Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 04, 2015

Week Ahead Economic Overview

A busy week for data watchers includes the release of industrial production numbers for a range of countries across Europe plus revised first quarter GDP figures for the eurozone and Japan. Retail sales and consumer confidence data are highlights in the US.

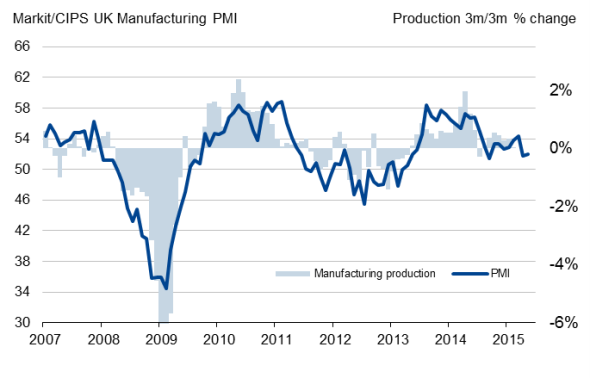

Industrial production data for April are eagerly awaited in the UK after March data showed some encouraging signs of growth. However, the survey data suggest the picture remains one of a manufacturing economy that continued to struggle in the face of the strong pound and heightened business uncertainty. PMI data for May signalled that factory output continued to grow at a modest pace, largely reliant on consumer spending. The survey data leave question marks over the health of the UK economy and its likely growth trajectory, suggesting policy makers will need to await further data before starting the process of raising interest rates.

UK manufacturing production and the PMI

Sources: Markit, ONS

The Office for National Statistics also updates construction output and trade data during the week. While March data signalled the first improvement in exports in three months, the UK's trade deficit rose to "29.9bn over the first quarter as a whole as imports soared. Moreover, PMI data have shown a renewed decline in exports at the start of the second quarter, after signalling a brief resumption of export growth in March. It therefore looks unlikely that the March upturn of exports was the start of an upward trend.

Revised first quarter GDP numbers are meanwhile released in the eurozone, which are not expected to show any change to the initial estimate of 0.4% growth. Economic growth in Germany slowed dramatically since the previous quarter, but Spain continued to grow strongly and France surprised on the upside. Greece, however, slid back into recession.

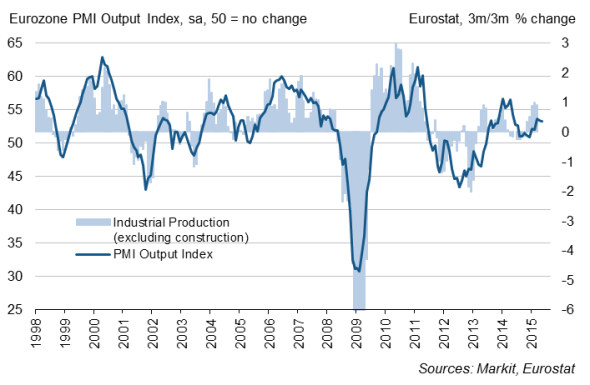

The currency union also sees the publication of industrial output figures for April. In March, production fell 0.3%, with contraction reported in France and Germany. Survey data have since shown a revival in manufacturing growth, with the PMI signalling the joint-strongest expansion over the past year in May.

Eurozone industrial production and the PMI

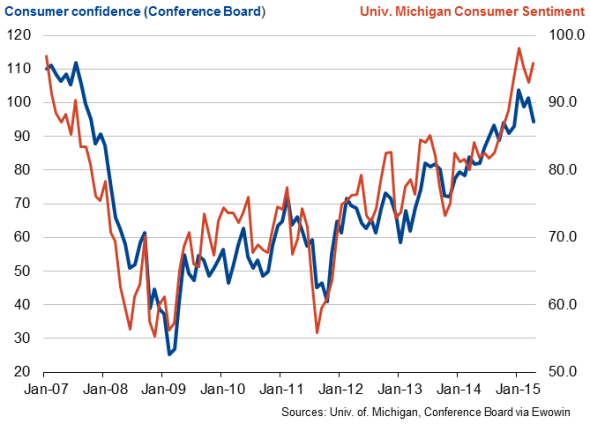

The US economy sank into contraction in the first quarter, but the decline has already been shrugged off as a temporary blip by policy makers, linked to extreme weather, port closures and what looks to be a regular pattern in the official data of the economy weakening at the start of the year. Data watchers will therefore be scrutinising updates on retail sales and consumer confidence numbers to gauge the extent to which the economy rebounded. The Reuters/Michigan Consumer Sentiment Index will provide crucial information about household sentiment, after the index dipped to a six-month low of 90.7 in May. Retail sales will give insight into household spending trends. Sales were flat in April, confounding expectations for a spring bounce and adding to signs that the economy may be struggling to fully rebound from the contraction seen in the first quarter. Moreover, PMI survey data signalled a weakening of output growth in May, suggesting that the US may be losing momentum again as it heads into the summer.

US consumer confidence

Over in Asia, revised first quarter GDP numbers are out in Japan, after the first estimate suggested that the economy expanded by a surprisingly-brisk 0.6%. PMI data were more downbeat, and have since picked up only slightly. With underlying inflation well below the central bank's target and the economy struggling amid weak domestic demand and stalling export growth, the chances of the Bank of Japan sanctioning further stimulus cannot be ruled out.

Monday 8 June

Trade data are issued in China, India, Russia and Germany, with the latter also seeing the release of industrial output numbers.

In Japan, revised first quarter GDP numbers are published.

England & Wales Regional PMI reports are published alongside the Bank of Scotland PMI and the Northern Ireland PMI.

Sentix releases investor confidence data for the eurozone.

In Canada, house starts and building permits figures are out.

The US sees the release of the Labour Market Conditions Index.

Tuesday 9 June

The National Australia Bank's Business Conditions Index is published.

Japan meanwhile sees the release of consumer confidence data.

Inflation numbers are updated in China.

Revised first quarter GDP figures are out in the eurozone.

Trade data and BRC retail sales numbers are issued in the UK.

In France, budget balance information are updated.

The NFIB Business Optimism Index is released in the US alongside wholesale inventory data.

Wednesday 10 June

Consumer sentiment numbers are out in Australia,

M3 money supply information are released in India, while M2 money supply data are issued in China.

Industrial production figures are published in France and the UK, with the latter also seeing the release of the latest Commercial Development Activity Report.

The Iceland Central Bank announces its latest interest rate decision.

Consumer price numbers are meanwhile released in Greece and Brazil.

Thursday 11 June

The Reserve Bank of New Zealand announces its latest monetary policy decision.

Latest employment numbers are published in Australia.

China sees the release of industrial output and retail sales data.

Manufacturing production data are meanwhile issued in South Africa

Inflation numbers and non-farm payroll data are updated in France, while Greece sees the release of unemployment figures.

The Royal Institution of Chartered Surveyors releases latest data on UK house prices.

In Canada, capacity utilisation and house price data are updated.

Initial jobless claims numbers and retail sales figures are out in the US.

Friday 12 June

Industrial production numbers are published in Japan and India, with the latter also seeing the release of consumer price figures.

Wholesale price figures are out in Germany, while consumer price data are out in Spain.

Eurostat releases industrial production number for the currency union.

Construction output figures for the UK are released by the Office for National Statistics.

Producer price data and the Reuters/Michigan Consumer Sentiment Index are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}