Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 06, 2017

Worldwide PMI surveys start fourth quarter on a strong note

Global economic growth edged up to the joint-highest in two-and-a-half years in October, continuing the steady pace of expansion seen throughout the year to date, according to the latest PMI" surveys. However, an improved performance in the developed world was in part offset by a second successive monthly slowing in emerging markets.

There was good news in that the sustained global expansion pushed employment growth to its joint-highest for a decade, again mainly driven by developed world job gains. Price pressures meanwhile eased amid slower growth of company costs, potentially taking pressure of worldwide inflation rates.

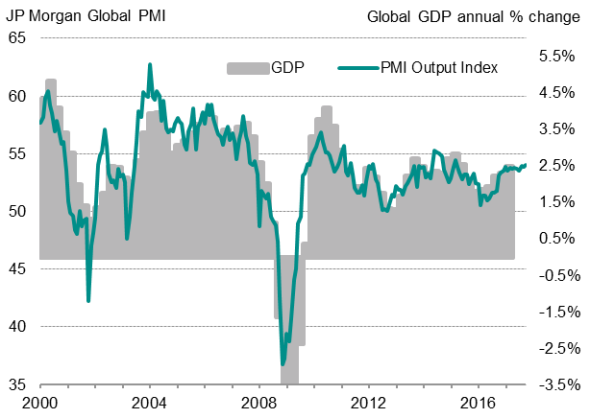

Global growth at joint-strongest since March 2015

The headline JPMorgan PMI, compiled by IHS Markit, inched higher to 54.0 in October from 53.9 in September, matching the August level which had in turn been the highest since March 2015. Historical comparisons suggest that the latest PMI indicates that global GDP (measured at market prices) is rising at a solid annual rate of just over 2.5%.

Global economic growth

Developed world growth reached its highest since April 2015, with a PMI output index reading of 54.0. An equivalent reading of 51.5 for the emerging markets meanwhile signalled the joint-weakest expansion seen over the past year.

October therefore sees a continuation of the relative underperformance of the so-called emerging markets relative to the developed world that has been evident in the survey data since 2013, a divergence which is also apparent in terms of labour markets.

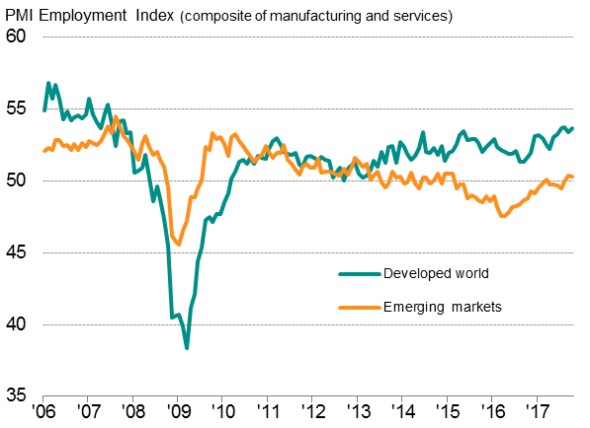

Jobs growth at joint-highest in a decade

Overall global job creation picked up further momentum to reach its joint-highest since December 2007. Faster jobs growth in the developed world was led by strong factory hiring alongside further solid service sector job gains.

Global employment

While emerging market employment rose for a second successive month, growth was again only marginal as modest service sector hiring was in part offset by lower factory payroll numbers.

However, although modest, the recent growth in emerging market jobs represents the best performance for over two-and-a-half years, suggesting some stabilisation of labour markets.

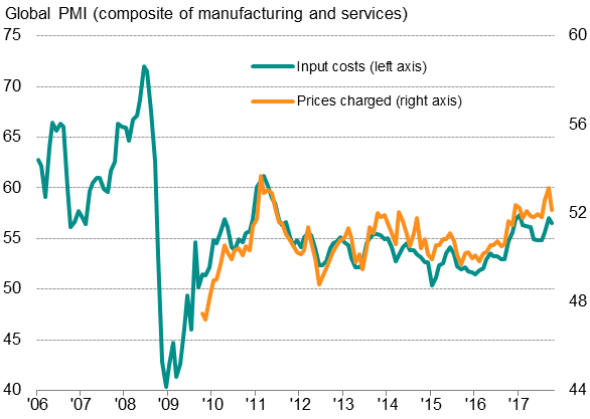

Price pressures ease

Global inflation pressures meanwhile eased at the start of the fourth quarter. Average prices charged for goods and services rose at the slowest rate for three months, with rates of increase weakening in both sectors. The ease represented a welcome moderation of inflationary pressures, as September's increase had been the sharpest for over six years.

Global prices

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

Input cost inflation slowed from September's eight-month high. Although manufacturing purchasing costs rose at the steepest rate since January, in part reflecting lingering supply shortages following US hurricane disruption, service sector input cost inflation (which includes wages) slowed to the joint-lowest since February.

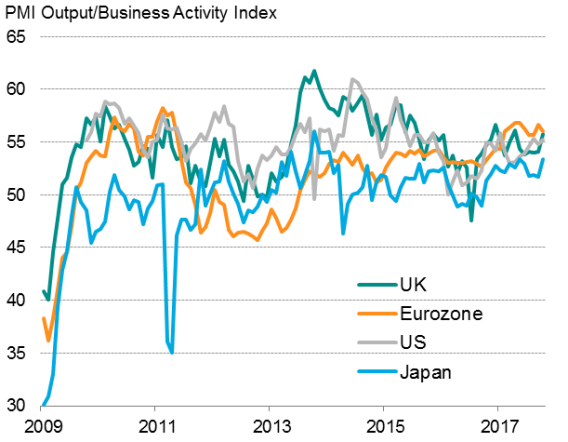

Evenly-spread developed world growth

In the developed world, the growth differential between the four largest economies was the narrowest since comparable data were first available in late-2009, highlighting the broad-based nature of the upturn. The fastest expansion was recorded by the eurozone for the ninth month running, despite the pace of growth slowing, closely followed by the UK, where the composite PMI hit a six-month high.

Developed world output

The surveys signal robust quarterly GDP growth of 0.6-7% and 0.5% respectively for the eurozone and UK at the start of the fourth quarter. A contrast was seen in future expectations, however, with elevated optimism in the eurozone conflicting with a slump in sentiment to a 15-month low in the UK, linked largely to Brexit worries.

Growth also accelerated in the US and Japan. The IHS Markit US Composite PMI rose to the second-highest since January, putting the economy on course for annualised GDP growth of 2.5-3% in the fourth quarter. The return to normal functioning for key supply chains, and reviving business activity in areas affected by the recent hurricanes, notable for manufacturing, was a key element of the stronger expansion seen in October and is widely expected to help support growth in coming months.

In Japan, the composite Nikkei PMI jumped to its joint-highest in 45 months. Service sector growth accelerated to broadly match the pace seen in manufacturing, where exports continued to help drive expansion. The rise in the PMI for Japan suggests GDP growth has re-accelerated, after having slowed in the third quarter following a surprisingly strong second quarter.

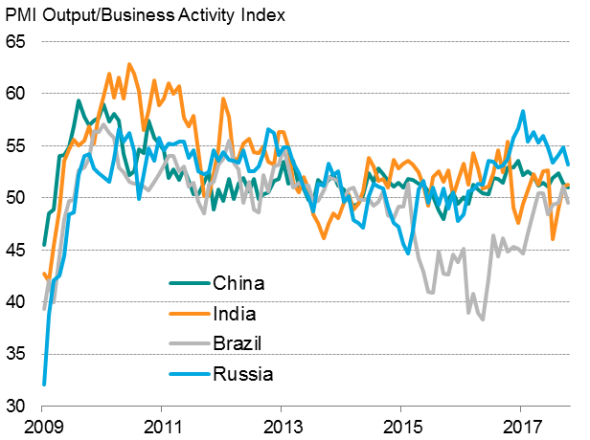

Emerging market malaise

Growth slowed in the emerging markets for a second successive month, down to the joint-lowest since last November, with malaise broad-based across the four major economies.

Emerging market output

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

The fastest expansion was seen in Russia, despite growth slipping to a 13-month low amid weaker rates of improvement in both manufacturing and services.

Growth also disappointed in China, with the Caixin PMI down to its weakest since June of last year thanks to a drop in factory output growth and still-modest service sector expansion. Employment also continued to more or less stagnate.

Sluggish growth was also seen in India, where the Nikkei PMI signalled a second month of expansion after the downturns seen in July and August, when business activity was hit by the introduction of the new sales tax. However, the overall rate of growth remained disappointingly subdued in October, suggesting an ongoing dampening of demand from the consumption tax.

However, it was Brazil that once again reported the worst performance as far as PMI surveys are concerned, with the data signalling a renewed slide back into decline after having indicated the strongest (albeit still modest) growth for two-and-a-half years in September. A downturn in Brazil's service sector offset modest manufacturing output growth.

Chris Williamson, Chief Business Economist at IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112017-Economics-Worldwide-PMI-surveys-start-fourth-quarter-on-a-strong-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112017-Economics-Worldwide-PMI-surveys-start-fourth-quarter-on-a-strong-note.html&text=Worldwide+PMI+surveys+start+fourth+quarter+on+a+strong+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112017-Economics-Worldwide-PMI-surveys-start-fourth-quarter-on-a-strong-note.html","enabled":true},{"name":"email","url":"?subject=Worldwide PMI surveys start fourth quarter on a strong note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112017-Economics-Worldwide-PMI-surveys-start-fourth-quarter-on-a-strong-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+PMI+surveys+start+fourth+quarter+on+a+strong+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112017-Economics-Worldwide-PMI-surveys-start-fourth-quarter-on-a-strong-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}