Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 07, 2016

Russia looks to the primary market as fears ease

As fears of recession ease, Russia looks set to test global investor appetite with a benchmark US dollar bond issue.

- Russia's 5-yr sovereign CDS spread recently tightened to a four month low

- US dollar denominated Russian sovereign bonds have returned 14.8% over the past year

- Markit iBoxx USD Corporates Russian Federation Index has seen its benchmark spread tighten 116bps since January 21st

Sidelined since 2014, Russia is preparing to test international investor appetite with the launch of a $3bn US dollar denominated sovereign bond. Western sanctions, falling energy prices and a tumbling ruble have pushed Russia's economy deep into recession, but a bounce in oil prices and a recent slew of positive economic data has subdued downside risk in the region.

This has been reflected in credit markets where Russia's 5-yr sovereign CDS spread, an indicator of the perceived credit risk, has tightened below 300bps for the first time in four months. This time last year, credit spreads topped 450bps despite oil prices being higher. Easing recessionary fears and Russia's ability to adjust to a low oil price environment has been rewarded by improving market sentiment.

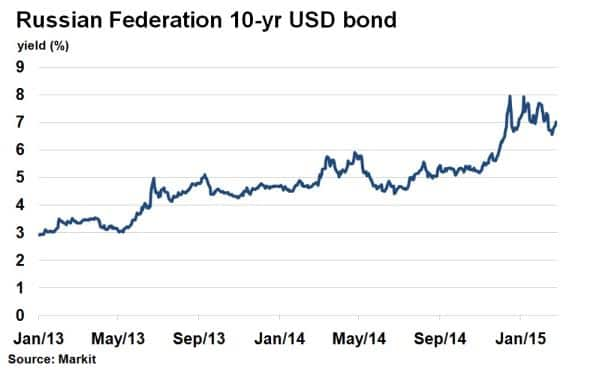

Russia's foreign government bond market has also seen yields stabilise recently. Russia's 10-yr US dollar bond yield has fallen to 6.96%, from 7.56% one month ago, according to Markit's Bond Pricing service.

Stellar returns

Investors looking at Russia's potential dip into the foreign government bond market need only reminding that Russian bonds returns have been very lucrative over the past year.

The Markit iBoxx USD Russian Federation Sovereigns Index has returned 14.8% on a total return basis over the past year; far outstripping returns on similar rated government debt. In fact, returns have been positive for 11 of the last 13 months and the average annual yield on the index stands at 6.25% - 52bps higher than similar rated US corporate bonds.

But participation in any bond auction may be harder to come by for some investors given the US government's disapproval of any potential deal, given Russia's financial sanctions.

Corporate risk

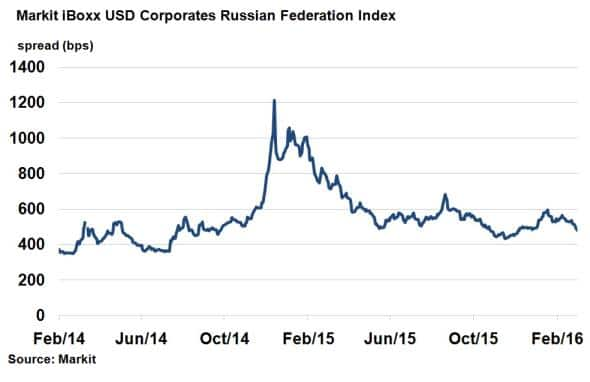

The positive sentiment has also been reflected in Russia's US dollar denominated corporate bond market.

The Markit iBoxx USD Corporates Russian Federation Index has seen its annual benchmark spread (yield above risk free US treasuries) fall 116bps since January 21st. spreads reached as high as 1,000bps last year, but have since fallen to under half that level.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07032016-Credit-Russia-looks-to-the-primary-market-as-fears-ease.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07032016-Credit-Russia-looks-to-the-primary-market-as-fears-ease.html&text=Russia+looks+to+the+primary+market+as+fears+ease","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07032016-Credit-Russia-looks-to-the-primary-market-as-fears-ease.html","enabled":true},{"name":"email","url":"?subject=Russia looks to the primary market as fears ease&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07032016-Credit-Russia-looks-to-the-primary-market-as-fears-ease.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia+looks+to+the+primary+market+as+fears+ease http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07032016-Credit-Russia-looks-to-the-primary-market-as-fears-ease.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}