Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 04, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Second quarter earnings season starts off with Alcoa which has seen significant covering in the run-up to results

- Nordic Semiconductors is the most shorted company announcing earnings in Europe this week after seeing short interest double so far this year

- Retailers again make up the majority of Asian firms seeing significant short interest prior to earnings

North American earnings

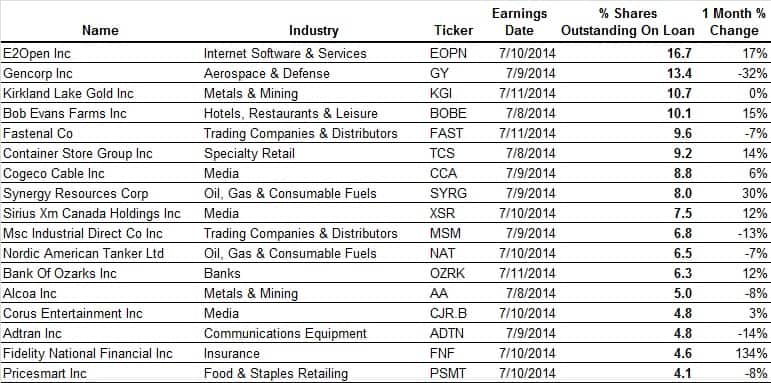

The coming week sees the start of the second quarter earnings season, heralded by aluminium producer Alcoa’s earnings announcement on Tuesday. On the short interest side, we see 17 firms announcing earnings with 4% or more of their shares out on loan.

The highlight of next weeks’ set of earnings from the 17 firms announcing results is Alcoa which has 5% of its shares out on loan. The firm went through a bit of a slump over the last couple of years as its upstream business became increasingly commoditised. The firm’s recent change of focus towards higher margin downstream finished products looks to be paying off however as analysts are expecting the firm to nearly double its EPS from the same period a year ago. Equity investors have also taken well to these recent developments as the firm has seen its shares rise by 40% since the start of the year. Short sellers, which had been very active in Alcoa, are also wary of the recent moves as the firm has seen its short interest fall by two thirds from the all-time highs seen earlier this year.

Another highlight of the week’s earning activity will be cloud software firm E2Open which finds itself the most shorted firm announcing earnings. The firm has yet to turn a profit in its last five quarters and has seen its short interest surge after its last quarter’s earnings miss and weak guidance. Current demand to borrow has surged by 17% in the last four weeks to 16.7% of shares outstanding.

As for the firm seeing the larges surge in short interest in the run up to earnings, the honour goes to insurance firms Liberty National Financial which has seen its demand to borrow more than double in the last month to 4.6% of shares. Note that this surge is more than likely linked to the firm’s spinning off its ventures business in recent weeks and is therefore not necessarily directional.

Finally we see significant short covering in tool and fastener company Fastenal which has seen its short interest fall by a third since recent highs in March prior to its last earnings release which came in better than expected.

European earnings

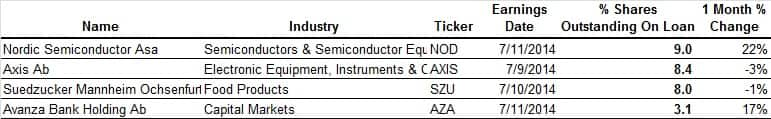

Europe sees relatively light earnings activity next week with only four firms seeing significant short interest in the lead-up to results.

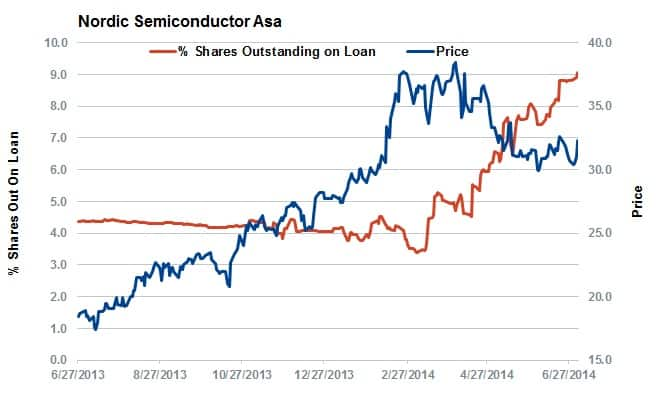

The most shorted firm is Nordic Semiconductor which has 9% of its shares out on loan. NOD which makes integrated circuits for mobile accessories has seen short sellers increase their positions significantly over the last three months after its profits failed to live up to expectations in the first quarter. The company’s share price has managed to hold relatively steady despite the recent setback as they seem to be focusing on the fact that analysts are forecasting sales to rise significantly over the coming three quarters.

NOD’s recent surge in demand to borrow has seen it edge out another Nordic tech firm to the most shorted honours. Second place goes to Axis Ab, a CCTV and networked video firm which has also seen shorts increase significantly over the last six months.

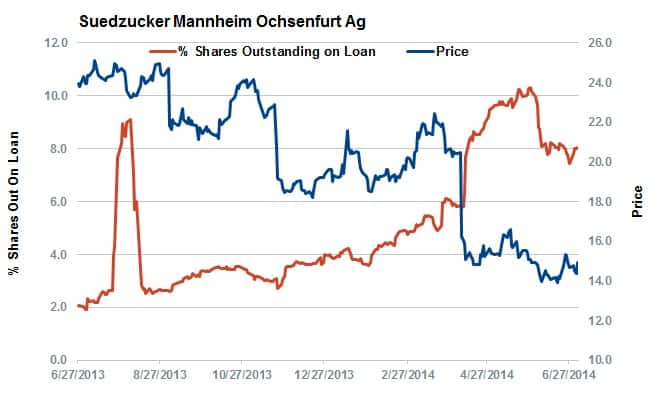

Rounding out the top three most shorted firms is German sugar firm which has 8% of its shares out on loan, a number that has also surged in recent weeks after disappointing results.

Asian earnings

Asia also sees light reporting flow, with seven firms having more than 3% of shares out on loan ahead of earnings.

Japanese consumer firms continue to make up the majority of the heavily shorted names ahead of earnings with Jin Co leading the way as the most shorted firm.

Another interesting short in the retail space is photo retailer Bic Camera which has seen demand to borrow jump by a third in the last couple of months as Japanese consumer confidence numbers started to falter in the face of rising prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072014120000Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072014120000Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}