Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 04, 2017

Chinese arbitrage opportunities sprout anew

Short sellers are targeting Hong Kong listed H shares that trade at a premium to mainland traded A shares after the fall in yuan.

- Four Hong Kong listed H shares now trade at a premium to A shares

- Anhui Conch, the most overpriced H share, attracts the most short sellers

- Shorts also targeting Weichai Power which has over 10% of shares shorted

Arbitrage opportunities that can be exploited by shorting Hong Kong listed "H" shares, which trade at a premium to a mainland traded "A" share issued by the same company, disappeared in the days since the Hong Kong-Shanghai Stock Connect launched in 2014; however there are indications that the trade may be coming back to life. Four H shares now trade at a premium to mainland traded A shares issued by the same company. This marks a notable turnaround for arbitrageurs given that every single H to A share cross in our database traded at a discount in the weeks following the onset of the connect.

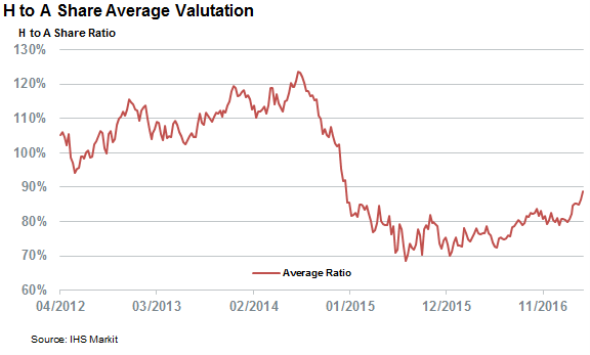

The resurgence of arbitrage opportunities in H shares is only a symptom of a wider momentum swing into H shares. These stocks slid from commanding a 20% premium to A share on average to trading at a 30% discount in the months surrounding the launch of the stock connect. That discount has since fallen by two thirds as H shares are now trading at an 11% discount to corresponding A shares on average. Most of this conversion can be attributed to the yuan's recent fall, which has driven up the value of H shares relative to their mainland traded peers.

The number of H shares trading within 5% of their corresponding A shares peers has also jumped significantly in recent months, which could open up further arbitrage opportunities in the coming weeks should the rapid conversion seen recently overshoot. Whether any of the 6 H shares which trade within 5% of their mainland peers will trade at a premium remains to be seen, but the momentum is definitely on the side of the asset class as no H shares commanded less than a 5% discount to their corresponding A shares in early February.

Anhui Conch Cement leads the way

Short sellers have been more than eager to take advantage of this trend as the four relatively overpriced H share listings have 7.1% of shares out on loan on average which is over twice the average seen by H shares on average.

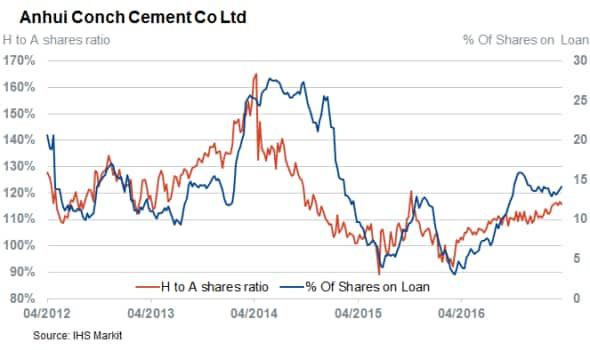

Building supply firm Anhui Conch Cement, whose 15% H share premium is the widest of the four also attracts the most arbitrageurs as it has 14% of its shares out on loan, the most out of any H share. Arbitrageurs have benefited handsomely from Anhui Conch's previously as over a quarter of the company's shares were out on loan back in 2014 when its H shares went from commanding a 70% premium to trading at a 10% discount in a little over 12 months.

Engine manufacturer Weichai Power is also rapidly attracting arbitrageurs as the ratio between its H and A shares rose from 60% to 110% over the last two months. Short sellers jumped on the trend shortly after H shares started to trade rich to their mainland traded cousins and over 11% of Weichai shares are now on loan to short sellers, the most since the days before the connect back in 2014.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042017-equities-chinese-arbitrage-opportunities-sprout-anew.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042017-equities-chinese-arbitrage-opportunities-sprout-anew.html&text=Chinese+arbitrage+opportunities+sprout+anew","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042017-equities-chinese-arbitrage-opportunities-sprout-anew.html","enabled":true},{"name":"email","url":"?subject=Chinese arbitrage opportunities sprout anew&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042017-equities-chinese-arbitrage-opportunities-sprout-anew.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+arbitrage+opportunities+sprout+anew http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042017-equities-chinese-arbitrage-opportunities-sprout-anew.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}