Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2015

Emerging market stagnation contrasts with robust developed world growth

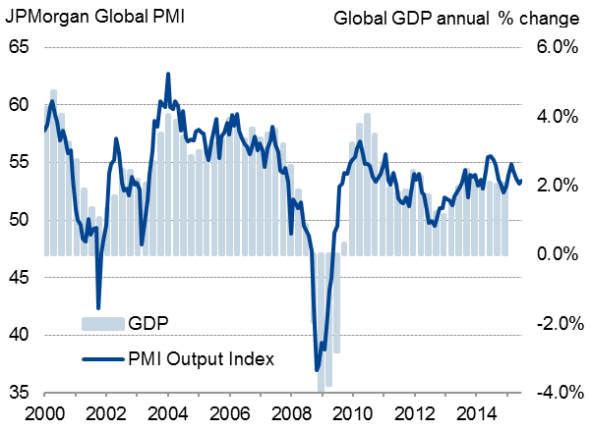

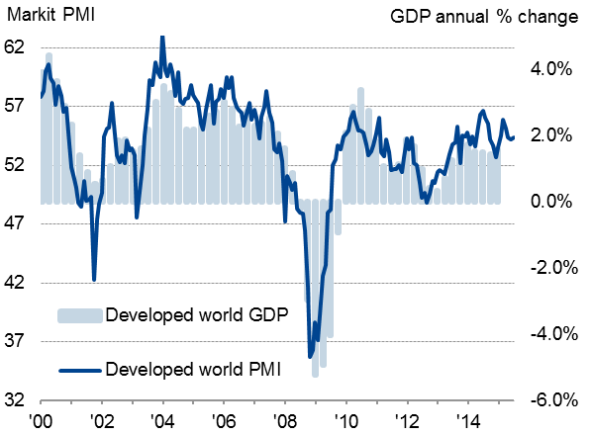

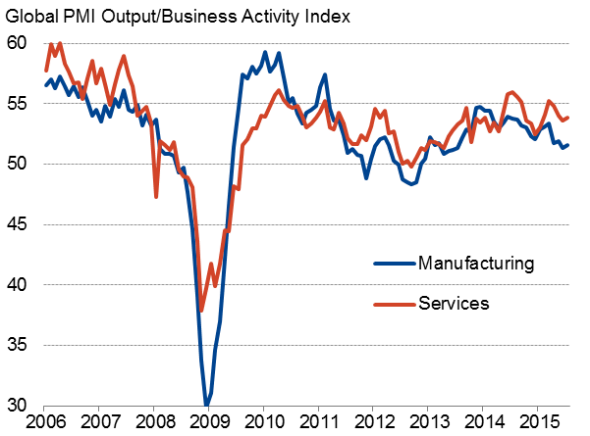

Global economic growth picked up very slightly for the first time in four months in July, according to worldwide PMI survey data. The JPMorgan Global PMI, compiled by Markit, rose from 53.1 in June to 53.4 in July, to signal a rate of global GDP growth of just over 2% per annum.

Global economic growth

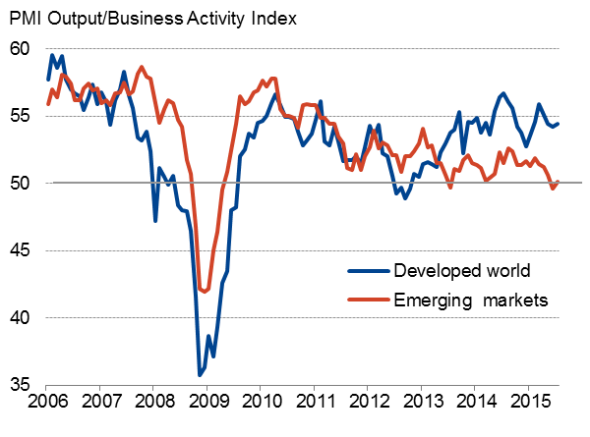

A marked divergence was once again evident between the developed and emerging markets, however, with robust expansion in the former contrasting with stagnation in the latter.

Developed and emerging markets PMI

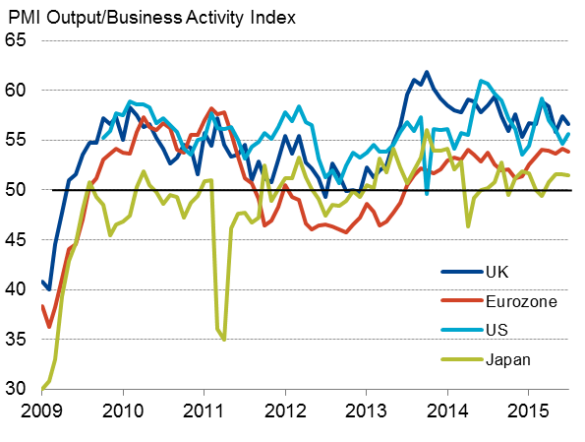

Developed world growth continued to be led by the US and UK, where rate hikes later this year look a strong possibility. However, resilient growth in the eurozone and signs of improving demand in Japan also provided positive news for policymakers.

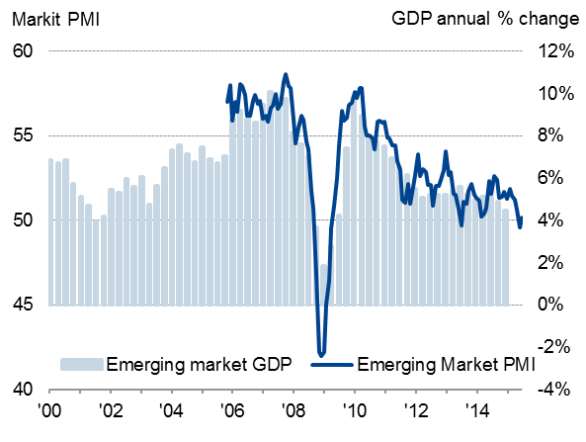

Emerging markets stagnate

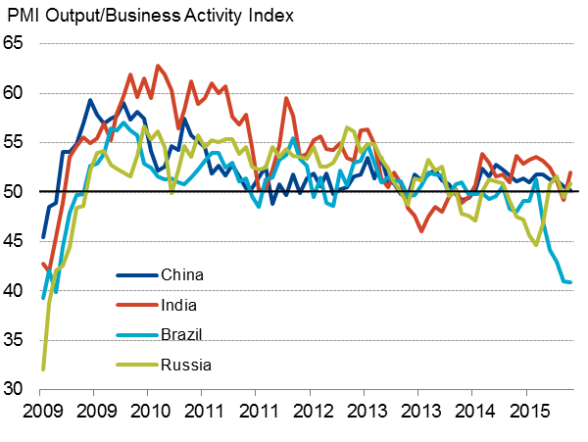

At 50.1, the emerging market PMI remained close to the low of 49.6 seen in June, suggesting emerging market GDP is growing at a meagre annual rate of around 4%, which would be the weakest seen since 2002 bar the global financial crisis. A deepening downturn in Brazil was accompanied by near-stagnation in China. Better news came from Russia and India, where the PMI data showed marginal and modest growth respectively after declines seen in both countries in July.

Emerging markets

Solid US and UK expansions

The weakness of the emerging markets will no doubt prey on the minds of US policymakers, mulling over when to start hiking interest rates. However, robust domestic economic conditions support the case for a rate hike later this year. An upturn in both manufacturing and services took the composite US PMI up to 55.7 in July, pointing to 2.1% annualised GDP growth at start of third quarter.

Policymakers in the UK are also likely to be edging closer to hiking interest rates after the UK PMI surveys showed ongoing strong growth in July. The "all-sector' PMI of 56.7 indicates the economy to have grown at a quarterly rate of 0.6% at the start of the third quarter. However, the rate of growth is showing signs of cooling which, alongside a steep slide in the rate of job creation, the strong pound and weakness in the manufacturing sector, will ensure the policy decision is finely balanced for many policymakers.

In Japan, the Nikkei "all-sector' PMI held steady at 51.5, with growth accelerating in manufacturing as the weaker yen helped boost exports. There were encouraging signs of growth picking up in coming months, as new orders across both manufacturing and services rose at the fastest rate since last November. The data will please policymakers who have been looking for signs that the economy retains modest growth momentum after demand was crimped by last year's sales tax hike, auguring against the need for further central bank stimulus at present.

The eurozone meanwhile showed encouraging resilience despite a record deterioration in Greek business conditions amid extended bank closures. The overall pace of economic growth across the region barely slowed from June's four-year high, with the Markit Eurozone PMI at 53.9 in July, down only marginally from 54.2 and signalling GDP growth of 0.4% persisting from the second quarter into the third. The ECB will regard the recovery as being "on track', strengthening the case to make no adjustments, or front-loading, its €60bn per month quantitative easing programme.

Developed world

Global manufacturing and services

Sources for all charts: Markit, JPMorgan, Caixin, Nikkei

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-market-stagnation-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-market-stagnation-contrasts-with-robust-developed-world-growth.html&text=Emerging+market+stagnation+contrasts+with+robust+developed+world+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-market-stagnation-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"email","url":"?subject=Emerging market stagnation contrasts with robust developed world growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-market-stagnation-contrasts-with-robust-developed-world-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+stagnation+contrasts+with+robust+developed+world+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-market-stagnation-contrasts-with-robust-developed-world-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}