Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 06, 2015

Week Ahead Economic Overview

The week will be dominated by the aftermath of Sunday's Greek referendum. Having delivered a resounding 'no' to austerity, a Eurogroup meeting on Monday will reveal the extent to which Greece's creditors are prepared to re-negotiate. The Greek government appears confident that talks will resume, with debt relief returning to the agenda. However, views appear to be mixed among the Eurogroup, raising the possibility that a dangerous split could occur, which would risk further destabilising the region.

The UK meanwhile sees the first Budget from a Conservative government for almost 20 years. Chancellor George Osborne is aiming for further aggressive cuts to the welfare bill on Wednesday, though better than expected tax receipts are helping to bring the books back into balance and could provide some wiggle room.

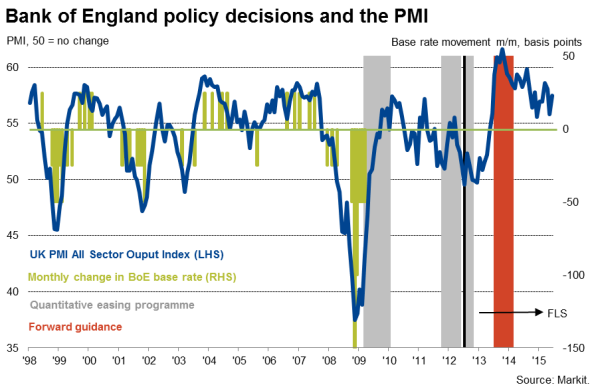

There's also some central bank action during the week, including the Bank of England's Monetary Policy Committee meeting. No change is expected, not least due to the Greek crisis, although faster than previously thought economic growth in the opening quarter of the year, solid PMI numbers for the second quarter and a revival of wage growth mean we are likely to see policymakers becoming more hawkish, adding to the likelihood of rates rising later this year.

The Reserve Bank of Australia also makes its policy decision. After recently cutting rates to 2.0%, news that GDP jumped by 0.9% in the first quarter probably means that policymakers will await new forecasts in August before making any further moves.

FOMC minutes will also be scoured for further signs that the Fed is gearing up to hike rates in September, when it will have seen second quarter GDP numbers, which the recent data flow indicate will show a resounding rebound from the first quarter weakness.

There's a lack of major US economic releases during the week, but industrial production updates in the UK and three largest eurozone countries (Germany, France and Italy) will provide important gauges of economic growth momentum in Europe.

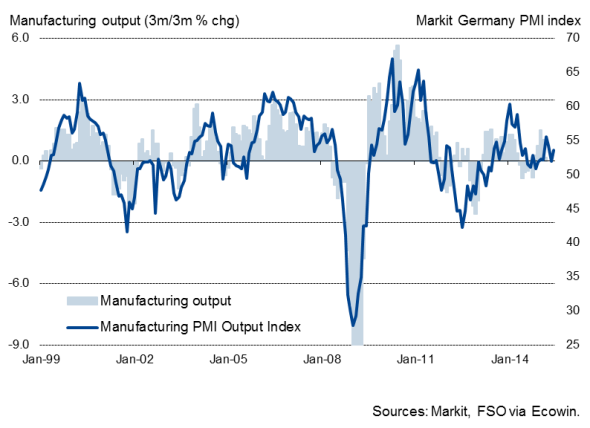

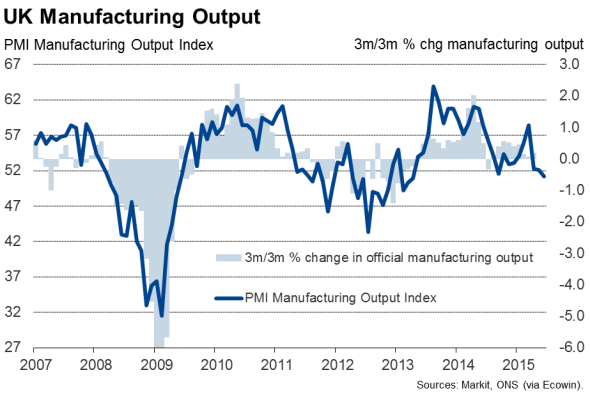

German Manufacturing Output

PMI data suggest UK industrial production numbers will be disappointing, as will trade data published during the week, as the appreciation of sterling is hurting exporters. Eurozone production numbers, on the other hand, are likely to show improving trends.

.

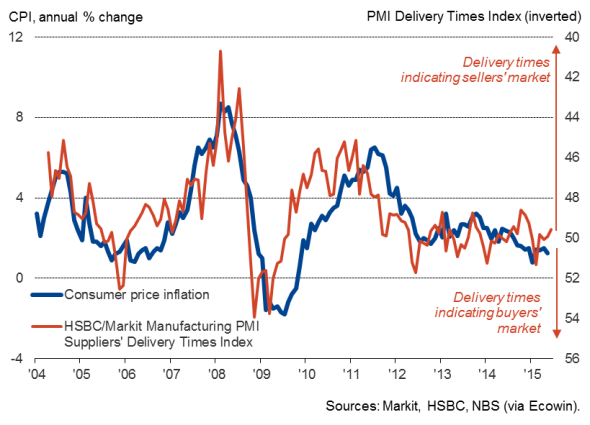

Over in Asia, the main number to watch is consumer prices in China, as any weakness in inflation adds further to chances of more policy stimulus.

China inflation

Sunday 5 July

All eyes are on Greece as it holds a referendum on whether to accept or reject creditors' proposals for a bailout agreement.

Emirates NBD-sponsored PMI data are meanwhile published for Egypt, Saudi Arabia and United Arab Emirates.

Monday 6 July

Japan sees the release of its Leading Economic Index by the Cabinet Office.

In Russia, an update on inflation comes from the publication of CPI data.

Industrial orders figures are out in Germany, ahead of industrial output numbers in Spain.

Markit Retail PMI data are published for the eurozone's 'big-three', with Germany's construction PMI also out.

Latest US Markit Services PMI data are released (along with Composite figures) later in the day.

Tuesday 7 July

A busy day in Australia starts with the publication of the AiG Performance of Construction Index, which is followed by RBA's latest interest rate decision and statement.

Global Sector PMI data are published, together with breakdowns for Asia and Europe.

Germany sees the release of industrial production data, while in neighbouring France latest trade figures are announced.

Industrial production numbers are the first major release of the week in the UK.

State-side, latest international trade data are out, followed by the Redbook Index.

Wednesday 8 July

The KPMG/REC UK Report on Jobs is published in the early hours, while later in the day George Osborne announces his Budget.

Meanwhile in Japan, current account figures are released ahead of the latest Economy Watchers Survey.

Brazil sees an update on consumer price inflation.

The standout in a relatively quiet day of activity is the FOMC minutes, with consumer credit data also out in the US.

Thursday 9 July

In China, both consumer and producer price inflation data are published.

Australia sees an update on consumer inflation expectations, and also the release of labour market statistics.

Emirates NBD publishes its Dubai Economy Tracker.

Major releases in Europe start with German trade numbers.

Bank of England announces its latest monetary policy decision.

Across the Atlantic, Canada releases its latest figures on housing starts, while in the US jobless claims data are published.

Friday 10 July

China issues a range of monetary aggregates.

Industrial production data are out in France and Italy, with the former also publishing consumer price numbers.

India also sees the release of industrial output figures.

In the UK, the ONS issues trade data.

Closing the week are latest unemployment data from Canada and the Monthly Budget Statement in the US.

Phil Smith | Economist, Markit

Tel: +44 149 1461009

phil.smith@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}