Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2015

UK construction sector reports weakest growth for almost two years

UK building activity showed the smallest rise for almost two years in April. The Markit/CIPS Construction PMI fell from 57.8 in March to a 22-month low of 54.2. Although remaining above the neutral 50.0 threshold to therefore signal an expansion of activity, the drop in the PMI points to a sharp easing in the rate of growth.

Together with a steep slowdown in manufacturing and disappointing GDP data, the construction survey adds to evidence that the UK economy has hit a soft-patch. The upturn has become largely reliant on the service sector, for which April's PMI will be published on Wednesday.

However, the construction slowdown may prove temporary, having been at least in part due to uncertainty and construction project delays in the run up to the most closely fought General Election in a generation. Encouragingly, companies are expecting business activity to turn higher in coming months, with optimism about the year ahead remaining elevated in April having climbed to a post-recession high in March.

Employment growth also remained buoyant in April, even picking up marginally on March to suggest that companies are preparing for higher future workloads. Clearly the election outcome will be a major factor in determining growth and confidence in coming months.

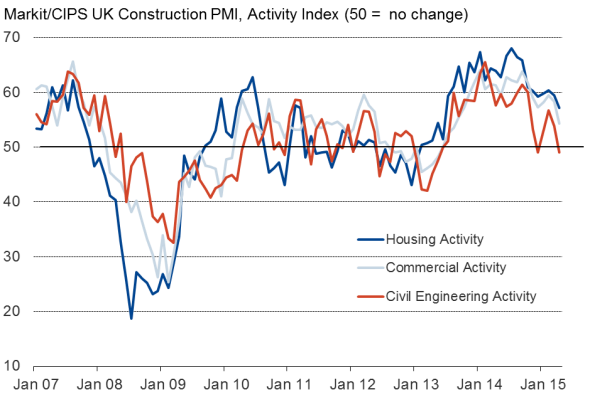

Broad slowdown

House building activity, which has been a key driver of the construction industry upturn, continued to see strong growth, but the increase was nevertheless the weakest seen since June 2013. Growth also slowed sharply in terms of commercial activity, which includes properties such as shops, factories, offices and industrial units, down to the weakest since August 2013.

House building

Sources: Markit, CIPS, Ecowin.

However, it was civil engineering projects that saw the worst performance, seeing activity fall slightly for the first time since December, linked in part to lower public sector building in the lead up to the election.

Construction activity by sector

Sources: Markit, CIPS.

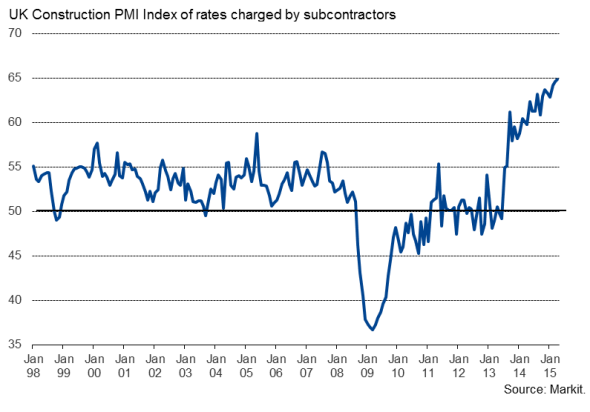

Record rise in subcontractor pay rates

While the survey showed raw material prices rising at the slowest rate for just over two years, it was a different story for rates charged by sub-contractors, which increased at the fastest rate in the survey's 18-year history. Higher subcontractor rates should feed through to upward wage pressures.

Subcontractor pay

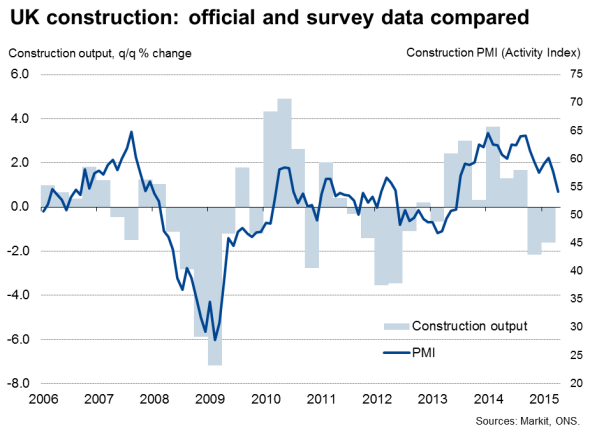

No recession

Although signalling a slowdown, the ongoing growth of the construction sector signalled by the PMI survey paints a substantially brighter picture than the official data, which showed output contracting sharply for a second consecutive quarter at the start of the year, which would mean construction is now in a technical recession. However, it should be noted that concerns over data quality have meant the official construction numbers are no longer considered "National Statistics", and the picture of ongoing (albeit weaker) growth painted by the PMI is corroborated by other data such as recent RICS and Markit/Savills Commercial Property development surveys.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-UK-construction-sector-reports-weakest-growth-for-almost-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-UK-construction-sector-reports-weakest-growth-for-almost-two-years.html&text=UK+construction+sector+reports+weakest+growth+for+almost+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-UK-construction-sector-reports-weakest-growth-for-almost-two-years.html","enabled":true},{"name":"email","url":"?subject=UK construction sector reports weakest growth for almost two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-UK-construction-sector-reports-weakest-growth-for-almost-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+sector+reports+weakest+growth+for+almost+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-UK-construction-sector-reports-weakest-growth-for-almost-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}