Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 06, 2015

Outstanding jobs report clears path for December hike

A better than expected jobs reports leaves the door wide open for the Fed to move in December, while in corporate credit, Glencore and VW decouple.

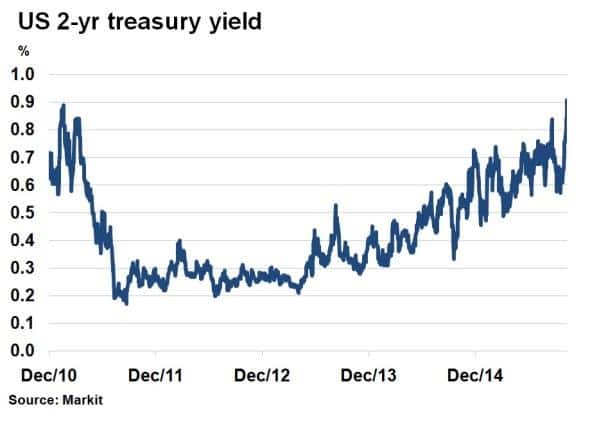

- Non-farm payrolls come in at 271k vs the expected 184k; 2-yr treasury yield spikes to 0.9%

- In Europe, the biggest weekly CDS widener and tightener have been VW and Glencore, respectively

- US high yield bond issuance is trailing 2014 by 14.2%, lowest levels since 2011

Ready for lift off

Today's monthly US jobs report came in much higher than expectations as non-farm payrolls registered 271k new jobs. The number gives a clear path for the Fed to raise interest rates in December. The inaugural rate rise, what would be the first since 2006, has been gathering momentum after fears of a global slowdown were eased last month.

Hawkish comments this week from Fed chairman Janet Yellen pushed 2-yr treasury yields to four year highs and they rose to 0.90% after today's huge jobs report, according to Markit's bond pricing service.

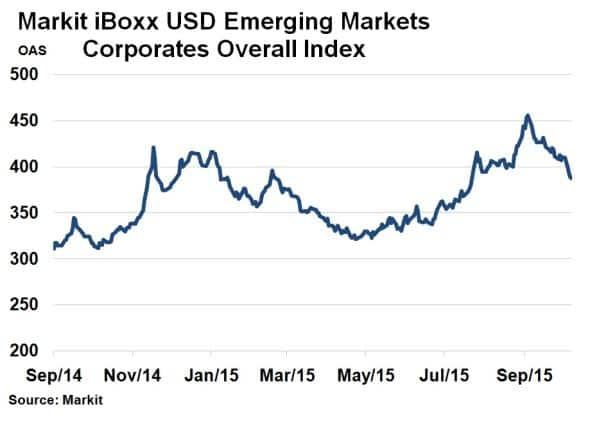

The heightened expectation of a rate rise will be closely watched by emerging markets, which have been keen issuers of US dollar denominated corporate debt since the financial crisis. The spread on the Markit iBoxx USD Emerging Markets Corporates Overall index edged over 450bps in September but has since tightened below 400bps, suggesting little worry of a December rate hike so far.

VW and Glencore

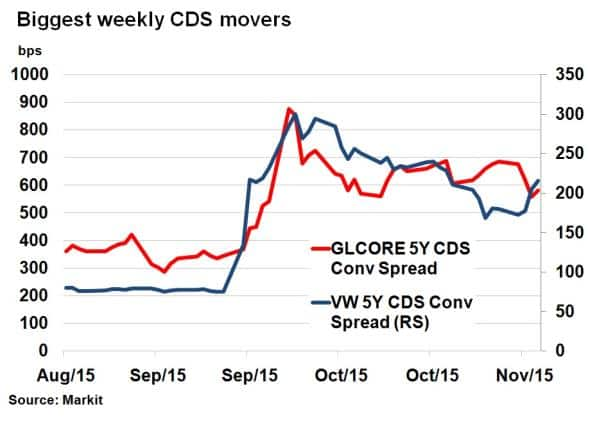

German automaker Volkswagen (VW) and Swiss commodity trading house Glencore were two of the names embroiled in September's global markets volatility. Credit spreads surged in tandem as idiosyncratic risks were exacerbated by fears of a global slowdown.

Calmer markets in October saw Glencore's credit risk diminish, and likewise with VW, which saw its 5-yr CDS spread tighten 100bps over the month. But this week has seen fortunes diverge.

The US Environmental Protection Agency reported that the VW emissions scandal might be wider than first thought, with petrol vehicles brought into the fray. Subsequently, VW's 5-yr CDS spread widened 43bps over the past week as investors demand greater compensation to protect against a potential default. In sharp contrast, Glencore announced further restructuring plans as it takes steps to reduce its debt profile. This prompted a more bullish view from analysts, and 5-yr CDS spreads have tightened 95bps over the past week. Glencore looks as if it may have turned a corner, while VW's troubles linger.

Issuance slows down

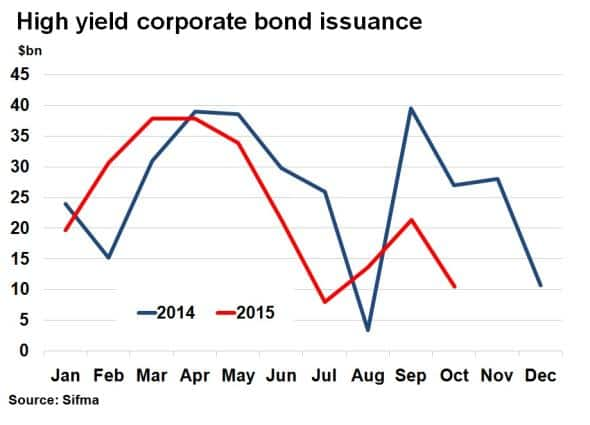

US high yield bond issuance is running at its slowest pace since 2011. Issuance is already 14.2% behind compared to the same stage last year, with October seeing $10.4bn of new issuance compared to $27bn in 2014.

Market volatility in the summer coupled with uncertainty about future interest rates have put the brakes on issuance, which could spell a negative sign for the US economy, where re-leveraging in US companies has fuelled economic activity.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-credit-outstanding-jobs-report-clears-path-for-december-hike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-credit-outstanding-jobs-report-clears-path-for-december-hike.html&text=Outstanding+jobs+report+clears+path+for+December+hike","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-credit-outstanding-jobs-report-clears-path-for-december-hike.html","enabled":true},{"name":"email","url":"?subject=Outstanding jobs report clears path for December hike&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-credit-outstanding-jobs-report-clears-path-for-december-hike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Outstanding+jobs+report+clears+path+for+December+hike http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-credit-outstanding-jobs-report-clears-path-for-december-hike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}