Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 06, 2015

Drachma in Europe, again

The upcoming Greek election, which looks set to bring the anti-austerity party Syriza to power, has reignited the Grexit debate amid an increasingly fragile period for the eurozone in the wake of slumping oil prices and prospects of ECB stimulus.

- Snap election on the 25th January has markets debating potential impact of Grexit

- Greek CDS spreads have increased 49% since the beginning of December 2014

- ETF investors continued to pull out of Greek exposed funds in the last weeks of 2014

Eurozone weakness

Markets have continued to watch the spectacular decline in oil prices, but the immediate focus in Europe has turned to Greece. The country is viewing the eurozone within creasing scrutiny, meanwhile speculation regarding monetary stimulus in the eurozone compounds investor fears over a Greek exit; bringing back fears of contagion.

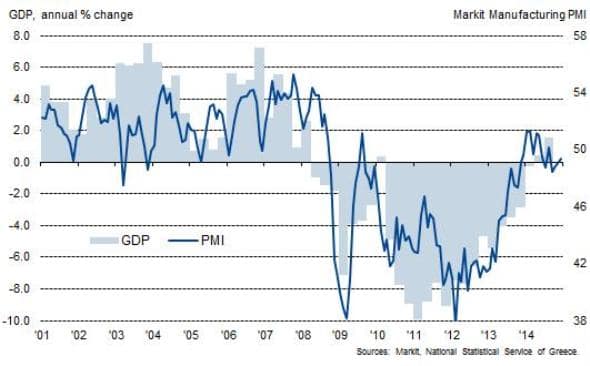

Markit PMI data accurately indicated an improvement in the Greek economy in early 2014, the first major upturn since 2007. GDP data later picked up accordingly. Towards the end of 2014, however, the PMI has signaled a renewed downturn. This is ahead of the elections this month which could take the fiscal future of the nation on a different path

Greek public debt has surged above 170% of GDP, and radical left wing party Syriza looks set to win the January elections with its calls for anti-austerity measures and debt pardons.

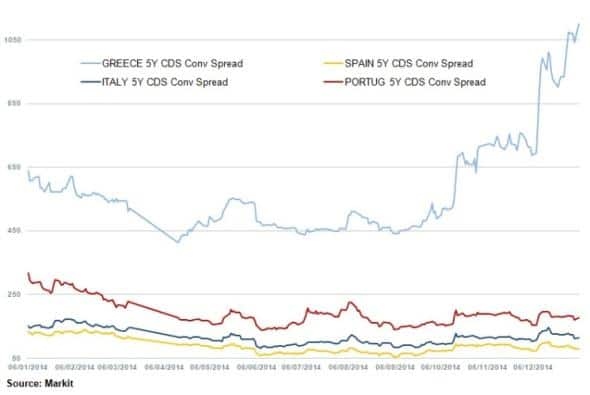

With the populist movement gaining public support on promises of debt re-restructuring and cuts to austerity measures, credit markets are pointing to the increased likelihood of a major credit event occurring.

CDS spreads for the country have increased by an alarming 49%, from 736bps in the first week of December 2014 to 1100bps as of the 5th January 2015. On January 6th 2014, spreads were 72% lower at 639bps compared to current highs of 1100bps.

However, it appears that fears over contagion in other markets have not yet emerged, as other "PIGS' nations' CDS spreads have not moved in response to Greece's recent woes.

Regional ETF fund flow

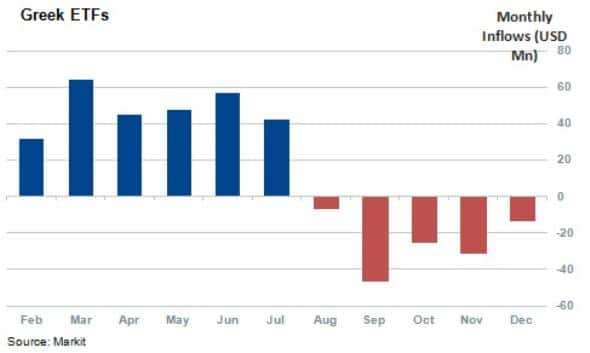

As highlighted in early December, Greek ETF investors were quick to withdraw investments from funds exposed to the region as net monthly inflows reversed and outflows were witnessed from August, right up until the end of 2014.

These recent outflows ended 11 consecutive quarters of inflows into Greek ETFs. Total Greek ETF AUM peaked in April 2014 at $723m. At the start of 2015, AUM is down 52% at $345m, with a precipitous month expected ahead.

In context, Greece represents a small fraction of ETF AUM exposed to eurozone countries with a total of four available products to investors.

Total eurozone AUM at the beginning of 2015 stood at $112bn and while AUM in Greece halved in 2014, total AUM in the Eurozone is currently only 7% shy of all-time highs reached in April 2014.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Equities-Drachma-in-Europe-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Equities-Drachma-in-Europe-again.html&text=Drachma+in+Europe%2c+again","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Equities-Drachma-in-Europe-again.html","enabled":true},{"name":"email","url":"?subject=Drachma in Europe, again&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Equities-Drachma-in-Europe-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Drachma+in+Europe%2c+again http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Equities-Drachma-in-Europe-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}