Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2017

Improved Caixin China PMI surveys point to steady fourth quarter growth

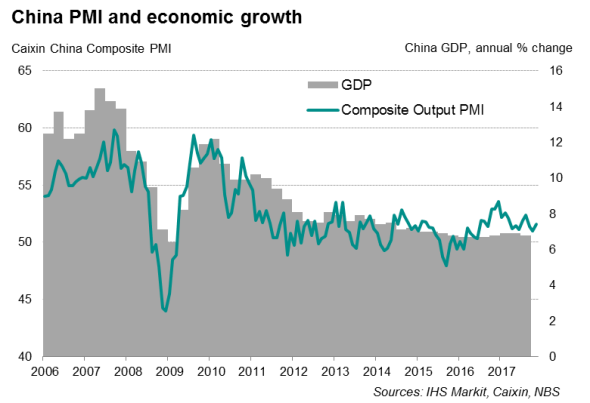

The Caixin PMI surveys presented an overall picture of steady growth in the Chinese economy midway through the fourth quarter.

To the surprise of many analysts, China's official economic growth rate has showed resilience throughout most of this year, which has been reflected by the Caixin PMI data showing moderate expansions in recent quarters.

PMI signals steady growth

The Caixin Composite PMI™ Output Index, a weighted average of the output indices from the manufacturing and services PMI surveys compiled by IHS Markit, rose from 51.0 in October to a three-month high of 51.6 in November, indicating modestly faster growth of business activity. The November reading takes the average PMI so far for the fourth quarter to 51.3, down from 51.9 in the three months to September but nonetheless still suggesting that the Chinese economy is hewing to a steady momentum.

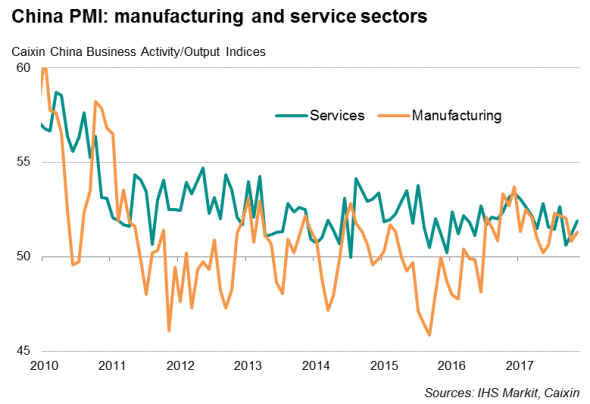

The survey data show that growth has been broad-based in recent months, with similar rates of expansions seen in manufacturing and service sectors. However, there were some reports that the government's crackdown on factory pollution had weighed on overall manufacturing performance.

Other survey indicators hint that stable growth will be sustained into December. Inflows of new orders grew moderately, with its rate of increase in line with the average so far this year. Similarly, backlogs of work rose modestly in November, while business confidence around the 12-month outlook remained positive.

A divergence in employment numbers and price trends, however, continued to be seen in the manufacturing and service sectors.

Employment

The upturn in manufacturing failed to feed through to the labour market as job losses persisted in November, in part reflecting on-going efforts by the government to rationalise the industrial sector. However, the rate of job shedding remained modest, contrasting with steeper declines seen throughout the previous two years. In contrast, service sector job creation remained moderate, which helped to offset the manufacturing job losses. Overall employment was stable in November as a result.

Profit margins

Pressures on manufacturing firms' margins meanwhile persisted, as the rate of inflation of input costs continued to outpace that of selling prices noticeably, suggesting that industrial profits are unlikely to pick up. Higher costs were commonly associated with increased prices for raw materials, including oil and energy. In contrast, service providers faced relatively modest inflationary pressures.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Improved-Caixin-China-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Improved-Caixin-China-PMI-surveys-point-to-steady-fourth-quarter-growth.html&text=Improved+Caixin+China+PMI+surveys+point+to+steady+fourth+quarter+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Improved-Caixin-China-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"email","url":"?subject=Improved Caixin China PMI surveys point to steady fourth quarter growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Improved-Caixin-China-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Improved+Caixin+China+PMI+surveys+point+to+steady+fourth+quarter+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Improved-Caixin-China-PMI-surveys-point-to-steady-fourth-quarter-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}