Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2015

UK "all-sector' PMI points to stronger economic growth in first quarter

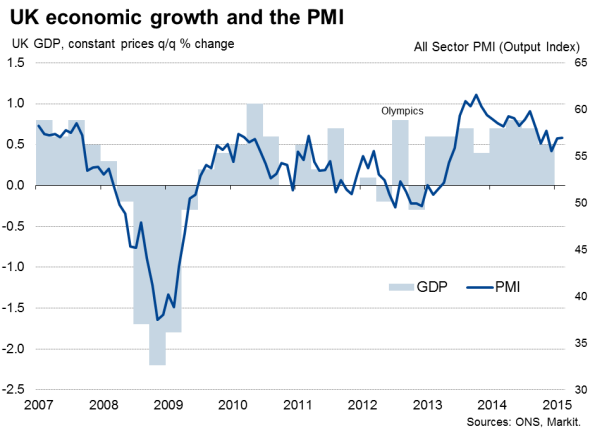

The UK economy is on course for yet another robust performance in the first quarter, with growth set to accelerate from the slowdown seen late last year, according to further strong PMI survey readings.

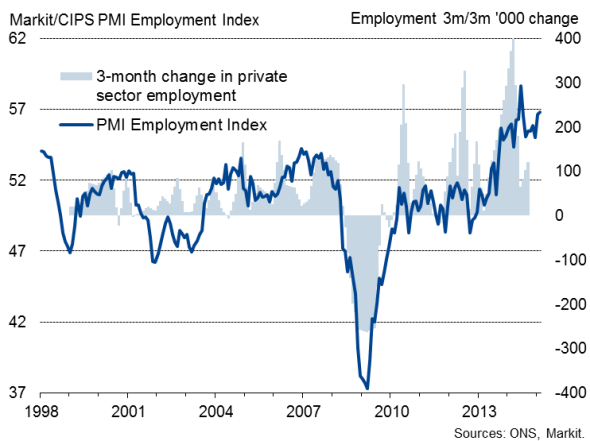

The surveys also show that job creation has been running at one of the strongest rates on record so far this year, a tightening of the labour market which looks set to drive pay growth higher in coming months.

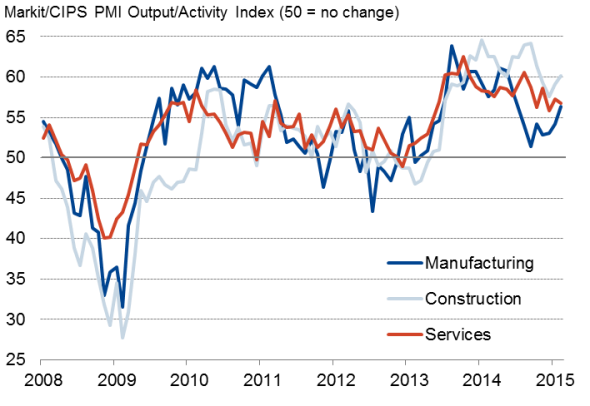

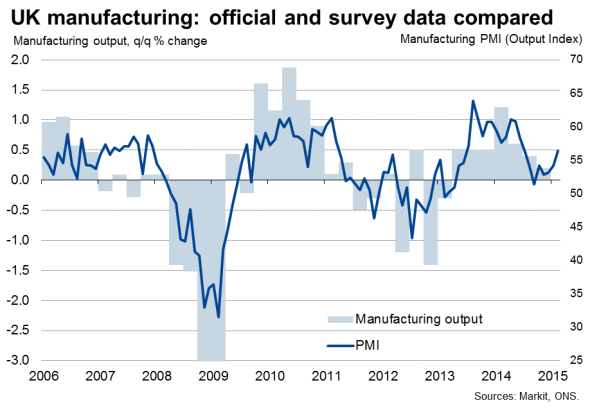

However, there are also signs that the pace of economic growth has cooled since the heady rates seen last year. The pace of expansion in manufacturing remains down on this time last year, and the underlying trend in the all-important service sector is now the weakest since mid-2013. While the recovery is far from stalling, forecasts of the economy growing by more than 2.5% this year look optimistic given the recent PMI numbers.

Business activity by sector

Despite the fact that the underlying growth trend has moderated, the combination of relatively robust economic growth, the improving labour market and signs of price pressures picking up again in February suggests the Bank of England will come under increasing pressure to tighten policy later this year. The policy debate will focus on the medium-term inflation outlook, and an upturn in wage growth at the same time as lower oil prices fall out of the annual consumer price comparisons looks likely to induce a more hawkish stance among Monetary Policy Committee members, provided growth does not slow in coming months.

Employment

Growth edges higher in February

The three PMI surveys collectively indicated a slight acceleration of economic growth for a second month running in February. A GDP-weighted average of the three PMI surveys' output indexes edged up from 56.9 in January to a three-month high of 57.0.

The PMI readings are so far signalling GDP growth of 0.6% in the first quarter, up from 0.5% in the fourth quarter of last year and in line with the economy's long-term annual trend rate of roughly 2.5%.

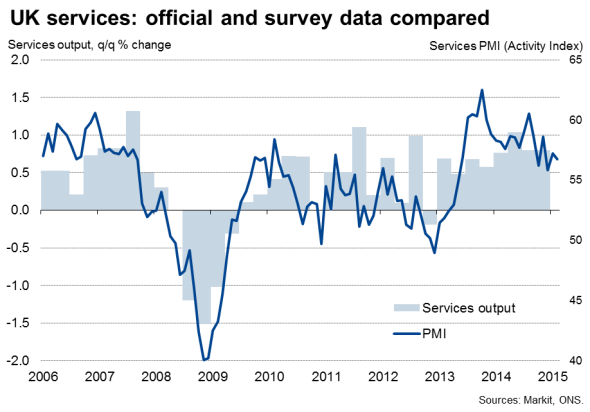

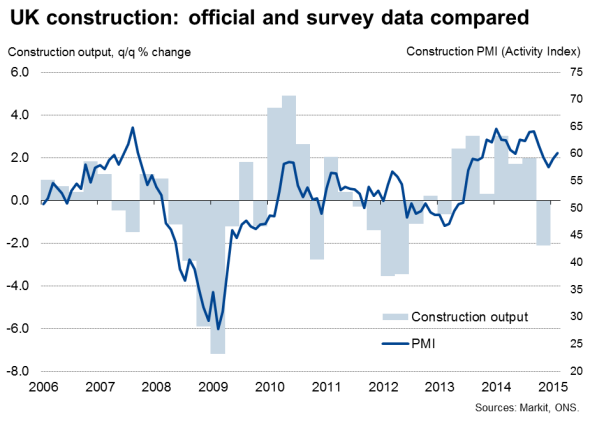

The upturn continued to be broad-based across all main sectors of the economy, once again led by construction, where the rate of expansion hit a four-month high. Growth slowed in the vast services economy, but the survey's activity measure remained broadly consistent with service sector output growing 0.7% in the first quarter, providing an important thrust to the overall economy, albeit down from 0.8% in the final two quarters of last year.

The three-month average of the services PMI is now at its lowest since June 2013, indicating a steady downward trend in the sector's growth trajectory compared to the peaks seen early last year.

Manufacturing output growth meanwhile accelerated to an eight-month high, indicating that the goods-producing sector has revived from the slowdown seen late last year. Manufacturing output rose just 0.3% in the fourth quarter of last year but is on course for a 0.4-0.5% rise in the first quarter.*

Near-record employment growth

The ongoing upturn in business activity fed through to another near-record rise in employment in February. The three surveys collectively signalled the second-strongest rate of job creation seen since comparable data were first available back in 1998 (the sole exception being the spike in hiring seen last June). The surveys are currently signalling job creation of approximately 70,000 per month. Hiring picked up in manufacturing and services but slowed to a 14-month low in construction, albeit remaining strong.

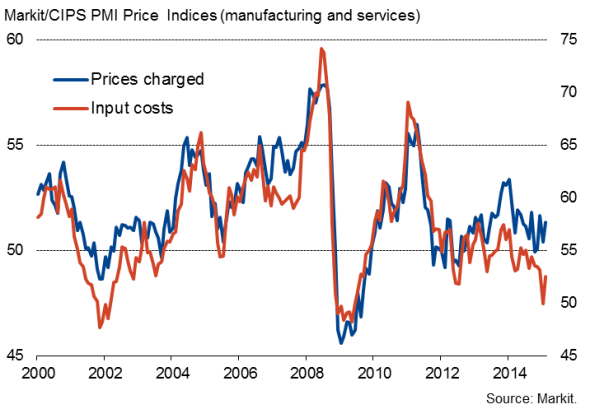

Price pressures pick up

Prices pressures meanwhile picked up during the month, though remained weak. Input cost inflation accelerated, having fallen to a five-and-a-half year low and almost stalling in January. A steep fall in manufacturing costs, linked largely to lower oil prices, was offset by rising cost inflation in services and construction.

Average prices charged for goods and services meanwhile also rose at a faster rate than the marginal pace seen in January.

The tightening labour market and upturn in price pressures suggest that inflationary pressures could start to revive in coming months, which may in turn put pressure on policymakers to worry about the medium-term inflation outlook, especially after current oil-related price falls drop out of the year-on-year comparisons.

Prices

* While the manufacturing and services data have tracked the official data well in recent quarters, there remains a question mark over construction. The sustained elevated construction PMI readings contrasts markedly with the official data, which indicated that the sector suffering a steep contraction of activity in the fourth quarter of last year in a surprise turnaround from strong growth earlier in the year. The PMI therefore suggest the official data may be understating recent construction activity and that the building sector in fact remains in rude health.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-UK-all-sector-PMI-points-to-stronger-economic-growth-in-first-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-UK-all-sector-PMI-points-to-stronger-economic-growth-in-first-quarter.html&text=UK+%22all-sector%27+PMI+points+to+stronger+economic+growth+in+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-UK-all-sector-PMI-points-to-stronger-economic-growth-in-first-quarter.html","enabled":true},{"name":"email","url":"?subject=UK "all-sector' PMI points to stronger economic growth in first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-UK-all-sector-PMI-points-to-stronger-economic-growth-in-first-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+%22all-sector%27+PMI+points+to+stronger+economic+growth+in+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-UK-all-sector-PMI-points-to-stronger-economic-growth-in-first-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}