Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 06, 2015

Late slump puts bonds in the red

Sovereign curves widened in the closing weeks of April which sent global bond markets into the red for the month.

- USD, EUR and GBP benchmark curves widened across the maturity spectrum in April

- Benchmark rate shifts ate into price returns which were the largest contributor to returns over the month

- Despite a challenging month, bond ETFs managed to attract over $12.4bn of net inflows

Read the full 48-page fixed income analysis covering bonds, indices and ETFs.

Market movements

Benchmark shifts push bonds down

- Sovereign bonds across the three major currencies retreated in the closing weeks of April, which sent their respective yield curves shifted outwards. This widening sent the Markit iBoxx Eurozone, US Treasuries and UK Gilts down 1.41%, 0.62% and 2.27%, respectively

- European sovereigns bonds were all negative for the month, with more volatile Italy, Spain and Portugal underperforming

- Markit iBoxx € Corporates lost 0.55%, on the back of negative credit (-17bps) and duration (78 bps) returns. High yield euro bonds performed relatively well with the Markit iBoxx € High Yield providing positive total returns for the month

- UK Gilts fell by a larger margin than EUR and $ sovereign bonds. This poor performance has put UK bonds flat for the year so far. These returns were entirely driven by curve returns shifts across the maturity spectrum

- Global inflation linked government bonds outperformed their conventional peers with US, UK and German inflation linked bonds all falling less than regular sovereigns

- Emerging markets proved to be the exception to the rule with the Emerging Marker Sovereign USD bonds returning 1.2% over the month. Russian bonds led the pack with a 6.7% return

ETF market activity review

Fixed income ETFs continue to prove popular

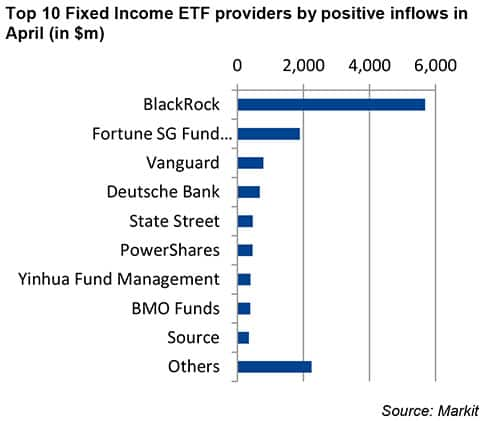

- Despite the challenging month for bonds, fixed income ETFs have continued to see inflows with over $12bn of inflows seen in the asset class

- High yield ETFs attracted net inflows of $756m in Europe contrasting with $129m of outflows seen in US listed products. Asian listed Money market ETFs continued to prove popular with Asian investors, with over $2.5bn of inflows over the month

- Blackrock funds led inflows in April with over $5bn in new assets. Blackrock-issued funds held the top three largest inflows in both the US and Europe

New ETF launches in April

- April saw four new ETF issuances in Europe with none in the US

- ETF Securities launched their first fixed income ETFs with corporate and government bond products. These two funds managed $50m at the end of the month

- Lyxor launched the Lyxor UCITS ETF EUR Liquid High Yield BB ETF which has taken the number of ETFs tracked by iBoxx to 166

Ivelin Angelov, Fixed Income Analyst, Markit

Tel: +442070646207

ivelin.angelov@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-credit-late-slump-puts-bonds-in-the-red.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-credit-late-slump-puts-bonds-in-the-red.html&text=Late+slump+puts+bonds+in+the+red","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-credit-late-slump-puts-bonds-in-the-red.html","enabled":true},{"name":"email","url":"?subject=Late slump puts bonds in the red&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-credit-late-slump-puts-bonds-in-the-red.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Late+slump+puts+bonds+in+the+red http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-credit-late-slump-puts-bonds-in-the-red.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}