Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2016

US job market smashes expectations for second month running

News of the US economy continuing to add jobs at an encouragingly solid pace in July fuels further speculation that the Fed will turn the screws and tighten policy again later this year.

Buoyant hiring

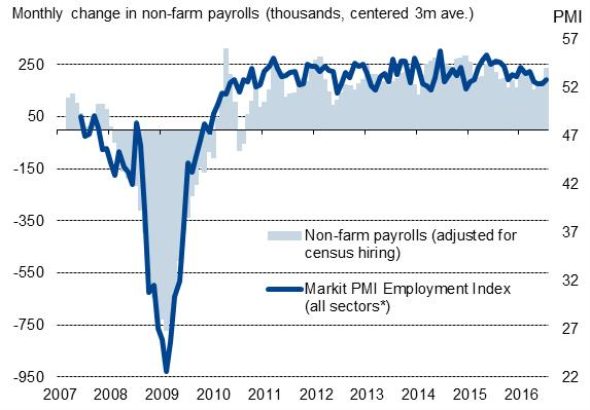

Official data showed non-farm payrolls rising by 255,000 in July, smashing market expectations for a second month running. Polls had pointed to an expected 180,000 increase. Data for both June and May were also revised slightly higher to +292,000 and +24,000 respectively. That leaves the average increase for the past three months at a robust 190,000, its highest since March.

US employment indicators

Employment rose in all broad sectors of the economy, helping to keep the rate of unemployment at 4.9% amid an increase in the number of people entering the labour market looking for work.

Adding to the good news was an improvement in pay growth. Average hourly earnings rose 0.3% against expectations of a mere 0.2% rise. While the annual pace of pay growth remained stuck at 2.6% and disappointing compared to pre-crisis rates, policymakers will be encouraged by signs that pay is picking up.

Fed likely to hike again

The steady job market improvement keeps alive the possibility of the Fed hiking rates again this year, but worries about sluggish economic growth and deteriorating productivity, as well as uncertainty created by the presidential election, suggest that any tightening of policy will be delayed until December.

The problem facing the Fed is that the ongoing robust rate of job creation is taking place against a backdrop of weak output growth, suggesting productivity and profit margins are likely to be suffering.

Lingering growth worries

GDP growth has disappointed in the first half of the year, and Markit's PMI data - which accurately foretold of the sluggish expansion in the first two quarters - suggest that growth has remained firmly stuck in a low gear in July. The July PMI sets the scene for another spell of meagre 1% annualised GDP growth in the third quarter.

US economic growth indicators

Sources: IHS Markit, Bureau of Labor Statistics, Commerce Department.

However, like the official data, the Markit PMI has signalled robust hiring so far this year (an average monthly rise of 175,000 signalled by the surveys compares with 186,000 recorded by the official data), and consequently indicates that 2016 has so far seen the worst period of productivity growth recorded this side of the global financial crisis.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082016-Economics-US-job-market-smashes-expectations-for-second-month-running.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082016-Economics-US-job-market-smashes-expectations-for-second-month-running.html&text=US+job+market+smashes+expectations+for+second+month+running","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082016-Economics-US-job-market-smashes-expectations-for-second-month-running.html","enabled":true},{"name":"email","url":"?subject=US job market smashes expectations for second month running&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082016-Economics-US-job-market-smashes-expectations-for-second-month-running.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+job+market+smashes+expectations+for+second+month+running http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082016-Economics-US-job-market-smashes-expectations-for-second-month-running.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}