Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 05, 2015

Ukraine bond restructuring sparks credit event

A beleaguered economy has forced Ukraine to restructure its debts, with ISDA constituting missed bond payments as a credit event.

- Ukraine's restructuring deal, and subsequent missed bond payment sparks credit event

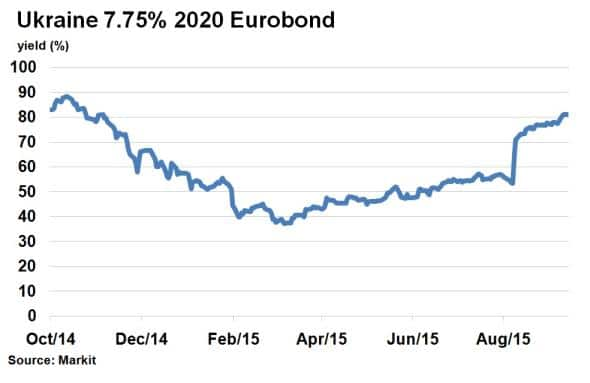

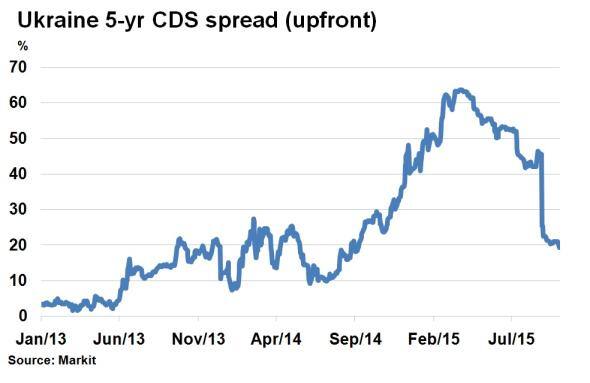

- Bonds rejoice restructuring deal; Ukraine's 5-yr CDS spread has halved since July

- Markit/Creditex to administer auction tomorrow; Eurobonds are currently trading between bid 78.5-80.5

On September 23rd theRepublic of Ukraine failed to pay principal on its $500m 6.875% coupon bond. A drawn out conflict with pro-Russian separatists in its eastern region and a plunge in price on its most lucrative exports have left the Eastern Bloc country struggling to meet its debt obligations.

Before the missed payment, the ISDA issued a statement citing a potential moratorium event (legal right to delay payment). The reason being that on August 27th, Ukraine decided to "technically" suspend bond payments as the country looked to restructure around $18bn of its debt to shore up its finances. It agreed with bondholders a deal which included a 20% write down in the face value of its bonds.

The restructuring agreement was well received by bond markets. Ukraine's $1.5bn Eurobond due 2020, which incidentally missed an interest payment last month, saw its bond price spike 20pts on the back of the restructuring announcement. Its latest bid price is above 80 (cash basis to par), according to Markit's bond pricing service; double the level seen since the depths of March.

Auction

News of the missed payment and the subsequent failure to redeem by the end of the grace period wasn't taken lightly by CDS market participants. CDS contracts are used to insure against potential bond defaults.

Unsurprisingly, credit spreads have tightened significantly since the bond restructuring agreement. While still trading on an upfront basis, the cost to insure against $10m of Ukrainian debt over five years has dropped dramatically from $4.6m + 500k annually, to $1.9m + 500k annually.

This morning a committee of 15 ISDA members, who include banks and major asset managers, decided that both a Repudiation/Moratorium Credit Event and a Failure to Pay Credit Event with respect to the Republic of Ukraine occurred on or around October 3rd. The two part process, a unique case, will now lead to an auction tomorrow administered by Markit/Creditex to determine the value of the defaulted bonds and subsequent CDS payouts. It would be the first sovereign credit auction since Argentina in September last year.

Ukraine's Eurodollar debt is currently trading at around bid 78.5-80.5, while Markit's CDS pricing service is implying a real recovery rate of around 70%.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-credit-ukraine-bond-restructuring-sparks-credit-event.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-credit-ukraine-bond-restructuring-sparks-credit-event.html&text=Ukraine+bond+restructuring+sparks+credit+event","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-credit-ukraine-bond-restructuring-sparks-credit-event.html","enabled":true},{"name":"email","url":"?subject=Ukraine bond restructuring sparks credit event&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-credit-ukraine-bond-restructuring-sparks-credit-event.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ukraine+bond+restructuring+sparks+credit+event http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-credit-ukraine-bond-restructuring-sparks-credit-event.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}