Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 05, 2016

CDS-bond arbitrage tightens as bonds continue recovery

Amid a more settled macroeconomic outlook, April saw a continued positive shift in the difference between credit default swap spreads and their cash spread equivalent.

- US dollar denominated corporates saw positive shift in their CDS-bond basis

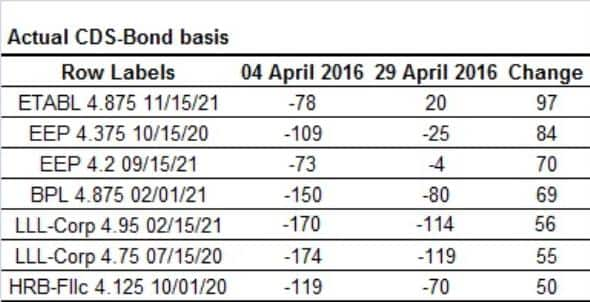

- Oil & gas firm EQT Corp saw the biggest change, to 20bps, from -78bps at the start of April

- South Korean steel firm POSCO has seen its basis shift from positive to negative

April saw a continued positive shift in the difference between credit default swap (CDS) spreads and cash spread equivalent, known as the CDS-bond basis, among US dollar denominated corporate bonds.

Calmer global markets and stronger oil and commodity prices encouraged continued recovery in battered bond prices in the oil & gas sector, with EQT Corp and Enbridge Energy Partners LP almost wiping out their large negative CDS-bond basis positions accumulated over the past year.

Analysing the CDS-bond basis

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. It is defined as an entity's bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Both bond and CDS spreads measure an entity's credit risk, so theoretically the basis should be zero. In practice other factors such as liquidity and transaction costs come into play, distorting the basis and giving rise to arbitrage opportunities.

Taking advantage of a positive basis would involve selling the cash bond (paying spread) while selling protection (receiving spread) on the same credit. Conversely, a negative basis trade would involve buying the bond (receiving spread) while buying protection (paying spread) on the same credit.

An analysis of US dollar denominated investment grade corporate bonds reveals many such discrepancies that could be arbitraged away. Our sample of bonds is taken from Markit iBoxx $ Corporates index, which incorporates bonds of a specified issue size and bond type. Since the 5-yr point on a CDS curve is typically the most liquid tenor, corresponding bonds in the index maturing between 2020 and 2022 have been taken into account for this analysis. The figures are based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

Energy names close basis further

US oil & gas exploration firm EQT Corp's 4.875% bond maturing in 2021 saw its large negative basis tighten to -107bps in March, from -340bps in February. This trend continued into April as the basis turned positive as of April 29th. EQT Corp saw the biggest shift in basis among the sample of bonds, to 20bps, from -78bps at the start of the month. Oil prices have jumped over 50% during the period which has led to bond spreads falling drastically, all but eliminating any theoretical arbitrage opportunities, as seen in EQT's case. Enbridge Energy Partners LP has seen a similar shift; its 4.2% bond maturing in 2021 saw its basis move 70bps in the positive direction to -4bps, from -73bps at the start of April. A recent positive quarterly earnings report was a boost for investors as the company tries to maintain its investment grade status.

Despite the basis shift into more positive territory, the majority of US dollar denominated names sampled still exhibit a negative basis, where their CDS spread exceeds their bond spread equivalent. At the top of the list is telecoms form Qwest Corporation, whose 6.75% bond maturing in 2021 has a CDS bond basis of -256bps.

Negative shifts

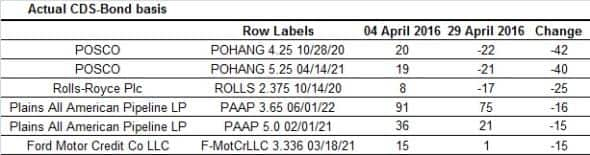

On the flip side, two names stood out in terms of their basis shifting in the negative direction. South Korea multinational steel making firm POSCO has seen its CDS bond-basis on two of its bonds move from positive basis to now exhibiting a negative basis. Steel prices have been under significant pressure over the past few months amid mounting fears around slowing Chinese demand. British industrial holding firm Rolls Royce saw its basis move to -17bps, having been 8bps at the start of March, after a rocky start to the year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-Credit-CDS-bond-arbitrage-tightens-as-bonds-continue-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-Credit-CDS-bond-arbitrage-tightens-as-bonds-continue-recovery.html&text=CDS-bond+arbitrage+tightens+as+bonds+continue+recovery","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-Credit-CDS-bond-arbitrage-tightens-as-bonds-continue-recovery.html","enabled":true},{"name":"email","url":"?subject=CDS-bond arbitrage tightens as bonds continue recovery&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-Credit-CDS-bond-arbitrage-tightens-as-bonds-continue-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS-bond+arbitrage+tightens+as+bonds+continue+recovery http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-Credit-CDS-bond-arbitrage-tightens-as-bonds-continue-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}