Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2014

US jobs growth weakens to eight month low in August

A disappointing employment report gives US policy makers food for thought about when the economy might be capable of withstanding higher interest rates. The slowdown in hiring certainly vindicates the Fed's cautious approach to tightening policy.

Although the summer saw robust economic growth, job creation has slowed as worries about the global economic outlook have intensified. Furthermore, in a sign that plenty of slack persists in the labour market, wage growth remained subdued.

Policy makers will therefore generally be keen to keep rate rises on hold to allow the economy to continue to grow and bring joblessness down further.

Job creation slows

Non-farm payrolls rose by 142,000 in August, surprising analysts who were on average expecting a 225,000 rise. Job creation in July and June was also revised down by 28,000, adding to the disappointment. The rise was the smallest seen for eight months. Payrolls have shown an average monthly rise of 177,000 so far in the third quarter, down from 267,000 in the second quarter and 190,000 in the first three months of the year.

The unemployment rate fell from 6.2% to 6.1%, in line with expectations, but whereas economists had been expecting the joblessness rate to fall because of strong hiring, the decline was in fact largely due to people dropping out of the labour market.

The recent cooling in the rate of hiring had been hinted at by Markit's Business Outlook Survey, which showed US hiring intentions falling to a post-crisis low in the summer. The number of companies expecting to increase their staffing levels over the next year outnumbered those expecting a decline by 17%, down from 27% earlier in the year (see last month's note).

The survey responses indicated that some of the easing in hiring intentions had reflected an anticipated cooling of the economy as interest rate rises grow nearer. Companies also reported a cautious approach to hiring due to the escalating situations in Russia and Gaza, as well as uncertainties about the potential cost impact of "Obamacare'.

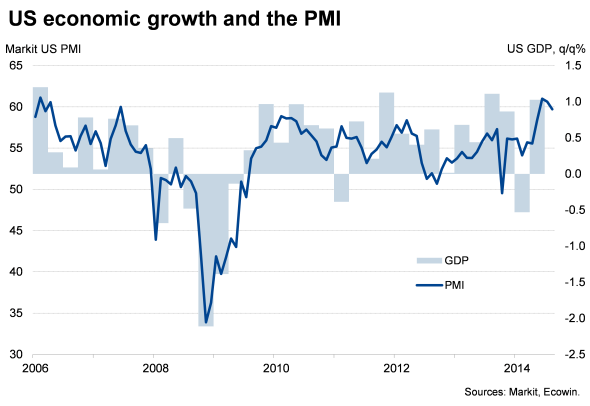

Despite the easing in employment growth in August, the economy should continue to create new jobs in healthy numbers in coming months, albeit with the rate of job creation having moved down a gear compared to the average rate of 222,000 new jobs being added every month in the first half of the year. Markit's PMI surveys suggest the economy is set to have grown at a 4% annualised rate again in the third quarter, with business activity surging in factories and across the vast services economy.

We should also not get too fixated on one data point. The underlying trend in hiring remains reasonably robust given the rising geopolitical concerns, alongside a rapid pace of economic growth. The jobless rate has also come down sharply from 7.2% last October.

Most importantly, however, the missing element of the recovery remains wages growth, the absence of which means policy makers will be in no hurry to cool the pace of economic growth via higher interest rates. Average employee earnings rose just 2.1% on a year ago, a rate that has held fairly steady in recent years despite the economic recovery.

In the detail, the private sector added just 134,000 new jobs. Manufacturers took on no extra workers, ending a 12 month run of continual hiring, but construction hiring jumped by 20,000. Private sector service providers meanwhile only took on 112,000 additional staff, the lowest rise since January.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014US-jobs-growth-weakens-to-eight-month-low-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014US-jobs-growth-weakens-to-eight-month-low-in-August.html&text=US+jobs+growth+weakens+to+eight+month+low+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014US-jobs-growth-weakens-to-eight-month-low-in-August.html","enabled":true},{"name":"email","url":"?subject=US jobs growth weakens to eight month low in August&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014US-jobs-growth-weakens-to-eight-month-low-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+jobs+growth+weakens+to+eight+month+low+in+August http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014US-jobs-growth-weakens-to-eight-month-low-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}