Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 04, 2016

Week Ahead Economic Overview

The week sees a notable number of countries update their industrial production data, which will provide analysts with important information on global industry trends. Updated second quarter GDP results are meanwhile released in the UK and eurozone and include a national breakdown, while retail sales and consumer sentiment numbers will add to the policy debate in the US.

China will be a key focus of the week. Although signs were growing that the People's Bank of China could introduce more stimulus to boost growth, recent comments suggest that the bank is sufficiently happy with the pace of growth to keep monetary policy "prudent" this year. Policy makers will be interested to see data on consumer prices, industrial production, retail sales and trade, which are all released during the week.

Markets expect industrial production to have risen 6.1% in July, with latest IHS Markit forecasts suggesting that the rate of growth could fall below the 6.0% mark this year. PMI data from Caixin have been fairly negative in recent months, although showed a welcome uptick in July. Meanwhile, inflation has fallen to 1.9% in June and is predicted to nudge down to 1.8% for the remainder of the year.

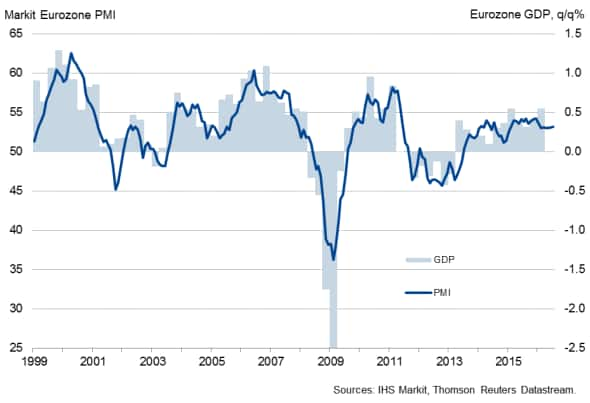

It came as no surprise when Eurostat last week announced a slowdown in eurozone GDP growth after a somewhat unexpectedly strong start to the year. The focus will now shift to the national data for clues as to which countries saw economic growth slow the most. PMI data for the second quarter signalled robust expansions in countries such as Germany and Spain, while France was hovering around the stagnation mark and growth in Italy looks to have slowed. Survey data for July meanwhile point to further unspectacular economic growth in the region.

Industrial production numbers for June will meanwhile provide a clearer picture of industry trends in the second quarter. It is likely that the sector acted as a drag on overall euro area economic growth.

Eurozone GDP and the PMI

Although the Office for National Statistics reported accelerated GDP growth in the second quarter, we expect the 0.6% pace of expansion will be revised down when more data become available. Analysts will therefore be closely watching the release of industrial production and construction output data. In its preliminary GDP calculations, the ONS reported a 2.1% surge in industrial production, the fastest increase since 1999. However, a downward revision is likely when June data become available, as the preliminary second quarter number was boosted by a strong April reading.

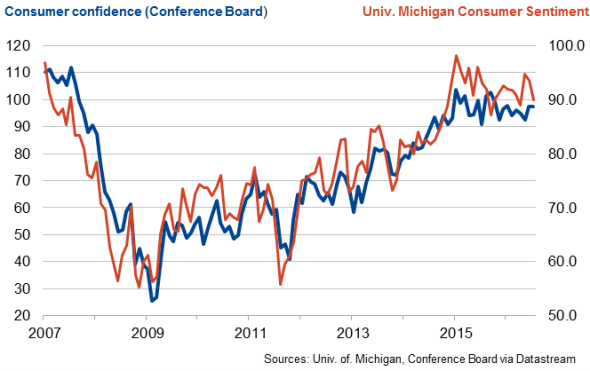

Over in the US, the Fed keeps its door open for a further rate rise later this year, subject to the economic data flow improving after a disappointing first half to the year. Retail sales and consumer sentiment numbers will provide policy makers with important information on consumer spending trends. The rebound in second quarter GDP was almost entirely driven by consumer spending, which rose 4.2%.

US consumer confidence indicators

Monday 8 August

Bank lending and current account data are published in Japan, while trade figures are out in China.

Business confidence numbers are released in South Africa.

The latest Eurozone Sentix Index is out.

Destatis issues industrial production numbers for Germany.

England & Wales Regional PMI results and the latest Scotland PMI are out.

In Canada, building permit data are published.

Tuesday 9 August

Business confidence numbers are released in Australia.

The Reserve Bank of India announces its latest monetary policy decision.

In China, consumer price figures are updated.

Germany sees the release of trade data, while budget balance numbers are issued in France.

The Office for National Statistics publishes industrial production and trade numbers for the UK. Moreover, retail sales numbers are released by the British Retail Consortium.

Retail sales data are also out in Brazil.

Housing starts numbers are meanwhile issued in Canada.

NFIB business optimism and wholesale inventory data are published in the US.

Wednesday 10 August

In Australia, consumer sentiment and mortgage lending data are issued.

Japan sees the release of machinery orders figures, while trade data are updated in India.

M2 money supply information is published in China.

Industrial production numbers are out in France.

The latest Savills UK Commercial Development Activity Report is published.

Mortgage data are meanwhile released in the US.

Thursday 11 August

Industrial output and retail sales data are released in China.

Trade numbers are meanwhile issued in Russia.

South Africa sees the publication of latest manufacturing and mining production figures.

Consumer price data are updated in France and Italy, with the latter also seeing the release of trade numbers.

Initial jobless claims figures are out in the US.

Friday 12 August

Consumer price and industrial output data are out in India.

Latest industrial production and updated second quarter GDP figures are out for the eurozone.

Meanwhile, consumer price numbers are released in Germany and Spain.

In France, non-farm payroll data are issued.

Construction output figures are issued in the UK by the Office for National Statistics.

The US sees the release of producer price, retail sales and business inventory data. Moreover, latest consumer sentiment numbers are published by the University of Michigan.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}