Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 04, 2014

Investors turn against gold after price decline

With developments mirroring the recent plight of high cost oil producers in the face of sinking oil prices, we analyse investment flows and sentiment towards gold as the precious metal price points towards $1000 per fine ounce.

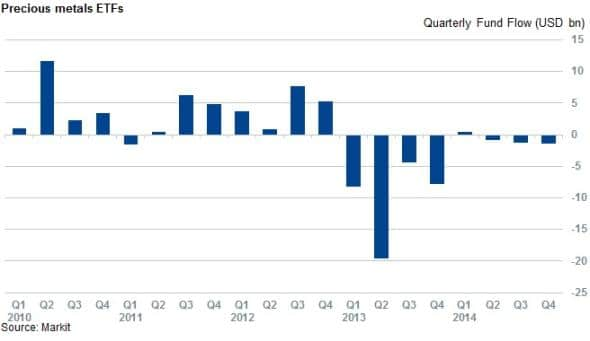

- ETF fund flows out of gold based funds have totalled $3 billion this year to date, accelerating in recent weeks

- The largest of the gold ETFs, the SPDR Gold share, saw the majority of outflows

- Despite this, short sellers have not yet targeted gold producing firms

QE ends but now big Japan

The US dollar looks set to strengthen as one of the largest quantitative easing experiments in history has finally come to an end. Expectations are that interest rate increases are on the horizon as inflationary pressures loom post the recent respite of depressed energy prices.

Last week the Bank of Japan announced that it would be increasing the country's asset purchasing program, taking the symbolic baton of global liquidity provider. It seems that the stage is set for a period of sustained dollar strength.

Now that gold's pricing currency is set to appreciate, the precious metals ability to keep afloat above $1000 looks set to tested. With commentators becoming increasing perplexed with recent declines, and camels and rhombuses making the rounds on newswires and financial news networks, it seems the historic safe haven is in for a turbulent close to the current woes.

ETF outflows persistent

Gold and precious metal ETFs have continued to see outflows in recent weeks as the case for shiny metals deteriorated. So far this quarter, the 325 precious metal ETFs have seen outflows of $1.34bn, which is already more than the $1.28bn seen in the three months to the end of September. This takes the year to date outflow tally to just shy of $3bn. Issuers can take some comfort in the fact that this is only a fraction of the $40bn pulled from the asset class over 2013.

The majority of outflows were absorbed by the SPDR Gold Trust, whose assets peaked in 2012 when it managed $76.7bn in October. This was before cumulative steady outflows totalling $35bn over the next two years. These outflows, combined with the recent fall in the value of gold, have seen the ETF's AUM sink to $27.8bn - roughly a third of its peak. The fund has also seen the majority of outflows since the start of the year, suffering $2.1bn of outflows since January.

Largest gold producers largely avoid short interest

Interestingly, short sellers have not seen much appetite to increase short positions in Gold producing firms in recent weeks as the major gold producers continue to see relatively low demand to borrow, despite poor recent share price performance.

The world's largest gold producer by volume in 2013 was Canadian based Barrick Gold. The company's share price has already declined by 30% year to date. With mounting pressure on the gold price, the company and peers such as Kinross may face a credit downgrade according to a recent article by Bloomberg. Kinross has seen some increased short selling activity since the beginning of the year as its share price tumbled 50% this year, but the current demand to borrow remains relatively insignificant.

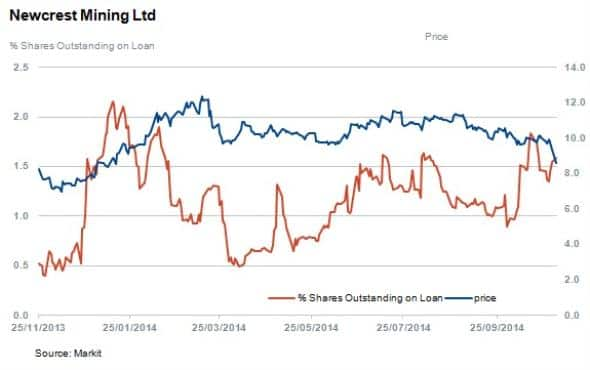

Newcrest is relatively flat so far this year after retreating 20% from gains made earlier in the year. Shares out on loan have tripled though from 0.5% to 1.6% of shares outstanding since March 2013, but again short selling is the name is fairly subdued.

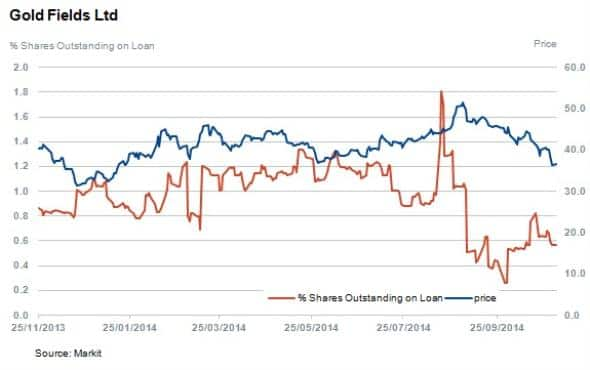

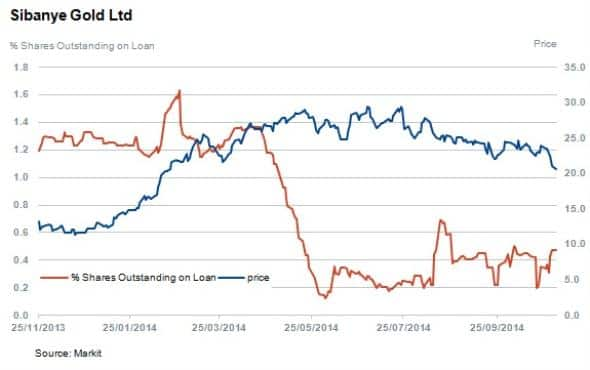

South African based Gold Fields and recently spun outSibanye Gold, which carries the majority of South African assets, have performed relatively better over the last 12 months, but shares are still down 18% and 13% respectively over the last quarter. Sibanye ironically has well outperformed Gold Fields who spun the assets out to insulate the parent company from the volatile South African operating environment.

Shorts seem to be happy to stay among minor gold producers as the constituents of the Market Vectors Minor Gold Producers ETFs have attracted more short activity than their larger peers.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Equities-Investors-turn-against-gold-after-price-decline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Equities-Investors-turn-against-gold-after-price-decline.html&text=Investors+turn+against+gold+after+price+decline","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Equities-Investors-turn-against-gold-after-price-decline.html","enabled":true},{"name":"email","url":"?subject=Investors turn against gold after price decline&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Equities-Investors-turn-against-gold-after-price-decline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+turn+against+gold+after+price+decline http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Equities-Investors-turn-against-gold-after-price-decline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}