Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 06, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come:

- Radioshack is the most shorted company announcing earnings, although it has seen some covering

- In Europe, German machinery firm Heidelberg Druck has 10% of shares out on loan

- Chinese company China Hushain is the only non-Japanese firm to see high short interest in Asia

North American earnings

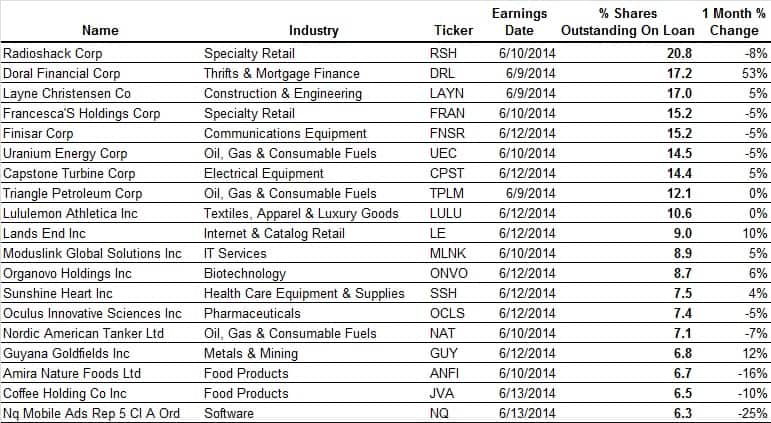

This week sees first quarter earnings announcements continue in full swing. On the heavily shorted end of the scale, there are 20 companies with 12.5% or more of their shares out on loan ahead of earnings.

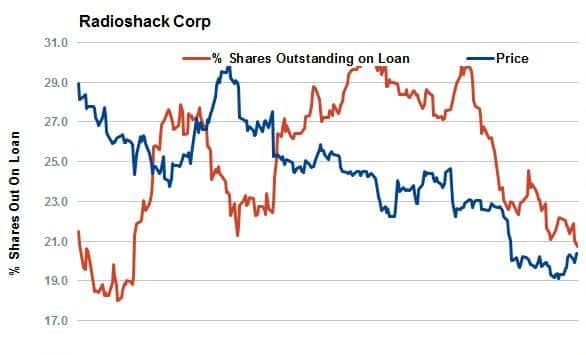

Troubled retailer RadioShack is the most shorted company announcing earnings this week with just over a fifth of its shares out on loan. The company has reported four loss making quarters in a row and its current market cap stands at the $156m mark after stumbling in its turnaround efforts. But the company is not giving up and plans to axe over 600 stores over the next three years. RadioShack is also negotiating rent relief with landlords and recently launched an initiative to sell startup products in order to rebound sales. These moves seem to have been well received by investors as RSH shares rebounded by a third from their thirty year lows seen in May. Short sellers have also been busy closing out positions, with current demand to borrow a third lower than the recent high seen at the end of March. Fashion retailers also see their fair share of short interest. Yoga retailer Lululemon Athletica has 10.6% of shares out on loan, a number that has held steady in the last few months despite the departure of founder Chip Wilson. Also shorted in the apparel space are Lands End and Francesca’s Holdings with 9% and 15.2% of shares out on loan respectively.

Looking beyond retail, Doral Financial has seen the largest jump in short interest ahead of earnings, with a 53% rise in demand to borrow. The company’s survival was recently put into doubt when Puerto Rico refused to pay out on $230m of tax overpayment that the company said it was owed. The fallout from this sees Doral in danger of losing its FDIC coverage which has sent shares to half the level they traded at in April. Short sellers have borrowed 17% of the company’s shares; 80% of the total supply available to sell short.

European earnings

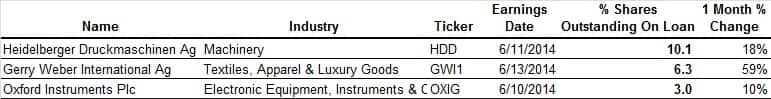

Europe also sees relatively low earnings activity, with just three firms seeing over 3% of shares out on loan ahead of imminent results.

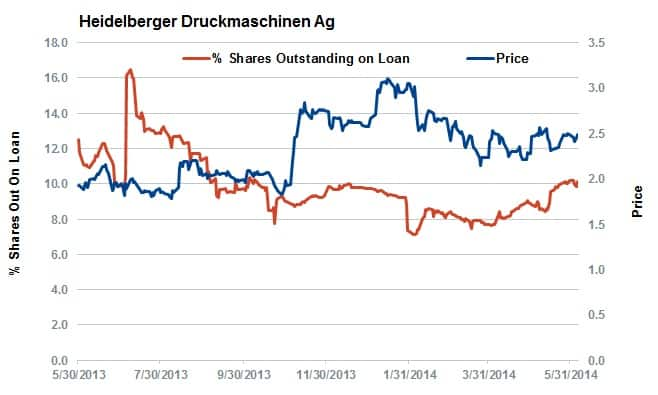

The only company to see any significant demand to borrow is German printing equipment manufacturer Heidelberger Druckmaschinen which has just over 10% of its shares out on loan ahead of announcing results. While HDD has been able to turn itself around in the last few years, short sellers are targeting the firm after analysts pared their expectations for the upcoming results. Demand to borrow HDD shares is up by nearly a fifth in the last four weeks.

In the UK, earnings attention will no doubt focus on recently listed online retailer Boohoo.com to see if the firm will be able to escape the recent struggles seen by peer ASOS. Short sellers have largely steered clear of Boohoo since its listing, but recent developments could see some renewed focus.

Asian earnings

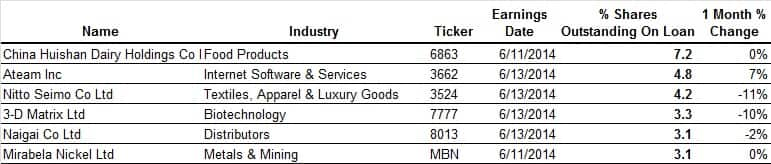

Asia also sees light reporting flow, with six firms with more than 3% of shares out on loan ahead of earnings.

By far the most shorted is Chinese dairy firm China Huishan Dairy which has seen short interest increase to 7.2% of shares in recent months. This demand to short the firm reflects weakness in the drinks world, as highlighted in the recent set of Markit Global Sector PMIs.

The other five Asian firms to see above average short interest are all Japanese traded firms, led by mobile software firm Ateam which has nearly 5% of shares out on loan.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062014120000most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062014120000most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}