Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 06, 2015

Week Ahead Economic Overview

Besides the ongoing Greek debt negotiations, the highlights of a busy week for economic data watchers are a first estimate of fourth quarter GDP numbers for the eurozone and the publication of the Bank of England's Inflation Report. Retail sales numbers are the highlight in the US.

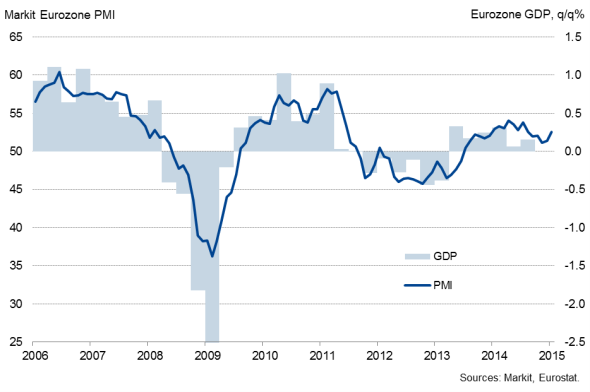

PMI data signalled that the eurozone economy ended 2014 with its worst quarter for over a year, suggesting GDP rose a mere 0.1%. However, the survey data have also signalled a pick-up of economic growth in January, with the PMI reaching a six-month high. The move to full-scale quantitative easing by the ECB should potentially help drive even stronger growth in coming months, but all eyes will remain firmly focused on how the Greek debt crisis plays out.

Eurozone GDP and the PMI

Sterling traders will also be eagerly anticipating the Bank of England's first Inflation Report for 2015. Mark Carney and his colleagues are likely to lower their growth and inflation forecasts for 2015, though keeping alive the prospect of interest rates rising later this year. However, with growth slowing and inflation at a fourteen-and-a-half year low, the likelihood of interest rates rising before 2016 is slowly diminishing.

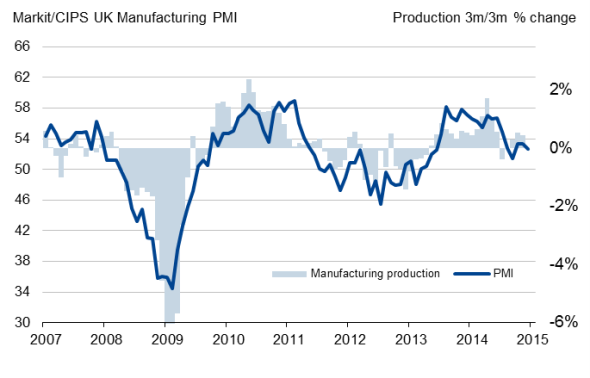

UK industrial output and construction numbers for December will also be updated during the week. Industrial production was down 0.1% in November due to a drop in oil and gas output. Further weakness is expected in December, after the PMI surveys signalled the worst performance for the economy for 19 months. However, survey data also signalled that UK factories reported a welcome upturn at the start of the year.

UK manufacturing production and the PMI

Sources: Markit, ONS

In the US, retail sales numbers will provide US policymakers with more insight on the health of the country's economy, with the FOMC remaining "patient" in timing the first increase in interest rates and watching the data flow carefully in the lead up to their next meeting on 17-18 March.

Retail sales fell 0.9% in December and GDP growth slowed to 2.6% in the final quarter of 2014, suggesting that the Fed could be thinking about pushing back its first hike into late-2015.

Data watchers will also keep a close eye on the data flow in India, as fourth quarter GDP numbers are released. The PMI surveys suggest that economic growth accelerated in the final three months of 2014, so we should expect a pick-up from the 5.3% (annualised) seen in the third quarter.

Monday 9 February

UK regional PMI reports and the Ulster Bank Construction PMI are released by Markit.

Current account data and consumer confidence numbers are meanwhile published in Japan.

In India, fourth quarter GDP figures and trade data are out.

Trade data are also issued in Russia and Germany.

Greece sees the release of industrial output numbers, while investor confidence data for the eurozone are published by Sentix.

Housing starts figures are out in Canada and the US sees the publication of the latest Labour Market Conditions Index.

The OECD publishes a statistics paper on leading indicators.

Tuesday 10 February

Business conditions data and house price numbers are released in Australia.

M2 money supply data and consumer price numbers are meanwhile issued in China.

In South Africa, unemployment numbers and manufacturing output data are updated.

Wholesale price numbers are out in Germany, while France, Italy and the UK release industrial output data.

Moreover, the British Retail Consortium publishes its Retail Sales Monitor.

NIESR publish their monthly GDP estimate.

Economic and business sentiment data are published in the US.

The OECD publishes a statistics paper on harmonised unemployment rates.

Wednesday 11 February

The UK Commercial Development Activity Report is released by Savills and Markit.

Consumer sentiment data are issued in Australia.

Current account numbers are meanwhile released in France.

Brazil sees the publication of retail sales data.

Thursday 12 January

In Australia, employment numbers are updated.

India sees the release of consumer price and industrial production data, while machinery orders numbers are out in Japan.

Mining production data are meanwhile issued in South Africa.

Inflation numbers are out in Germany, while the eurozone sees an update on industrial output data.

In Greece, unemployment data are published.

The Royal Institution of Chartered Surveyors releases house price data, while the Bank of England publishes its quarterly Inflation Report.

The Swedish Central Bank announces its latest interest rate decision.

House price numbers are issued in Canada, while the US sees updates on retail sales data and initial jobless claims.

Friday 13 February

Fourth quarter GDP estimates and trade data are published for the eurozone, while France sees an update on non-farm payroll numbers.

Spain meanwhile sees the release of consumer price figures.

The Office for National Statistics releases construction output data for the UK.

In Canada, manufacturing sales numbers are out, while the US sees the publication of import and export prices and the Reuters/Michigan Consumer Sentiment Index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}