Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 06, 2017

Worldwide PMI surveys indicate fastest economic growth for over two years

Global economic growth rose to its highest for over two years in August, according to the latest PMI data, with even more marked improvements seen in order book and employment trends. Rising inflationary pressures - the highest for over six years - accompanied the upturn, as growth gathered pace in both the developed and emerging worlds.

In the developed markets, the eurozone continued to lead the upturn, albeit with the US closing the gap. All major emerging markets meanwhile saw improved PMI readings.

The data therefore suggest that an increasingly broad-based global upturn has gained momentum over the summer and should have further to run. Rising demand has boosted firms' pricing power, while higher employment should meanwhile help boost consumer spending.

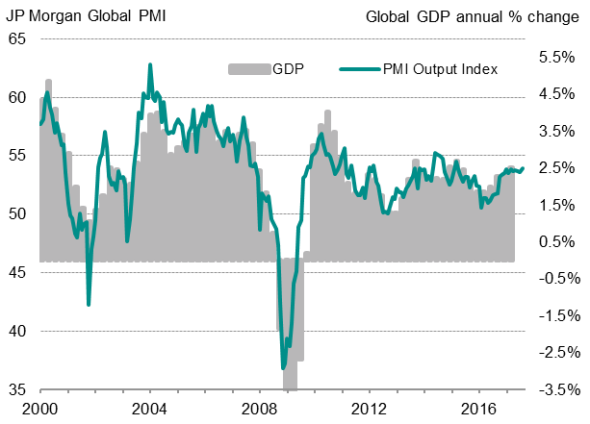

Global growth at 28-month high as demand improves

The headline JPMorgan PMI, compiled by IHS Markit, rose from 53.6 in July to 53.9 in August, its highest since April 2015. Historical comparisons suggest that the latest PMI indicates that global GDP (measured at market prices) is rising at a solid (albeit unspectacular) annual rate of just over 2.5%.

Some of the survey sub-indices provided further positive signals. Inflows of new business showed the largest rise for almost three years, and employment growth edged up to its best for over six years, albeit by the smallest of margins.

In most cases, job gains were commonly linked to the need to boost capacity in line with increased workloads: August saw one of the largest monthly increases in backlogs of uncompleted orders recorded over the past six-and-a-half years.

Global economic growth

Companies' expectations of their own output levels in a year's time also revived, with optimism approaching the recent high seen back in June.

Output price inflation at six-year high

The strengthening of demand has brought with it increased pricing power. Average prices charged for goods and services rose worldwide at the steepest rate since May 2011, with faster rates of inflation seen in both manufacturing and services.

Input cost inflation meanwhile reaccelerated to its highest since April, reflecting a combination of higher energy prices, upward wage pressures and suppliers pushing price hikes through supply chains.

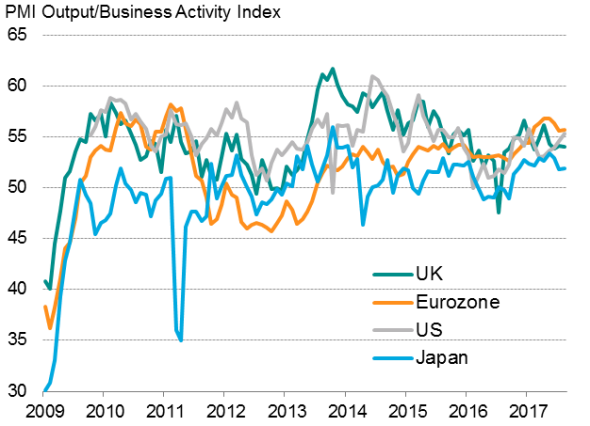

Developed world led by eurozone

Growth in the developed world edged higher to the fastest since April 2015, fuelled by stronger growth of both manufacturing and services. The eurozone led the developed markets for the seventh straight month, though faster growth in the US (which saw the sharpest expansion of business activity since January) meant the gap closed further.

The survey data indicate that the eurozone could enjoy GDP growth of 0.6% in the third quarter, while the US PMI surveys are running at levels historically consistent with 0.5% quarterly growth.

The Nikkei Japan PMI surveys also remained relatively buoyant, signalling a slight improvement in growth from July's nine-month low. The surveys suggest the economy could achieve another robust expansion after the 1.0% increase seen in the second quarter.

Growth in the UK meanwhile slowed to one of the weakest over the past year, suggesting the economy is likely to notch up another spell of only modest 0.3% growth in the third quarter.

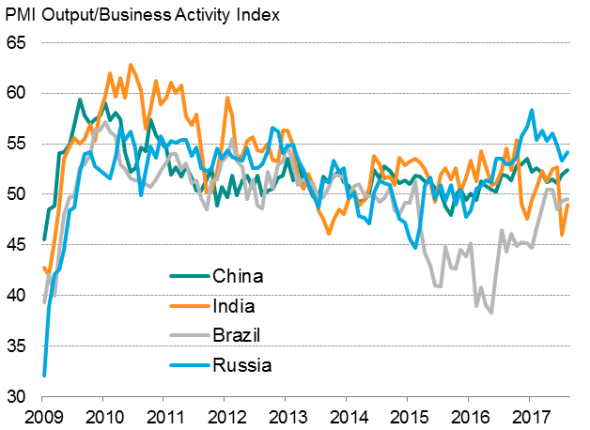

Varied emerging market trends

Emerging markets growth also perked up, reviving from the recent lows seen in June and July. Improved performances were seen in both manufacturing and services, though in both cases growth remained below recent peaks seen earlier in the year.

Of the four largest emerging markets, Russia reported the strongest improvement for the tenth successive month, with the rate of growth lifting off July's ten-month low.

Emerging market output

Developed world output

An improved performance was also seen in China, where the Caixin PMI surveys registered the strongest monthly upturn since February on the back of faster service sector growth. The stronger data add to perceptions what the economy is faring better in 2017 than previously anticipated.

Brazil's PMI also rose but remained (marginally) in contraction territory for a third successive month, suggesting the economy remains vulnerable to a renewed downturn after two consecutive quarters of growth in the first half of the year.

The Nikkei India PMI also remained in contraction territory for a second successive month, with business continuing to be disrupted by the introduction of the national sales tax. However, the rate of decline eased considerably compared with July to suggest the economy was showing signs of starting to stabilise.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Worldwide-PMI-surveys-indicate-fastest-economic-growth-for-over-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Worldwide-PMI-surveys-indicate-fastest-economic-growth-for-over-two-years.html&text=Worldwide+PMI+surveys+indicate+fastest+economic+growth+for+over+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Worldwide-PMI-surveys-indicate-fastest-economic-growth-for-over-two-years.html","enabled":true},{"name":"email","url":"?subject=Worldwide PMI surveys indicate fastest economic growth for over two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Worldwide-PMI-surveys-indicate-fastest-economic-growth-for-over-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+PMI+surveys+indicate+fastest+economic+growth+for+over+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06092017-Economics-Worldwide-PMI-surveys-indicate-fastest-economic-growth-for-over-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}