Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 06, 2015

Sterling bond returns power ahead of peers

Despite talk of an earlier than expected interest rate rise latest minutes show the BoE remains dovish, while sterling corporate bonds have continued to outperform developed country peers.

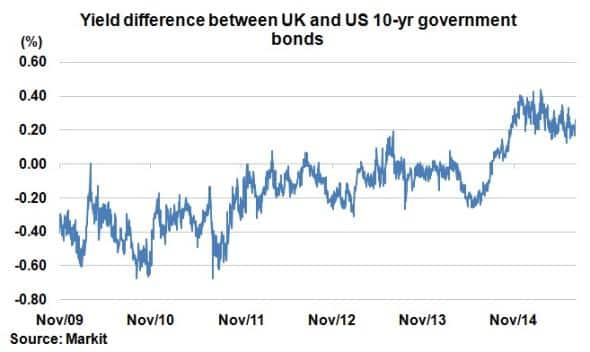

- 10-yr yield difference between gilts and treasuries on a downward trend since February

- HY sterling corporate bonds have returned 4% in 2015, the best among developed peers

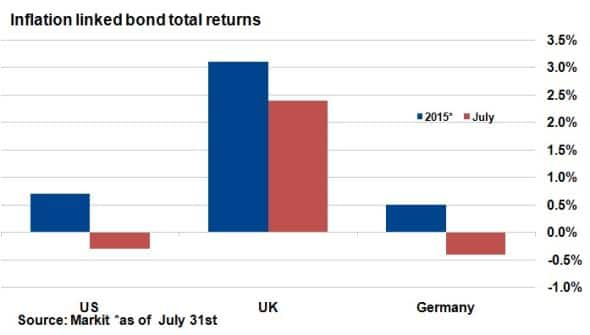

- Last month saw UK IL bonds outperform German and US IL bonds by 2.8% and 2.7%

It was 'Super Thursday' in the UK today as the Bank of England (BoE) simultaneously released its latest interest rate decision, associated minutes and the latest inflation report. Building up to today's announcements, anticipation was running high regarding whether the bank was moving closer to a first rate rise, just as counterparts in the US are looking to do the same.

Since February, the yield difference between 10-yr gilts and 10-yr treasuries has been slowly converging. The difference hit a 5-yr high (treasuries yielding more than gilts) when the level reached 0.4% in February, but this has since steadily declined to under 0.2% at the latest count.

This convergence goes hand in hand with improvements in the UK's economy (wage pickup, reduction of slack) which encouraged talks of a closer interest rate hike date.

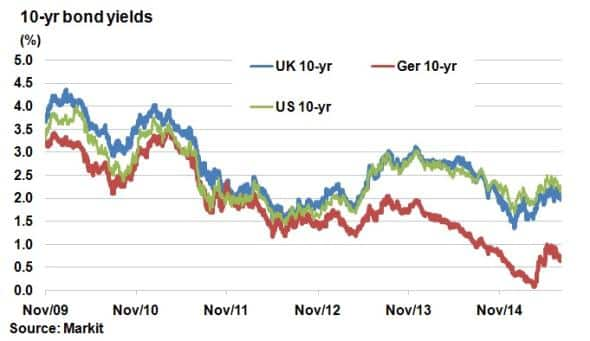

To the market's surprise, the BoE decided 8-1 to keep interest rates unchanged. It was expected that more members would vote for a rise, but inflation targets were lowered due to weaker commodity prices in July. The rise in sterling also influenced the decision. The 10-yr gilt yield has remained unchanged at 2.07% after the bank's decision, according to Markit's bond pricing service.

Bond returns

Although the BoE has remained cautious about the state of the UK economy, sterling corporate credit has been the go to place for investors chasing returns this year.

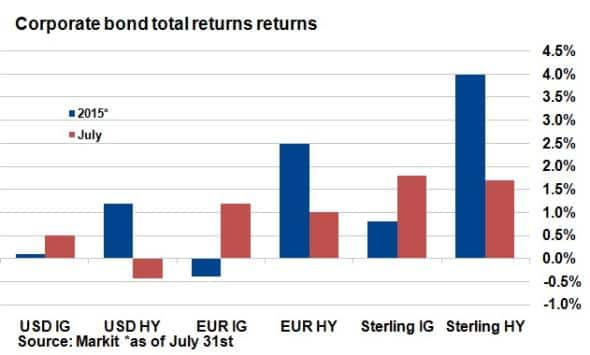

Breaking down corporates into high yield (HY) and investment grade (IG) among key western currencies, sterling HY bonds has been the best performers in 2015 to date according to Markit's iBoxx indices. The aftermath of the Greek saga saw corporate credit in both sterling and euro improve, with sterling powering ahead.

Sterling HY has been followed by euro HY which has returned 1.5% less, and US HY which has returned just over 1% in 2015. July was a particularly strong month for sterling credit as both IG and HY returned over 1.5%.

This marks a sharp contrast to US HY which was negative for the month of July, partly due to weaker commodities, and euro IG and HY which returned around 1%.

The past month has also seen UK inflation linked (IL) bonds outperform US and German peers. Inflation linked gilts were the only asset from the three to return a positive total return for the month of July at 2.4%.

It comes as no surprise investors piled into the asset class on talks of a possible earlier than expected rate rise. This investor appetite has more than likely been dampened i by today's dovish tones from the BoE.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-credit-sterling-bond-returns-power-ahead-of-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-credit-sterling-bond-returns-power-ahead-of-peers.html&text=Sterling+bond+returns+power+ahead+of+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-credit-sterling-bond-returns-power-ahead-of-peers.html","enabled":true},{"name":"email","url":"?subject=Sterling bond returns power ahead of peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-credit-sterling-bond-returns-power-ahead-of-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sterling+bond+returns+power+ahead+of+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-credit-sterling-bond-returns-power-ahead-of-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}