Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 06, 2014

Share buybacks or special dividends?

Buybacks have grown significantly in popularity in recent years compared to special dividends; we seek to uncover the causes driving this trend and whether it is set to continue.

- Share buybacks are currently facing scrutiny, particularly compared to traditional dividends payouts

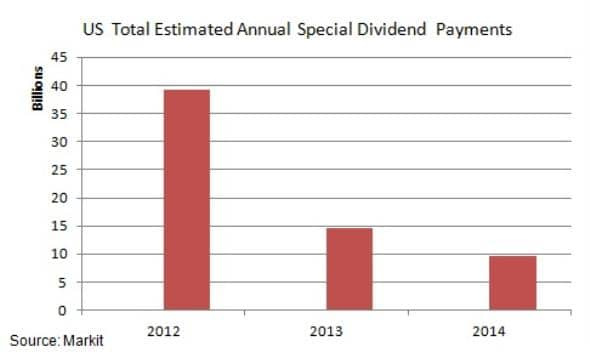

- Markit's dividend forecasting data indicate that special dividends are dramatically down on 2012 peaks

- Buybacks carry the positive market signals of a pseudo-dividend with no commitment to follow through, compared to a special dividend

Buybacks at any price

From the early 80s[i], the increased use of buybacks as preferred vehicles to return capital to investors has divided opinion on their merits. Buybacks are the current cause celebre among activist investors in order to yield more pressure on management teams with surplus cash.

The recent widespread adoption of buybacks in the place of increased dividends can be attributed to a number of factors. The main attraction for management teams and investors seems to be the flexibility and versatility compared to traditional dividend policies. Most executive remuneration packages now include some form of options which were intended to reduce agency risk by aligning incentives, but have maximised focus on share price. Dividends by nature go against share price maximisation all else equal and thus it could be argued buybacks can be used to help reach those all-important strike price levels.

Dividends are notoriously sticky commitments to back out of and the reluctance to increase dividend payments is unsurprising given the current low visibility and economic uncertainty facing large firms.

This is especially true for a technology company such as Apple whose main product and revenue source did not even exist eight years ago[ii]. Since March 2012, Apple has returned $94.4bn predominantly ex-shareholders as 72% were in the forms of buybacks and share repurchases.

Companies have displayed a healthy appetite in the past and embraced special dividends to some extent in 2012. This was in lieu of upcoming tax changes that would alter the treatment of dividends[iii].

According to Markit dividend data aggregating over the past three years, special dividends last peaked in 2012 and amounted to $40bn. Currently special dividends look set to reach only a fourth of that in 2014 in an environment of peaking buybacks.

What do buybacks have?

Buybacks are not binding and management is not obliged to actually implement a program. This provides flexibility when times are tough - shielding market reaction to a company divorcing its dividend policy or going on trial separation.

The main positive real affect buybacks have versus dividends is that they lower share count. This increases all per share metrics and most importantly value per share, all else equal, for remaining shareholders.

Dividends are applied to the entire shareholder base whereas buybacks are normally conducted on the open market. Since the shareholder who is selling stock is willing, it follows that the remaining shareholders should be concerned with maximising total returns and remaining tax efficient.

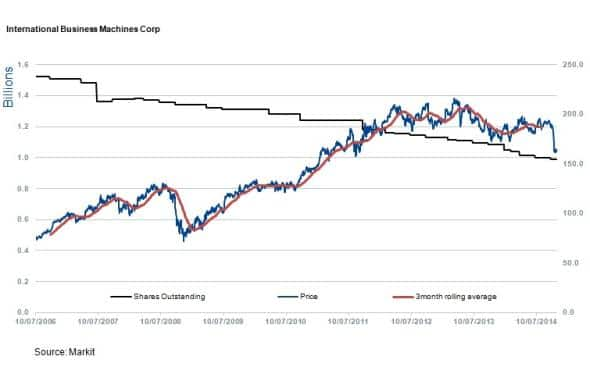

Big Blue, the consistent purchaser

IBM's intentions are to increase shareholder value but against a backdrop of decreased earnings and a changing technology market the company has engaged in large levels of buybacks, mostly at increasing stock prices. The benefits unfortunately may have gone to ex-shareholders.

In IBM's case, more than double has been spent on buybacks than in R&D in the past few years. Apple and IBM are the top two 'buyback' firms of the S&P 500, purchasing $33bn and $19bn worth of stock respectively in the 12 months leading up to September 2014.

IBM's share price has performed poorly recently and while not directly related to buybacks had the firm paid dividends, as a shareholder you would have been worse off, ceteris paribus.

It seems that the market has not made up its mind regarding buybacks versus dividend, as the amount of buybacks in the S&P peaked recently, and has since declined slightly.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Equities-Share-buybacks-or-special-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Equities-Share-buybacks-or-special-dividends.html&text=Share+buybacks+or+special+dividends%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Equities-Share-buybacks-or-special-dividends.html","enabled":true},{"name":"email","url":"?subject=Share buybacks or special dividends?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Equities-Share-buybacks-or-special-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Share+buybacks+or+special+dividends%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Equities-Share-buybacks-or-special-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}