Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 04, 2016

UK linkers outperform despite falling inflation expectations

Despite the UK's monetary policy committee highlighting weak inflation today, inflation-linked gilts have proved to be a strong investment so far this year.

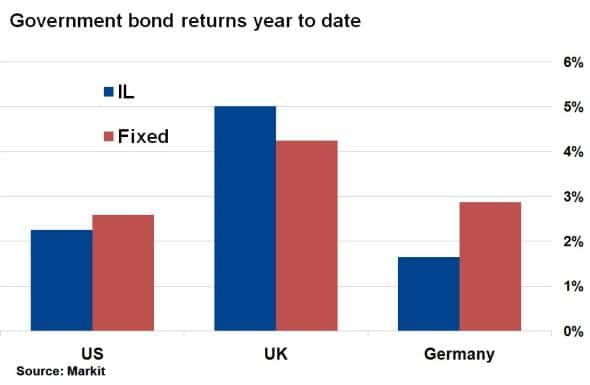

- UK inflation-linked gilts have returned 5% so far this year, outperforming gilts by 0.8%

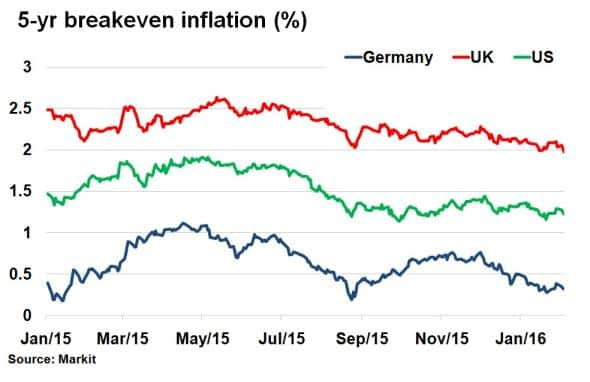

- 5-yr breakeven inflation rates across the UK, US and Europe are all now below 2%

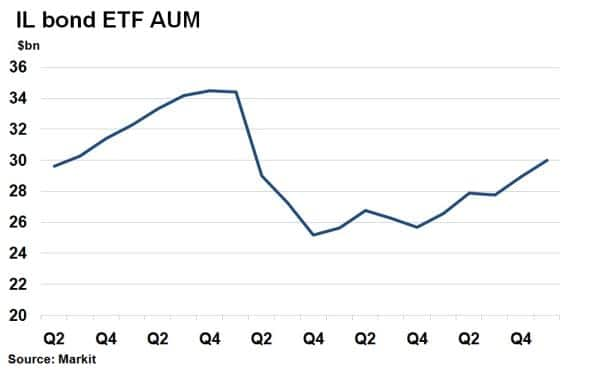

- ETFs tracking inflation linked bonds have seen AUM surpass $30bn for the first time since Q2 2103

Last month the UK's Office for National Statistic's (ONS) reported that inflation rose to an 11 month high in December. The 0.2% month on month change took the market by surprise and investors were quick to react by snapping up inflation-linked (IL) gilts, propelling returns in the asset class.

IL gilts outperform

According to Markit's iBoxx indices, IL gilts have returned 5.0% so far in 2016, the best performance among its developed nation IL peers. What makes the outperformance compelling is that IL gilts have also outperformed their conventional gilt counterparts, unlike US treasuries and German bunds.

Developed nation's government bonds have had a strong start to 2016 as investors parked money into safer assets amid extended global market volatility. The surprise UK inflation number on the upside went further to prompt investors to protect against both credit and inflation risk.

Falling expectations

The positive returns among IL government bonds this year however paint a different picture for inflation expectations, calculated using nominal yields from fixed government bonds and real yields on inflation-linked equivalents.

According to Markit's bond pricing service, the UK's 5-yr breakeven inflation rate (what bonds are implying inflation will average over the next five years) was 1.97% as of February 3rd. Despite a 4bps widening on the day of the ONS announcement last month, the breakeven rate has since recessed as oil /commodity price and global growth fears have resurfaced. In fact, at today's UK MPC meeting, future rate hike expectations were moved out further out, as even hawkish members decided to switch stance.

5-yr breakeven inflation in the US remains well below the 2% target, although the recent oil and commodity price declines have had less of an impact on the downside. In Europe, 5-yr inflation expectations are hovering close to pre-ECB QE levels of 0.3%, prompting ECB president Mario Draghi to retreat back into his normal ultra-dovish rhetoric last month.

ETF flows remain strong

Despite dwindling inflation expectations ETFs tracking inflation linked indices have seen continual growth.

According to Markit's ETP analytics service, ETFs exposed to inflation linked bonds saw total AUM surpass $30bn dollars for the first time since Q2 2013. November and December last year particularly saw strong inflows, $930m and $660m respectively.

The continuous AUM growth in IL bonds over the past few years may be a sign of the growing popularity of the ETF platform, or simply investors' faith in central banks, which may be poised to do more to stimulate economic activity.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-UK-linkers-outperform-despite-falling-inflation-expectations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-UK-linkers-outperform-despite-falling-inflation-expectations.html&text=UK+linkers+outperform+despite+falling+inflation+expectations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-UK-linkers-outperform-despite-falling-inflation-expectations.html","enabled":true},{"name":"email","url":"?subject=UK linkers outperform despite falling inflation expectations&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-UK-linkers-outperform-despite-falling-inflation-expectations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+linkers+outperform+despite+falling+inflation+expectations http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-UK-linkers-outperform-despite-falling-inflation-expectations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}