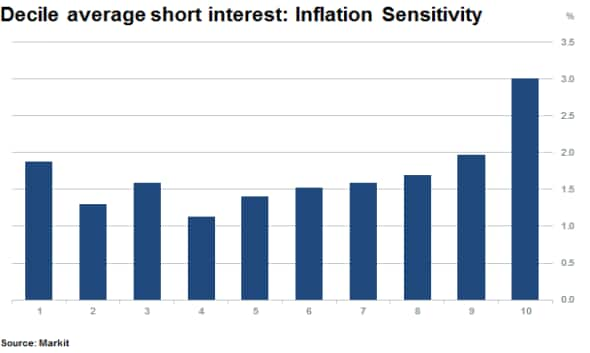

Interestingly, the most shorted decile on average currently, according to Inflation Sensitivity deciles, is D10 with average short interest of 3% - 60% higher than D1, the next highest. This implies that on average short sellers were proven correct in June across this universe of Japanese equities.

The most shorted firm currently in D10 is Kawasaki Kisen Kaisha or "K" Line, a Japanese integrated shipping company which currently has 13.5% of shares outstanding on loan. Shares in the stock have plummeted since short interest reached a high in April.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072016-Equities-Yen-and-deflation-defeating-Japan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072016-Equities-Yen-and-deflation-defeating-Japan.html&text=Yen+and+deflation+defeating+Japan","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072016-Equities-Yen-and-deflation-defeating-Japan.html","enabled":true},{"name":"email","url":"?subject=Yen and deflation defeating Japan&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072016-Equities-Yen-and-deflation-defeating-Japan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yen+and+deflation+defeating+Japan http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072016-Equities-Yen-and-deflation-defeating-Japan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}